Ripple's XRP plunges over 4% following funding rates decline

- XRP funding rates’ decline suggests rising caution among investors as the crypto market correction extends.

- Spot traders have managed to soak up the selling pressure with net outflows across Binance, OKX, Kraken and Bybit.

- XRP could decline to find support near $2.17 after posting a double-top pattern in the recent market decline.

Ripple's XRP declined 4% on Friday following a decline in its funding rates. The remittance-based token could decline to test the $2.17 support level if the crypto market decline extends.

XRP funding rates decline as spot traders attempt to weather selling pressure

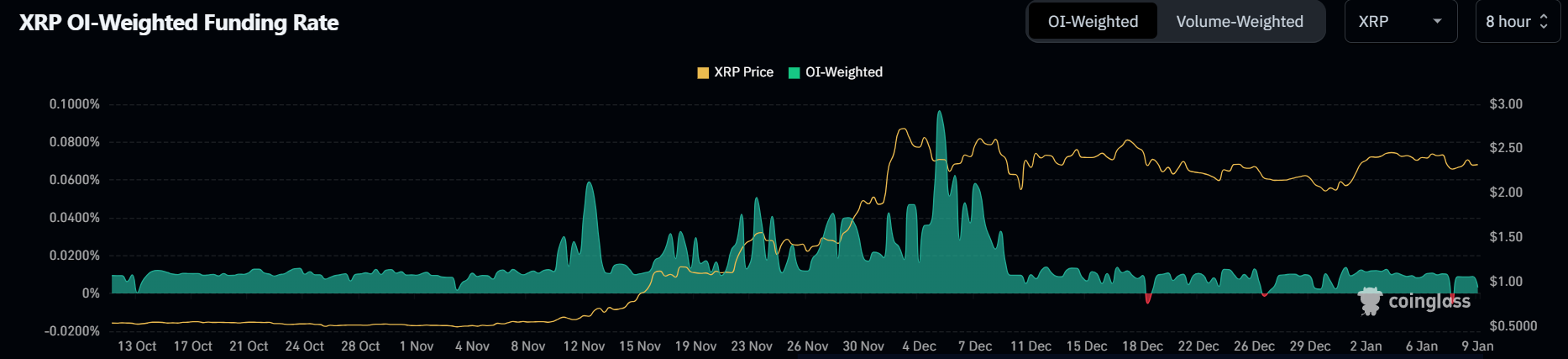

XRP's funding rate briefly flipped negative in the past 24 hours and is well below the stable 0.01% level following the extended decline in the crypto market, per Coinglass data.

XRP Funding Rates. Source: Coinglass

Funding rates are periodic payments between crypto futures traders to help keep the price of a derivatives contract close to its underlying asset's spot price. When funding rates are negative, it suggests rising bearish pressure and short traders pay a fee to long traders — and vice versa when funding rates are positive.

Additionally, XRP's open interest has remained at elevated levels since seeing a spike on Monday.

The recent XRP funding rates decline to 0.03% with open interest remaining at high levels, suggests a cautioned optimism among traders as bearish sentiments have continued to prevail in the market. Conversely, markets often rebound when funding rates decline below normal levels during bullish seasons.

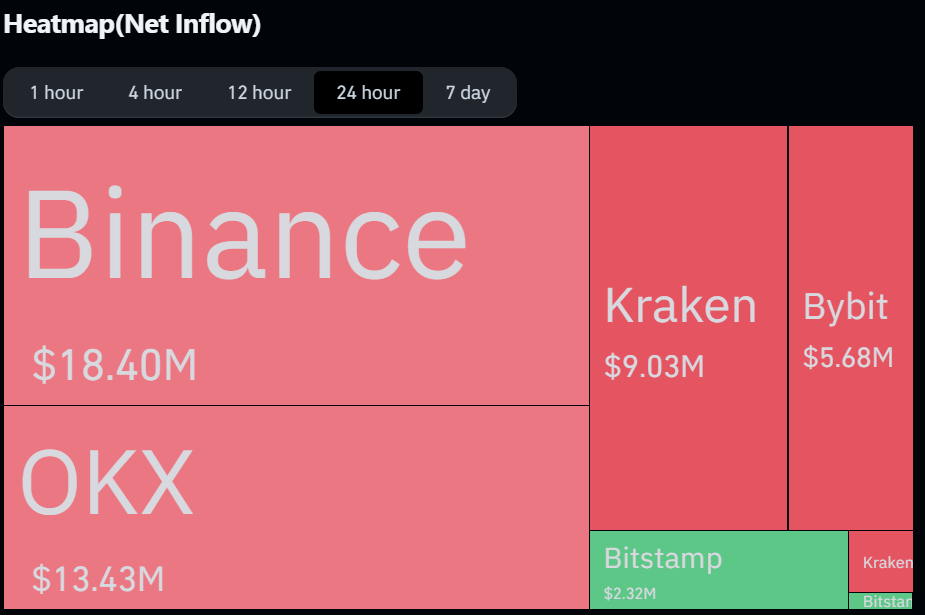

This partially explains why XRP spot traders are buying the dip, with exchanges like Binance, OKX, Kraken and Bybit seeing net outflows. Net outflows in crypto exchanges indicate rising buying pressure.

XRP Exchange Net Flows. Source: Coinglass

Meanwhile, Ripple's President Monica Long has stated in an interview with Bloomberg Crypto that the firm's RLUSD stablecoin will expand into prominent exchanges in 2025, with Bitstamp as the latest to support the token. She also expressed that an XRP ETF could be next in line after Bitcoin and Ether ETFs launched last year.

XRP could test the $2.17 support after posting a double-top pattern

Ripple's XRP sustained $11.76 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long positions crossed $9.54 million, while short liquidations were $2.22 million.

XRP formed a double top pattern after two rejections at the upper boundary of a pennant, subsequently falling below the $2.33 support level. Consequently, the remittance-focused token may decline further to find support around $2.17.

XRP/USDT 8-hour chart

If XRP extends the decline and breaks below $2.17, it could bounce off the lower boundary support of the pennant. However, a move below the pennant and the support level at $1.96 will validate a rounding top pattern that could send XRP toward $1.71 — a level obtained by measuring the pattern's height and projecting it downward.

On the upside, XRP could rally to test the $2.90 resistance if it sustains a candlestick close above the pennant.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, indicating dominant bearish momentum.

A daily candlestick above $2.90 will invalidate the thesis.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.