Ethereum Price Forecast: ETH dives over 6% as staking withdrawals rise

Ethereum price today: $3,440

- Ethereum investors have withdrawn over 500K ETH from staking protocols in the past month.

- WisdomTree deposited over 11K ETH in Coinbase a few minutes before the market's recent sell-off.

- Ethereum could bounce off the lower boundary support line of a symmetrical triangle pattern.

Ethereum (ETH) is down 6% on Tuesday after the recent general crypto market decline canceled out gains seen in the past five days. If ETH fails to bounce off the lower boundary support line of a symmetrical triangle pattern, it could crash to the $3,000 psychological level.

Ethereum staking outflows rise, short-term holders realize losses

Ethereum investors have been withdrawing their assets from staking protocols since early December. According to CryptoQuant's data, over 500,000 ETH have flowed out of staking protocols in the past month. Despite the crypto market maintaining a slightly bullish structure, these substantial net outflows could affect ETH's long-term prospects.

-638718709780019430.png)

Ethereum Total Value Staked. Source: CryptoQuant

A decline in the total amount of staked ETH indicates investors may not be willing to hold on to their positions in the long term.

A potential reason for the staking outflows could be profit-taking among investors due to rising prices in the past two months.

Meanwhile, Santiment data shows that the recent ETH selling activity came from coins less than one year old, after a slight increase in the 90-day, 180-day and 365-day Dormant Circulation. Some of these coins were sold at a loss of over $6.6 million.

[18.32.28, 07 Jan, 2025]-638718710221670753.png)

ETH Dormant Circulation. Source: Santiment

Such movements among short-term holders are expected during price swings.

Crypto analytics platform Lookonchain's data also showed that asset manager WisdomTree deposited 11,733 ETH worth about $42.61 million into Coinbase just before the market's sharp decline.

Additionally, Ethereum exchange-traded funds witnessed net inflows of $128.7 million on Monday, with BlackRock's iShares Ethereum Trust (ETHA) raking in $124.1 million inflows.

Ethereum Price Forecast: ETH risks decline to $3,000 if symmetrical triangle support fails

In the past 24 hours, ETH futures recorded over $73 million in liquidations, with long positions accounting for $64.05 million and short positions for $9.01 million, per Coinglass data.

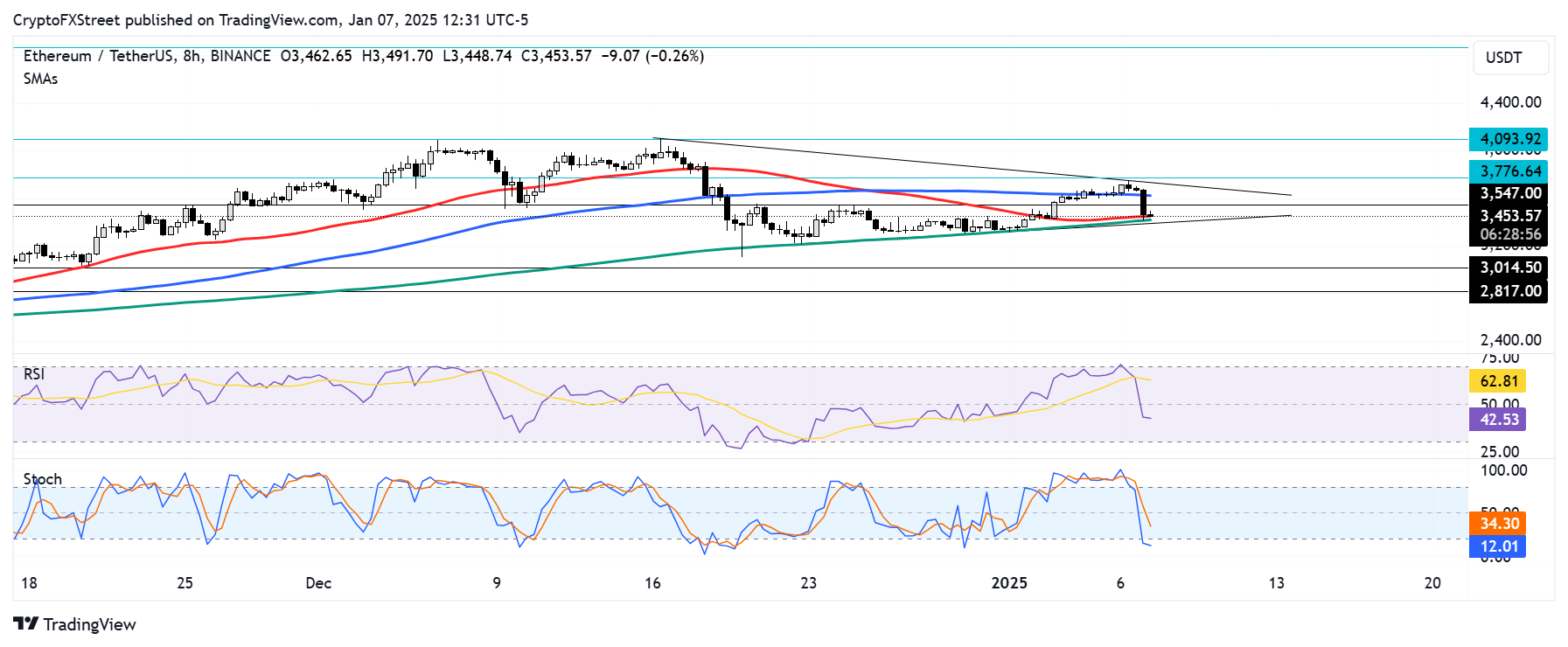

Ethereum is consolidating within a key symmetrical triangle pattern extending from December 16. After seeing a rejection at the triangle's upper boundary, ETH has crossed below the 200-day Simple Moving Average (SMA) and is testing the lower boundary support line.

ETH/USDT 8-hour chart

A bounce off the lower boundary support line where the 100-day and 50-day SMAs converge could help ETH surge above the symmetrical triangle and the resistance level near $3,780. If ETH completes this move with a high volume, it could overcome the $4,093 key resistance level. A breakout above $4,093 may propel ETH to tackle its all-time high resistance at $4,868.

However, if ETH declines below the lower boundary and SMAs support, it could decline toward the $3,000 psychological level. A move below this level could see ETH finding support near the $2,817 key level.

After bouncing off the overbought region line, the Relative Strength Index (RSI) is below its neutral level. Meanwhile, the Stochastic Oscillator (Stoch) has retreated into the oversold region, indicating ETH could see a recovery soon

A daily candlestick close below $2,817 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.