XRP could rally ahead of Depository Receipts launch; Brad Garlinghouse set to join White House crypto council

- XRP saw brief gains above 4% following reports of the launch of XRP Depository Receipts.

- The receipts function similarly to an ETF, providing investors access to XRP's price without holding the asset.

- Ripple CEO Brad Garlinghouse is among prominent names being considered for the White House Crypto Council.

- XRP could rally to tackle a key wedge's upper boundary after bouncing off its support level.

Ripple's XRP gained 4% on Friday following reports that investment firms Receipts Depository Corp and Digital Wealth Partners plan to launch XRP Depository Receipts in the United States. The receipts will offer investors exposure to XRP's price, similar to exchange-traded funds (ETFs).

Meanwhile, Ripple CEO Brad Garlinghouse has reportedly been shortlisted among potential candidates for a White House crypto advisory council position.

XRP sees modest gains following reports of upcoming Depository Receipts launch

XRP witnessed narrow gains, up 4% on Friday, as the crypto market failed to recover going into the weekend. The rise likely stems from reports that an XRP Depository Receipt (DR) may soon hit the institutional investment markets.

Investment firms Receipts Depository Corp and Digital Wealth Partners are planning to issue US Depository Receipts for XRP, according to Fox Business Eleanor Terrett.

The receipts will give US institutional investors access to XRP's price, much like American Depository Receipts (ADR).

ADRs represent depository receipts that are listed and traded in the United States. These financial instruments are issued by foreign companies through an intermediary bank and are exclusively available to investors within the US market.

The XRP DR will represent ownership of the underlying asset without having to make a direct XRP purchase.

The benefits of these DRs are similar to exchange-traded funds (ETFs), which allow investors to gain exposure to the price of an underlying asset without necessarily holding it.

Crypto platform Anchorage Digital will custody the XRP DRs under the oversight of the Office of the Comptroller of the Currency (OCC).

Meanwhile, Ripple CEO Brad Garlinghouse is among the candidates shortlisted for the White House crypto council, according to a report by the New York Post.

President Trump signed an executive order establishing the group to foster innovation in digital assets and blockchain technology.

The move came in response to concerns among crypto community members who had expressed frustration over what it viewed as "regulatory by enforcement" under the previous presidential administration.

Additionally, Garlinghouse is reportedly among a group of leaders chosen by the Commodity Futures Trading Commission (CFTC) for a CEO forum it plans to hold.

NEW: The @CFTC is planning to hold a CEO Forum to discuss the launch of the agency’s digital asset markets pilot program for tokenized non-cash collateral such as stablecoins.

— Eleanor Terrett (@EleanorTerrett) February 7, 2025

Participants will include leaders from @circle, @coinbase, https://t.co/2JKQGIM0yc, and @Ripple.…

The forum will be geared towards discussing the introduction of the CFTC digital asset markets pilot program, which focuses on tokenized non-cash collateral, including stablecoins.

XRP holds wedge's support line, could rally toward its upper boundary

XRP saw $17.32 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations accounted for $8.58 million and $8.74 million, respectively.

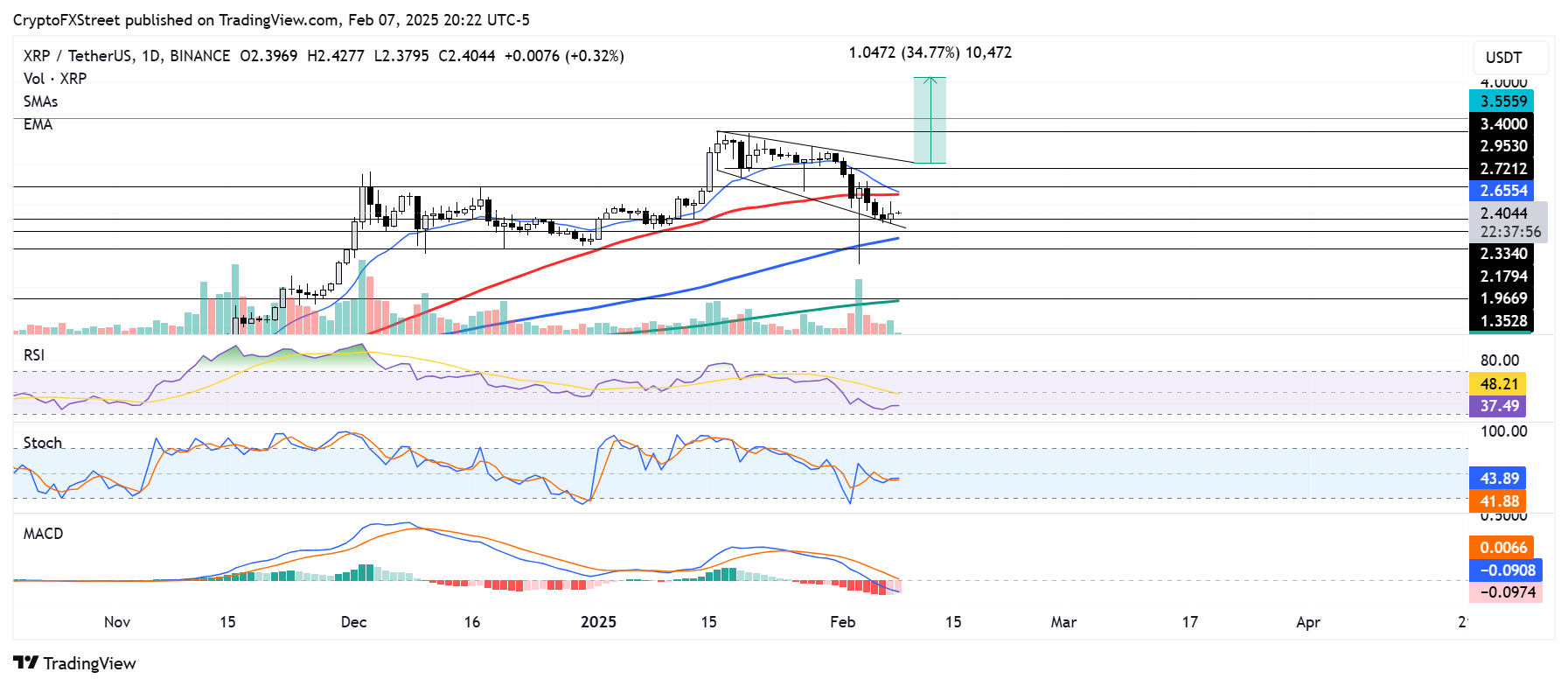

XRP bounced off the lower boundary support line of a descending broadening wedge pattern near the $2.33 level on Thursday.

The remittance-based token is looking to bounce to tackle the wedge's upper boundary resistance but faces a key hurdle near the $2.72 level — strengthened by the 50-day Simple Moving Average (SMA) and 14-day Exponential Moving Average (EMA).

XRP/USDT daily chart

If XRP sees a breakout above the wedge's upper boundary line and holds it as a support, it could rally to set a new all-time high near the $4.00 psychological level.

The Relative Strength Index (RSI), Stochastic Oscillator (Stoch) and Moving Average Convergence Divergence (MACD) histograms are below their neutral level, indicating dominant bearish momentum. A crossover above their respective neutral levels will flip XRP to a bullish trend.

A daily candlestick close below the descending falling wedge's lower boundary line — that establishes it as a resistance — will invalidate the bullish thesis and send XRP to find support toward $1.35.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.