Bitcoin Price Forecast: BTC faces further downside as whale transactions surge to 2-year high

- Bitcoin price opened trading at $94,800 on Tuesday, marking its lowest level since November 27.

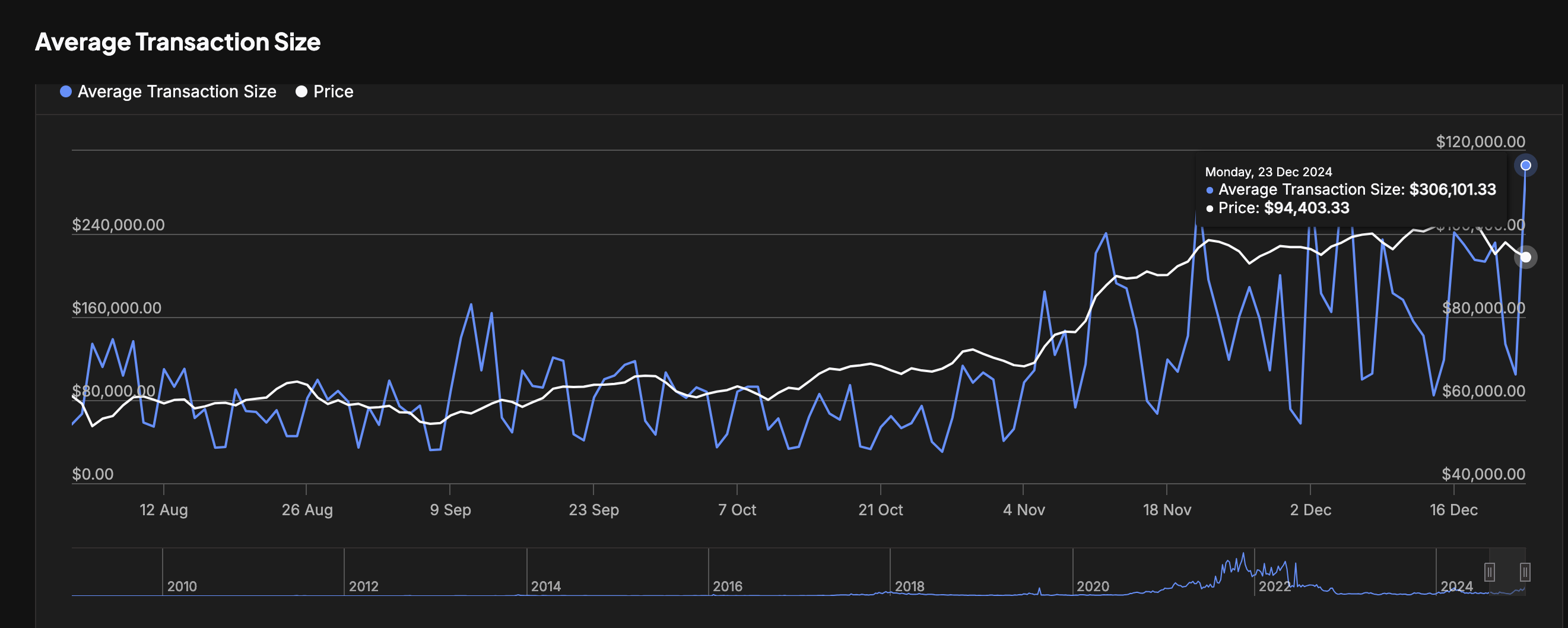

- The average transaction size on the Bitcoin network hit a 2-year high of $306,101 on December 22, signaling large-scale sell-offs by whale investors.

- The Bull Bear Power indicator points to continued downside risks, with bears dominating market momentum for six consecutive days.

Bitcoin price opened trading below the $95,000 level on Tuesday, marking its lowest level since November 27. On-chain data trends show rising sell-side pressure from large investors. Is BTC at risk of falling below $90,000?

Bitcoin plunges below $95,000 despite MicroStrategy purchases

Following hawkish United States Federal Reserve (Fed) statements in the aftermath of the interest rate cut decision on December 17 has sparked bearish reactions across crypto markets.

While altcoins registered considerable rebound over the weekend, BTC has continued to languish in bearish territories.

Bitcoin price action | BTCUSDT (Binance)

Bitcoin’s underwhelming price performance has come amid another $516 million BTC purchase from MicroStrategy, announced on Monday.

The chart above shows how BTC price opened trading at $94,881 on Tuesday, bringing its seven-day timeframe losses to 12.4%.

More so, Japanese Investment firm Metaplanet Inc. also announced the purchase of an additional 619.7 Bitcoin for approximately $58.9 million.

Bitcoin price declining further despite two major purchase announcements from MicroStrategy and Metaplanet signals increased selling pressure among other large investors.

Bitcoin whale activity hits two-year peak amid market crash

Large corporate investors have been rebalancing their positions following the Fed's hawkish guidance for Q1 2025.

Consequently, Bitcoin's 12% price decline in the past seven days has coincided with notable whale activity.

Recent on-chain data trends reveal a significant spike in the average value of Bitcoin transactions during this market downturn.

Bitcoin Average Transaction Size vs. BTC Price | Source: IntoTheBlock

Bitcoin Average Transaction Size vs. BTC Price | Source: IntoTheBlock

As reported by IntoTheBlock, the average transaction size for Bitcoin reached $306,100 on Monday, marking the highest level since November 2022.

Historically, spikes in transaction sizes during market dips are associated with intensified sell-offs among whales, contributing to increased downward pressure on the market.

This behavior could extend the bearish trend if it continues, as larger trades often influence overall market sentiment and liquidity.

Without a corresponding rise in demand, this could lead to further price corrections in the near term.

Bitcoin price forecast: $90,000 support at risk?

Bitcoin’s price action hints at further downside as it struggles to recover from the recent market crash.

On Monday, the average transaction size on the Bitcoin network soared to $306,101, marking a two-year high.

This reflects heightened whale activity, likely indicating large-scale sell-offs.

Currently, Bitcoin trades near the lower boundary of the Donchian Channels at $90,500, a key support level.

A breach below this could intensify selling pressure, with the next critical support found at $88,000.

Bitcoin Price Forecast | BTCUSDT

Bitcoin Price Forecast | BTCUSDT

The bearish dominance is further supported by the Bull Bear Power (BBP) indicator, which has remained in negative territory for six consecutive days.

Resistance lies at $99,426, the midline of the Donchian Channels.

A break above this level could signal a bullish recovery, opening the door for a potential test of the $108,353 upper resistance.

For now, Bitcoin’s immediate future hinges on its ability to hold above $90,500.

A close below this level could validate bearish forecasts, while a sustained move above $99,426 might invalidate the current downtrend, signaling the start of a recovery