Litecoin Price Forecast: $500M Whale demand could revive LTC rally as Franklin Templeton triggers sell-off

- Litecoin price hit $128 on Thursday, retracting 5% from the 30-day peak of $140 recorded after the US SEC’s confirmation of Bitwise’s LTC ETF filing.

- Whales have acquired $500 million worth of LTC in the last 14 days, with institutional players making strategic moves.

- Rising average transaction size signals increased whale presence, which could provide buffer against volatility amid profit-taking.

Litecoin price hit $121 on Thursday, retracting 5% from the 30-day peak of $130 recorded in the aftermath of the US SEC’s confirmation of Bitwise’s LTC ETF filing on Wednesday. Can bulls revive the $150 breakout attempt or succumb to a $120 reversal?

Litecoin (LTC) faces major rejection at $130 amid widespread profit-taking

Litecoin (LTC) has exhibited strong price action in the second half of February, mirroring the broader cryptocurrency market’s volatility.

The altcoin surged over 42% in the past two weeks, reaching a high of $130 following the US SEC’s confirmation of Bitwise’s LTC ETF filing.

This rally aligns with the growing optimism surrounding the SEC’s acknowledgment of Dogecoin (DOGE) and XRP ETF filings on February 14.

The increasing probability of a Bitcoin ETF approval—estimated at 90% by Polymarket bettors—has further fueled bullish sentiment across the market.

However, as is often the case during euphoric price breakouts, strategic traders capitalized on the gains, triggering a profit-taking wave.

Litecoin price analysis (LTCUSD) | Feb 21, 2025

LTC quickly retraced 5% from its 30-day peak, settling at $127.8 at press time on Thursday.

The abrupt pullback follows a remarkable 42% rally over the previous 15 days, with prices soaring as high as $136 on Tuesday before cooling off.

Despite the rejection at $130, on-chain metrics suggest that the underlying market fundamentals remain strong, pointing toward a potential recovery.

Franklin Templeton launches spot Bitcoin and Ethereum ETP

On Thursday, U.S.-based investment firm Franklin Templeton announced the launch of exchange-traded products (ETPs) for Bitcoin and Ethereum.

The development was among the factors that contributed to Litecoin’s retracement, as investors redirected their attention toward the two largest cryptocurrencies.

The newly launched Franklin Crypto Index ETF (EZPZ) provides exposure to Bitcoin and Ethereum price movements, marking another milestone in institutional crypto adoption. The ETP’s sponsor fee of 0.19% will be waived for investors until August 31, 2025.

“The rapid growth of our ETF business reflects our unwavering commitment to staying at the forefront of innovation,

EZPZ offers a convenient and low-cost way to gain exposure to the two most established and largest blockchain ecosystems. Over time, the ETP intends to expand its holdings to include other eligible digital assets, evolving into a broader crypto benchmark.”

- David Mann, Global Head of ETF Product and Capital Markets at Franklin Templeton.

Following the announcement, Bitcoin surged past $98,700, marking its highest trading level of the week. Ethereum also posted modest gains, climbing 0.51% to breach the $2,770 threshold.

The shifting investor focus away from Litecoin, coupled with early profit-taking among traders banking on an LTC ETF approval, contributed to LTC’s 5% decline.

However, as the immediate market reaction subsides, Litecoin could stabilize and avoid deeper losses

Litecoin Whale demand surges after SEC acknowledges DOGE and XRP filings

Despite Litecoin’s retreat below $130, on-chain data indicates that institutional investors and crypto whales are accumulating LTC at an accelerating rate.

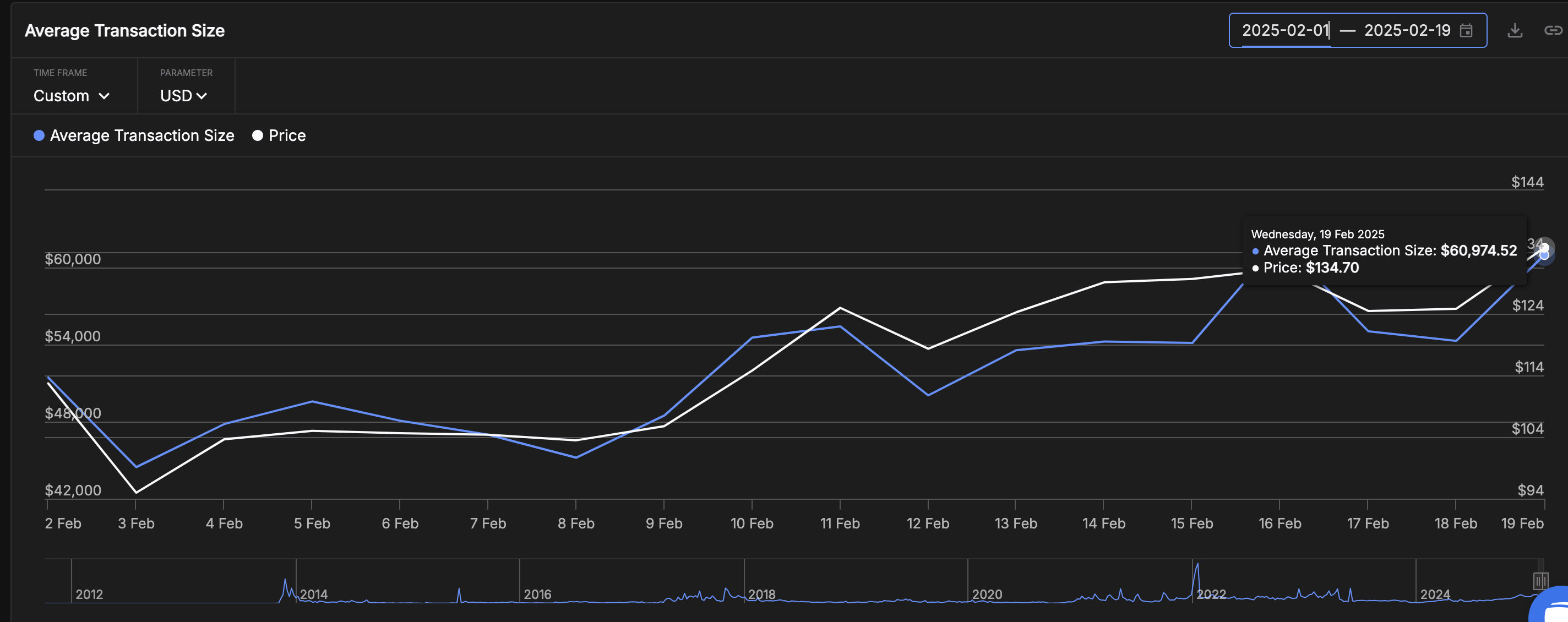

The Average Transaction Size metric from IntoTheBlock, which tracks the daily buy/sell trades of whale investors by measuring the average dollar value of all transactions executed on the Litecoin network, has been climbing steadily.

On February 8, before the SEC acknowledged new altcoin ETF filings, the average transaction size on the Litecoin network stood at a low of $45,190.

However, as ETF speculation intensified, this metric surged to $60,974 by Wednesday, marking a notable 35% increase in institutional-scale transactions within a week.

The increasing presence of large holders suggests that smart money is positioning itself in anticipation of a longer-term uptrend, despite short-term profit-taking pressure.

Litecoin average transaction size vs LTC price | Source: IntoTheBlock

A rising average transaction size is typically a bullish signal for an asset’s price, as it reflects heightened liquidity and deep-pocketed investors entering the market.

Higher liquidity allows for smoother price movements, minimizing the impact of large sell orders and reducing the likelihood of sharp price corrections.

Hence, this persistent whale demand could provide a much-needed buffer against volatility, helping early profit takers and panic sellers to exit their positions with minimal drag on LTC prices.

Furthermore, with increased liquidity, bullish investors can deploy capital more efficiently, sustaining buying pressure even in the face of short-term retracements.

If whale activity continues to rise, Bitcoin's price could find strong support above $120, paving the way for another push toward $130 and beyond in the coming weeks.

LTC price forecast: Bulls must hold $120 to maintain dominance

Litecoin price is testing critical support at $128.83 following a sharp 4.49% retracement from its recent high of $135.23.

The 42% rally that propelled LTC from $95 to $136 in 15 days now faces its first major test, with sellers attempting to seize control.

The Keltner Channel's midline at $121.66 emerges as a key level, while the lower bound at $99.98 presents a worst-case scenario should momentum falter.

Litecoin (LTC) price forecast

Despite the downturn, LTC remains above the Parabolic SAR support at $109.44, indicating that the broader uptrend remains intact unless a decisive breakdown occurs.

Bulls must defend $120 to prevent a deeper pullback, particularly as selling volume accelerates with a -192.33K volume delta. If the correction extends, a drop to the lower Keltner Channel boundary near $100 could be on the horizon.

Conversely, if Litecoin holds above $121 and reclaims $130, a fresh rally toward $143.35 could materialize, keeping the bullish narrative alive.