Crypto market turns risk-off: Where are Bitcoin and meme coins headed?

- Bitcoin corrects nearly 6% on Tuesday, down to $86,400.

- Meme coins on Solana and blue-chip tokens like Dogecoin, Shiba Inu, Pepe and TRUMP start recovering.

- Analysts at Nansen identify a risk-off sentiment among crypto traders and commented on catalysts driving Bitcoin's price lower.

Bitcoin (BTC) traders faced over $746 million in liquidations in the past 24 hours, according to Coinglass data. Meme coins led the market crash last week, with developments surrounding LIBRA and MELANIA and the $1.4 billion Bybit hack, where stolen funds were laundered through Solana meme coins.

Analysts at Nansen published their research in a recent report and shared exclusive comments with FXStreet, highlighting the weakness in the crypto market and analyzing recent United States (US) macroeconomic developments.

Bitcoin stabilizes at support, meme coins begin recovery

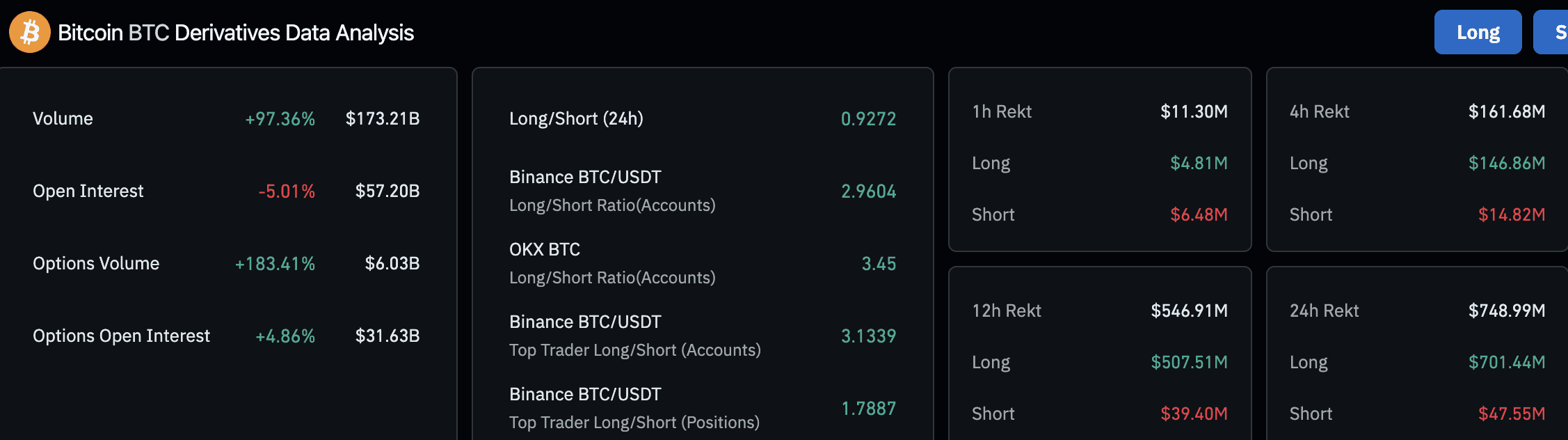

Crypto price data from CoinGecko shows that Bitcoin stabilized above the $86,000 level on Tuesday after it slipped under the $90,000 level. BTC wiped out nearly 6% of value on the day, and derivatives traders faced $746 million in liquidations in a 24-hour timeframe.

Bitcoin derivatives data analysis | Source: Coinglass

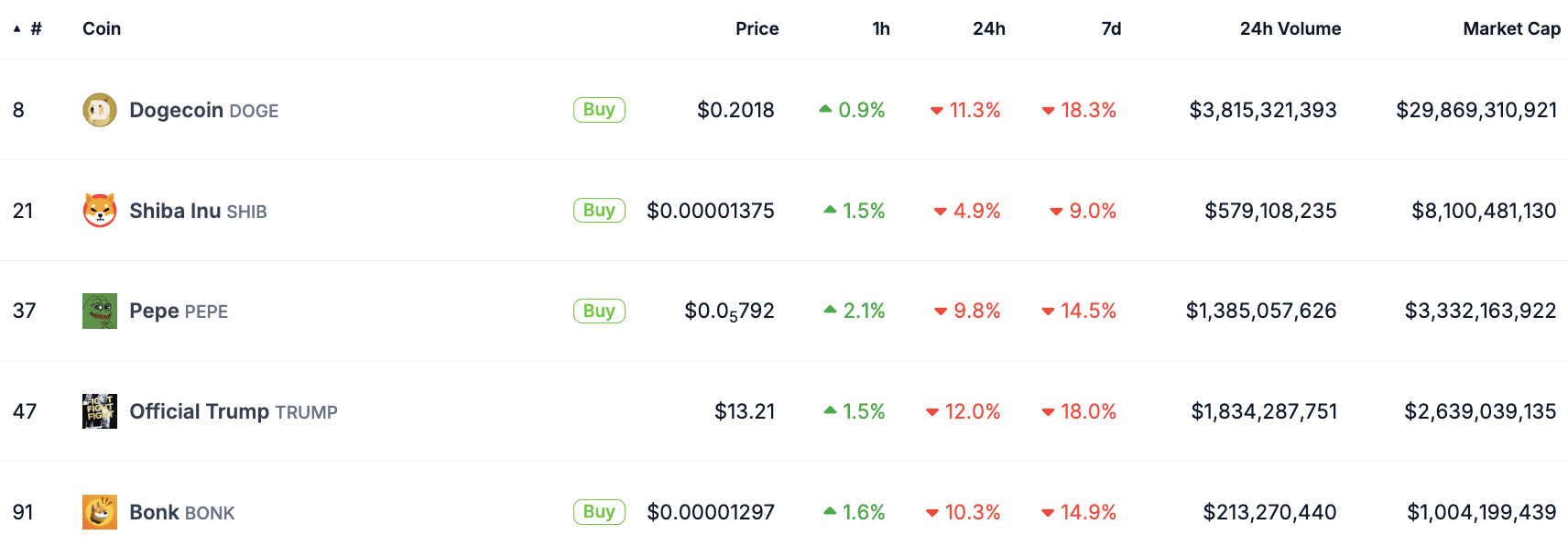

CoinGecko data shows that blue-chip meme coins started their recovering in the North American trading session on Tuesday. After a nearly double-digit seven-day decline, Dogecoin (DOGE), Shiba Inu (SHIB) and Official Trump (TRUMP) prices are looking up.

Meme coin price changes | Source: CoinGecko

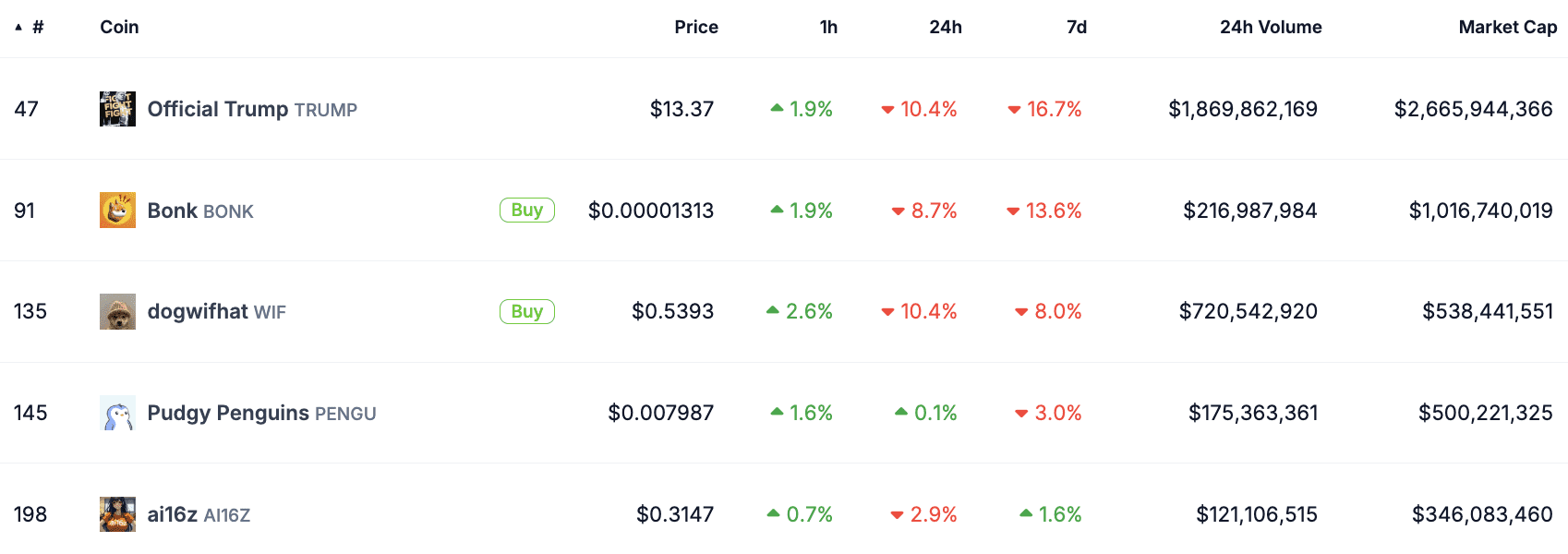

Solana-based meme coins recovered alongside blue-chip memes, prices gained between 1 and 2%. These tokens suffered near double-digit corrections in the last 24 hour.

Solana-based meme coins | Source: CoinGecko

Expert commentary on crypto market sentiment

Aurelie Barthere, Principal Research Analyst at Nansen, commented on the factors influencing Bitcoin price and the state of the crypto market.

"Lately, there has been weakness in crypto prices, ex-BTC, and in equity prices. BTC is now breaking lower following other token prices. Regarding catalysts, the double-whammy of the LIBRA scam, followed by the Bybit hack, are obvious crypto-specific candidates that have likely been weighing on risk appetite,” Barthere told FXStreet.

There is also some concern about the slowdown in US growth since last week's US Services PMI release, the lowest in 22 months and consistent with GDP growth tracking at 0.6% only. Our Nansen Risk Barometer also just turned Risk-off from Neutral today.

The next catalysts for risk assets are Nvidia's earnings reporting on February 26 and core PCE inflation on February 28."

Nansen’s research report titled, “BTC price finally breaks, now what?,” published on Tuesday, identifies how the sentiment among traders turned “risk-off” after having been “neutral” since mid-November 2024.

The report outlines how a large percentage of altcoins have consistently underperformed relative to Bitcoin, down 14% to 87% in the broad market correction.