Bitcoin Price Forecast: BTC recovers slightly as MicroStrategy adds $10,107 BTC and launches STRK

- Bitcoin recovers slightly and trades above $102,000 on Tuesday after reaching a low of $97,777 the previous day.

- BTC’s recovery was driven by MicroStrategy’s purchase of 10,107 BTC for $1.1 billion and the launch of its convertible preferred stock STRK.

- Dr. Sean Dawson, Head of Research at Derive.XYZ, told FXStreet that the probability of BTC falling below $75,000 by the end of Q1 is rising.

Bitcoin’s (BTC) price recovers slightly, trading above $102,000 on Tuesday after reaching a low of $97,777 the previous day. BTC’s recovery was driven by MicroStrategy’s purchase of 10,107 BTC for $1.1 billion and the launch of its convertible preferred stock STRK, available to institutional investors and select retail investors. Moreover, Dr. Sean Dawson, Head of Research at Derive.XYZ, told FXStreet that the probability of BTC falling below $75,000 by the end of Q1 is rising.

Bitcoin recovers as Microstrtegy adds $1.1 billion BTC and launches STRK

Bitcoin’s price corrected, reaching a low of $97,777, but recovered its fall and closed above $102,000 on Monday. This recovery was fueled by Michael Saylor’s post on X, which highlighted that MicroStrategy (MSTR) had acquired 10,107 BTC worth $1.1 billion at an average price of $105,596 per Bitcoin, and the firm currently holds 471,107 BTC for $30.4 billion, at an average price of $64,511 per BTC.

MicroStrategy has acquired 10,107 BTC for ~$1.1 billion at ~$105,596 per bitcoin and has achieved BTC Yield of 2.90% YTD 2025. As of 1/26/2025, we hodl 471,107 $BTC acquired for ~$30.4 billion at ~$64,511 per bitcoin. $MSTR https://t.co/UM5dGUS9Ma

— Michael Saylor⚡️ (@saylor) January 27, 2025

Moreover, the company announced the launch of a new convertible preferred stock offering called STRK, available to institutional investors and select retail investors. This has generated interest and discussion among investors and the crypto community, particularly regarding the implications for Bitcoin’s market and MicroStrategy’s financial maneuvers.

$MSTR today announced the launch of $STRK, a new convertible preferred stock offering available to institutional investors & select retail investors. To view the investor presentation video, learn more about participating, & access key details, click here.https://t.co/xB5GQG1uXP

— Michael Saylor⚡️ (@saylor) January 27, 2025

Bitcoin correlation to traditional markets and China’s Deepseek

QCP Capital’s report on Monday states, “BTC dipped back below $100k, along with other risk assets, as news of China’s Deepseek continues to spread from the weekend.”

The report further explains that the Chinese LLM potentially threatens US equity markets by disrupting US Artificial Intelligence (AI) dominance with their cost efficiency and groundbreaking open-source technology.

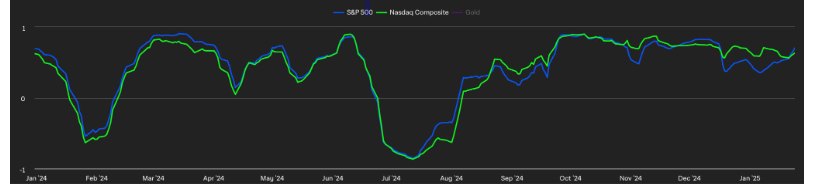

Moreover, a Bitfinex Alpha report also highlights that Bitcoinʼs correlation with the S&P 500 and NASDAQ has reached new year-to-date highs, highlighting Bitcoinʼs evolving status as a major risk-on asset.

The report further explains that any shift in equities could easily trigger a domino effect on Bitcoin, amplifying volatility.

Bitfinex analyst states, “A taste of this on January 27 was seen when concerns over surging popularity of a Chinese discount artificial intelligence model wobbled investors’ faith in the profitability of AI and sent equities falling.”

Bitcoin, S&P500 and NASDAQ correlation chart. Source: Bitfinex report

In an exclusive interview with FXStreet, Dr. Sean Dawson, Head of Research at Derive.XYZ, told “the probability of BTC falling below $75K by the end of Q1 (March 28) has risen to 9.2%, up from 7.2% in the last 24 hours.”

Dawson continued that Monday’s drop had caused the 1-day BTC At-the-money (ATM) implied volatility (IV) to spike from 52% to 76%, indicating heightened demand for put options to hedge downside risk. This reflects a shift in market sentiment towards bearishness as traders adjust to rising uncertainty.

Bitcoin Price Forecast: BTC finds support around 50-day EMA

Bitcoin’s price dipped but recovered its fall after retesting its 50-day Exponential Moving Average (EMA) at $98,223 and closed above $102,000 on Monday. At the time of writing on Tuesday, it recovers slightly, trading above $102,900.

If the 50-day EMA holds as support, BTC could recover to retest its January 20 all-time high of $109,588.

The Relative Strength Index (RSI) indicator on the daily chart reads 55, rebounding above its neutral level of 50 on Monday, indicating a slight rise in bullish momentum. However, traders should be cautious as the Moving Average Convergence Divergence (MACD) indicator is converging. If the MACD flips to a bearish crossover on a daily basis, it would give a sell signal and suggest a downtrend ahead.

BTC/USDT daily chart

If BTC continues its correction and closes below the 50-day EMA at $98,223, it could extend the decline to test its next key support around $90,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.