Ripple secures partnership with Chainlink to enhance RLUSD DeFi adoption

- Ripple revealed its latest partnership with Chainlink to boost the RLUSD stablecoin utility in DeFi markets.

- Chainlink Price Feeds will allow on-chain developers to integrate RLUSD into their DeFi applications.

- RLUSD could benefit from the latest MiCA laws following the delisting of USDT across major European exchanges.

Ripple (XRP) unveiled in a press release on Tuesday its latest collaboration with decentralized oracle network Chainlink to boost its RLUSD stablecoin utility and adoption across DeFi markets.

Ripple embraces Chainlink standard for wider RLUSD adoption

Ripple announced a partnership with the decentralized oracle network Chainlink to enhance the adoption of its RLUSD stablecoin.

The XRP parent company aims to enhance RLUSD's utility across Ethereum's DeFi markets through Chainlink's secure infrastructure, which has allegedly powered $18 trillion in transactional value.

"By adopting the Chainlink standard for verifiable data on the Ethereum blockchain, Ripple is enhancing the utility of RLUSD across the on-chain economy," Ripple stated.

The company also seeks to maximize Chainlink's price feeds for reliable on-chain market data. This will boost RLUSD's integration across decentralized applications for use cases such as trading and lending.

"By leveraging the Chainlink standard, we bring trusted data on-chain, further strengthening RLUSD's utility across both institutional and decentralized applications," said Jack McDonald, senior vice president of Stablecoin at Ripple.

The Chainlink Effect for stablecoins. https://t.co/BKJIgFZOAk pic.twitter.com/0KwBKraKDx

— Chainlink (@chainlink) January 7, 2025

Meanwhile, RLUSD could be among the largest beneficiaries of the recent Markets in Crypto-Assets (MiCA) laws guiding the use of digital assets in Europe.

Since Tether has not secured MiCA compliance, most European exchanges have delisted USDT from their platforms. Hence, with a chunk of the European stablecoin market volume left open, newer assets like RLUSD could witness wider adoption from institutional and retail investors in the region.

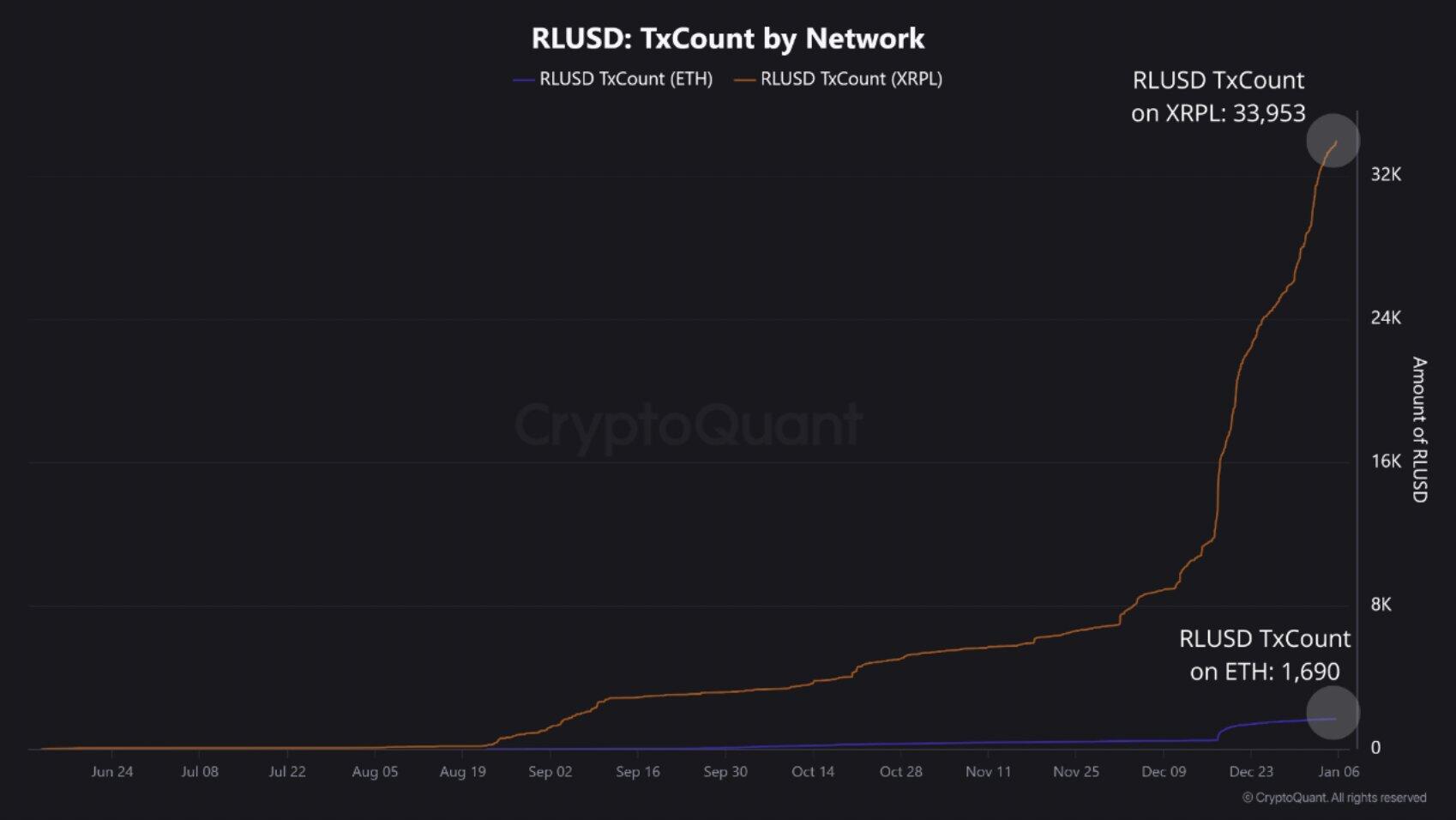

Furthermore, CryptoQuant data revealed a surge in RLUSD's transaction count since Ripple announced its launch in December. The stablecoin has since witnessed 33,953 transactions on the XRP Ledger and 1,690 on Ethereum. This indicates a growing preference for RLUSD among investors.

RLUSD Transaction Count by Network. Source: CryptoQuant

If RLUSD adoption continues its uptrend, it could boost demand for XRP, which serves as an auto-bridge asset for converting the stablecoin to other currencies.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.