Bitcoin Cash Price Forecast: 40,000 investors sell BCH as BTC, ETH lead crypto crash

- Bitcoin Cash price plunged to a 40-day low of $390 as the crypto market crash extended further on Friday.

- On-chain data trends shows traders have emptied 40,000 active BCH wallets within the last three days.

- From a technical standpoint, BCH bulls now face a strong challenge breaching the $450 resistance level.

Bitcoin Cash price plunged to a 40-day low of $390 as the crypto market crash extended further on Friday. On-chain data trends show a large number of existing BCH holders emptying their wallets amid the market dip.

Bitcoin Cash price plunges 35% as crypto sell-off bites harder

Following the hawkish stance that accompanied the Federal Reserve (Fed) rate decision on Wednesday, the global crypto market has been in a steep downtrend.

While Bitcoin price plunged as low as $94,200 on Friday, the bearish headwinds has spread toward popular Proof-of-Work altcoins like Bitcoin Cash (BCH) and Litecoin (LTC).

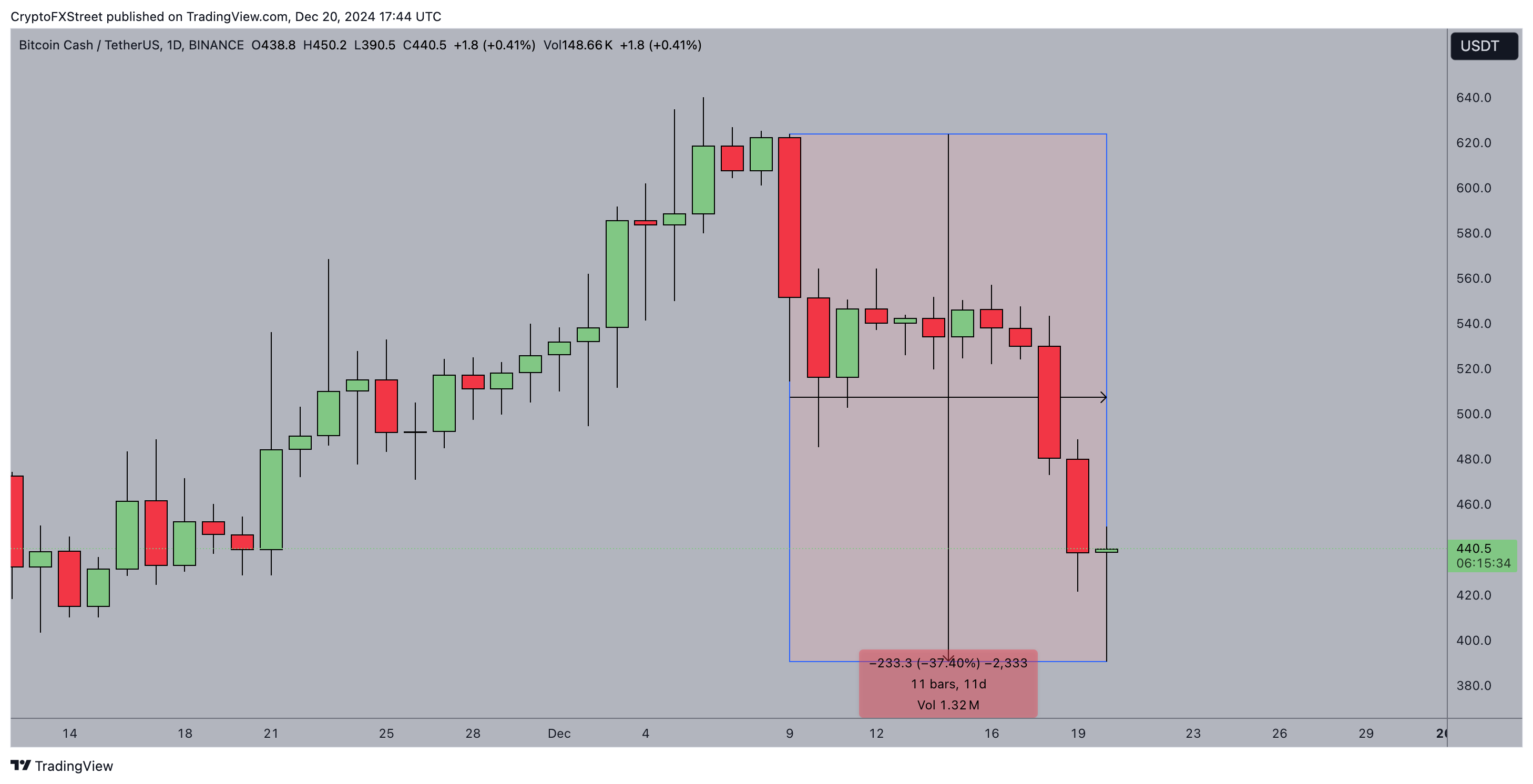

Bitcoin Cash price action | BCHUSDT (Binance)

The chart above shows how BCH price has plunged 35% since an initial market wobble on December 9.

During that period, Bitcoin Cash price dropped from $623 to hit a 40-day low of $390 on Friday.

40,000 BCH investors emptied their wallets amid crypto crash

Bitcoin Cash (BCH) has experienced a steep 35% price dip over the last 18 days, declining faster than major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

On-chain data reveals that a significant number of BCH holders have been liquidating their positions amid the ongoing market crash, sparking fears of further downside risks.

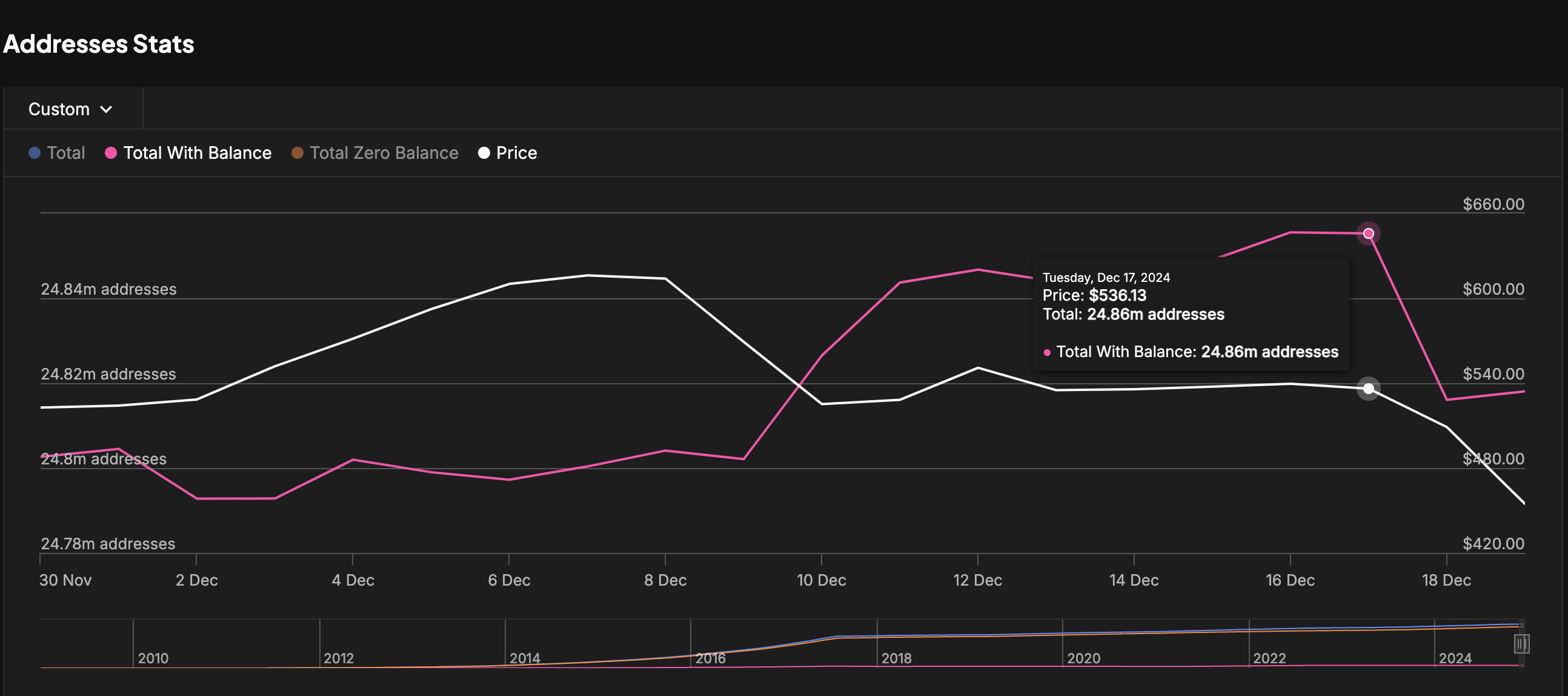

Recent data from IntoTheBlock highlights a notable reduction in the number of actively funded wallets on the Bitcoin Cash blockchain.

This metric offers valuable insight into investor behavior, during volatile market phases.

As of December 16, 2024, there were 24.86 million funded BCH wallets on the network.

Bitcoin Cash Total Holders | Source; IntoTheBlock

Bitcoin Cash Total Holders | Source; IntoTheBlock

However, as the Fed meeting unfolded earlier this week, a sharp wave of selling activity emerged.

Over the past three days, approximately 40,000 wallets were emptied, bringing the total number of funded wallets down to 24.82 million by December 19, 2024.

This data points to a significant exodus of BCH holders, with 40,000 wallets liquidating their entire holdings during the market downturn.

Such widespread capitulation underscores the heightened anxiety among investors, many of whom appear to be retreating amid the current uncertainty.

This trend signals potential downside risks for BCH in the near term. The first concern is the apparent loss of investor confidence.

The rapid reduction in funded wallets reflects a bearish sentiment, with many investors seemingly losing faith in BCH as a reliable store of value.

This could discourage new participation and further amplify the selling momentum.

Additionally, the mass liquidation has increased selling pressure on BCH, a factor that could deepen the token’s volatility.

With fewer active participants and heightened selling activity, Bitcoin cash could face sharper price declines if the market crash persists.

BCH Price Forecast: $450 resistance looming large

Bitcoin Cash (BCH) faces significant resistance at $450 after a steep decline of 37% over the past 11 days.

The Bollinger Bands on the daily chart indicate narrowing volatility with prices testing the lower band near $447.

This suggests that BCH may struggle to break out of its downward trajectory, especially with the current trend showing limited momentum toward recovery.

Bitcoin Cash (BCH) Price Forecast

Bitcoin Cash (BCH) Price Forecast

The Bull-Bear Power (BBP) indicator highlights a bearish dominance, currently at -181, underscoring strong selling pressure.

The $450 level aligns with the midpoint of the Bollinger Bands, acting as a critical resistance zone that BCH needs to surpass to signal any bullish reversal.

A failure to clear this hurdle could reinforce bearish sentiment, pushing prices further down.

On the flip side, two key support levels provide potential downside buffers.

The first is at $430, where recent wicks have found temporary stability.

The second is at $390, coinciding with the lower Bollinger Band and marking a psychological threshold.

Breaching these supports could trigger further declines, but holding them could signal consolidation amid the ongoing sell-off.