Bitcoin (BTC) vs Gold (XAU): Asset Tokenization expert weighs impact of US Inflation on 2025 price trends

- Bitcoin price has faced downward pressure, dropping 6% in February due to U.S. tariff wars and inflation concerns.

- Gold prices have climbed 6% over the same period, as investors hedge against economic uncertainty.

- The RWA sector, including tokenized gold and real estate, has surged 6.6%, reflecting a shift in investor sentiment.

Bitcoin price consolidated at $97,000 on Feb 15, down 6% within the monthly time frame, reeling under bearish headwinds from US tariff wars and rising inflation. Conversely, Gold (XAU) has increased 6% over the same time frame. As investors flock toward safe-haven assets amid an uncertain macroeconomic landscape, a gold and real-world-asset expert offers market insights.

Bitcoin (BTC) price tumbles, Gold (XAU) advances amid testy US macroeconomic landscape

Bitcoin price has faced intense bearish headwinds in February 2025, with three major factors triggering downward volatility. The blowback from a US tech stock sell-off after DeepSeek disrupted OpenAI’s market position in late January set the pace for a negative start to the month.

Former President Donald Trump exacerbated the BTC price dip when he announced sweeping tariffs on Canada, Mexico, and China. While the tariffs on Canada and Mexico were quickly rolled back, those imposed on China went ahead, adding pressure to financial markets. Further downside was triggered by a hotter-than-expected US Consumer Price Index (CPI) report this week, fueling concerns about prolonged inflationary pressures.

Bitcoin (BTC) Price Action vs Gold (XAU) | Source: TradingView

As investors reassess risk exposure in an increasingly volatile macroeconomic environment, the appeal of safe-haven assets like gold has strengthened. Gold prices climbed to $2,882.43 per ounce, up 6% over the past 15 days. Meanwhile, Bitcoin remains range-bound, consolidating at $97,000 and down 6% over the same period.

Tokenized Assets in demand as volatile Bitcoin prices spark RWA Boom

Beyond Bitcoin’s price action, key market metrics suggest that the uncertain macroeconomic landscape is reshaping investor behavior.

While Bitcoin prices have dropped 6% in February, the Real World Asset (RWA) sector within crypto markets has experienced notable capital inflows.

Instead of moving funds off-chain after de-risking from BTC, investors now appear to be reallocating capital into tokenized RWAs, including gold, real estate, and fixed-income securities.

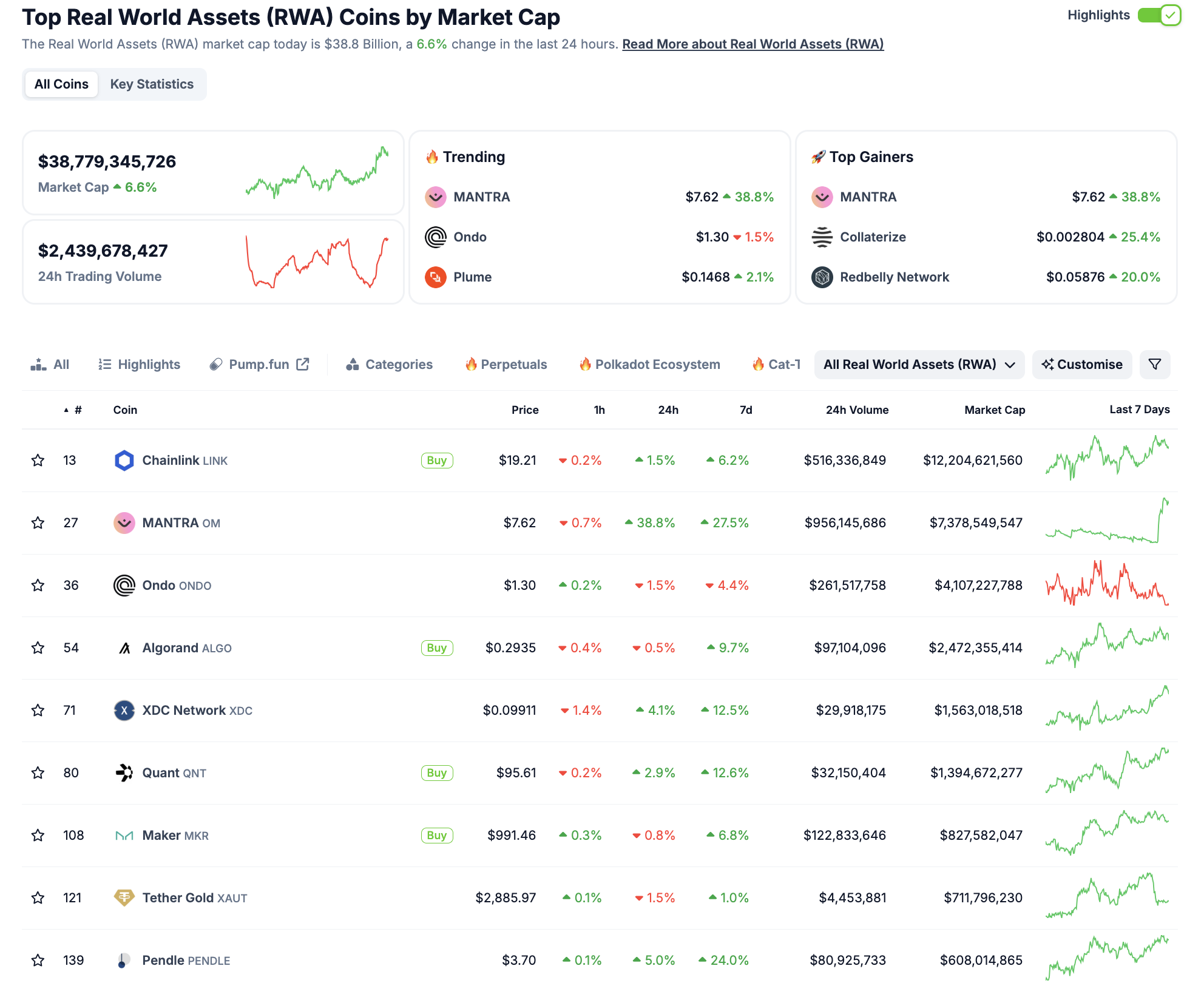

According to CoinGecko data, the RWA market capitalization has surged 6.6% as of Feb 18, reaching $38.8 billion—an increase of over $2.5 billion within the last 24 hours. During the same timeframe, Bitcoin remained trapped within the narrow $97,000–$98,000 range.

Real World Asset (RWA) Sector Performance, Feb 15, 2025 | Source: Coingecko

Real World Asset (RWA) Sector Performance, Feb 15, 2025 | Source: Coingecko

Chainlink (LINK), Mantra (OM), and XDC Network (XDC) have emerged as key front-runners in the RWA boom.

With Mantra leading the way with 27.5% gains over the past 24 hours, all top 10 RWA protocol assets posted gains this week, with the exception of Ondo Finance, which saw a mild 4.4% retracement. This reflects he growing investor demand for tokenized safe-haven assets as BTC price stangates under bearish pressure from hawkish macroeconomic expectations.

Amid rising interest in tokenized gold and surging capital inflows toward RWA protocols, speculation is growing that tokenized commodities could become a more dominant asset class should inflationary pressures persist.

This week’s inflation report has only reinforced the perception that Bitcoin could struggle in a hawkish macroeconomic environment, while gold and RWAs stand to benefit from shifting investor sentiment.

Will RWA sector growth trigger demand for Tokenized Gold ?

With Bitcoin under pressure from macroeconomic headwinds, including inflation concerns and geopolitical tensions, gold and tokenized RWAs are increasingly seen as viable alternatives. If inflation remains elevated, Bitcoin may continue to stagnate, while tokenized commodities and gold-backed assets could see continued inflows in 2025.

In a recent exclusive interview with FXStreet, Kevin Rusher, founder of real-world asset platform RAAC offered expert insights into this narrative.

- Q1: Bitcoin has dropped over 6% this month, while Gold has risen 6%. Do you think this signals a shift in investor sentiment from crypto to traditional safe-haven assets?

Kevin Rusher: "As we know, Bitcoin was designed to be the ultimate inflation hedge. However, because of its widespread adoption by institutions like BlackRock and JP Morgan, it tends to move with the market.

However, when we see a really serious crash like the banking crisis of March 2023, we do see different activity.

So no, I don't think there is a difference between Bitcoin and gold, but I do think that investors are looking for safety."

- Q2: How does tokenized gold compare to physical gold and Bitcoin as an inflation hedge?

Kevin Rusher: “The beauty of gold is that it will be an inflation hedge no matter how you hold it.

Throughout history, people have held gold to preserve their wealth and that will never change.

If you hold gold in an ETF, that's an extremely safe way to do it, and your investment will rise with the value of the asset minus the fees of the fund.

With tokenized gold, you will benefit from the appreciation of the asset as well as - depending on the platform - potentially a yield, and several other opportunities to use that investment throughout the decentralized finance ecosystem.

- Q3: What advantages does tokenized gold offer over traditional gold ETFs or futures contracts?

Kevin Rusher: “You can't beat an ETF for safety when it comes to holding gold, and futures will always be the preferred instrument of traders looking to profit from very short-term moves up and down.

Tokenization gives you the option to earn a yield on your holding or use it to borrow and lend within the decentralized finance ecosystem."

- Q4: Beyond gold, what other real-world assets are gaining traction in tokenized markets, and why?

Kevin Rusher: “Property is perhaps the original base case for tokenized assets. With fewer and fewer people able to access the stable and reliable returns that property can afford, tokenized property makes a lot of sense.

This is especially the case when we're looking at rental property in the public sector which is extremely safe and has a guaranteed yield.

Traditionally, only institutional or very high net-worth investors could access these opportunities.

However, through the tokenization afforded in decentralized finance, anyone can now access these stable and reliable assets.

- Q5: What regulatory hurdles does tokenized gold face compared to Bitcoin and other cryptocurrencies?

Kevin Rusher: "By nature of being a cryptocurrency, tokenized gold faces much the same challenges as any other cryptocurrency and every jurisdiction has different rules.

Investors must always check the laws of their local jurisdiction and make sure that they are complying with them."

- Q6: Are institutional investors showing increasing interest in tokenized gold over Bitcoin? If so, what’s driving this trend?

Kevin Rusher: “We are seeing enormous interest not just from institutions but from gold miners themselves when it comes to tokenizing gold.

There are so many opportunities to capitalize on the world's oldest and most reliable asset that there are few parties not interested in getting involved in its tokenization.

When it comes to what's driving this trend? It's history. There is nothing more reliable than gold. I wouldn't say it is gold versus Bitcoin, though.

I think the two offer quite different things. Although both are long-term stores of value, with one you have to accept quite a lot of volatility, whereas the other will give you much less volatility and reliability.”

- Q7: How does RAAC ensure the security and legitimacy of tokenized assets like gold?

Kevin Rusher: “On the RAAC platform users can hold tokenized versions of gold, as well as property and - in the future - other real-world assets in a way that allows them to take advantage of the huge liquidity in the Curve ecosystem – the biggest in decentralized finance.

Thanks to this, they can use the tokens they get in return for their investment in several different ways - or simply choose to hold them on the platform to earn a yield.

No investment is ever fail-safe, including gold, but RAAC utilizes the most reputable and liquid platforms available in DeFi.”

- Q8: In the long run, do you see tokenized gold coexisting with Bitcoin, or could it potentially replace BTC as a store of value?

Kevin Rusher: “I think tokenized gold and Bitcoin will always coexist as they do very different things.

Although Bitcoin is often referred to as digital gold, it is highly volatile and you really must have a very long-term mindset for it.

Gold, on the other hand, is much more stable, and so - if you only want to save in the short term – you're much less likely to see the wild ups and downs with gold that you will see with Bitcoin.

Both, however, are great long-term options to store value. As such, they will both be around for a very, very long time.”

In summary:

Bitcoin’s recent price struggles amid inflationary pressures and geopolitical turbulence underscore the evolving dynamics of safe-haven assets. While BTC’s 6% decline in February reflects investor unease, gold’s corresponding 6% rally highlights its enduring role as a hedge against macroeconomic uncertainty.

The surge in tokenized real-world assets, particularly gold, suggests that investors are increasingly diversifying into blockchain-powered alternatives without fully sidestepping traditional stores of value.

Institutional interest in tokenized gold is rising, driven by its stability, accessibility, and integration within decentralized finance. However, Bitcoin remains a long-term contender, offering a different value proposition despite its volatility.

As inflationary concerns persist, the competition between Bitcoin and tokenized commodities will likely intensify. Rather than a binary choice, market experts hint at a future where both asset classes coexist, catering to distinct investor preferences.