Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

- Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week.

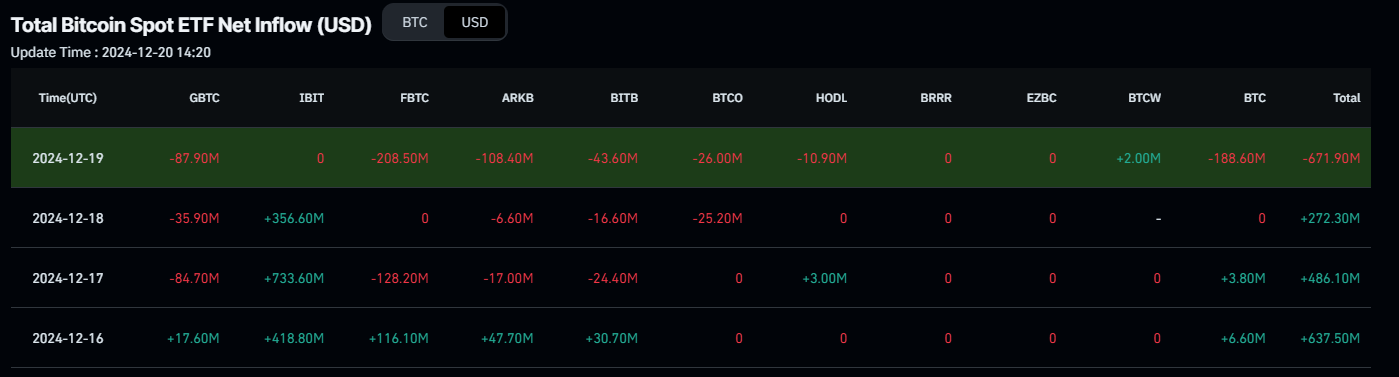

- Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

- The US Fed’s hawkish rate-cut decision fueled Bitcoin’s correction this week.

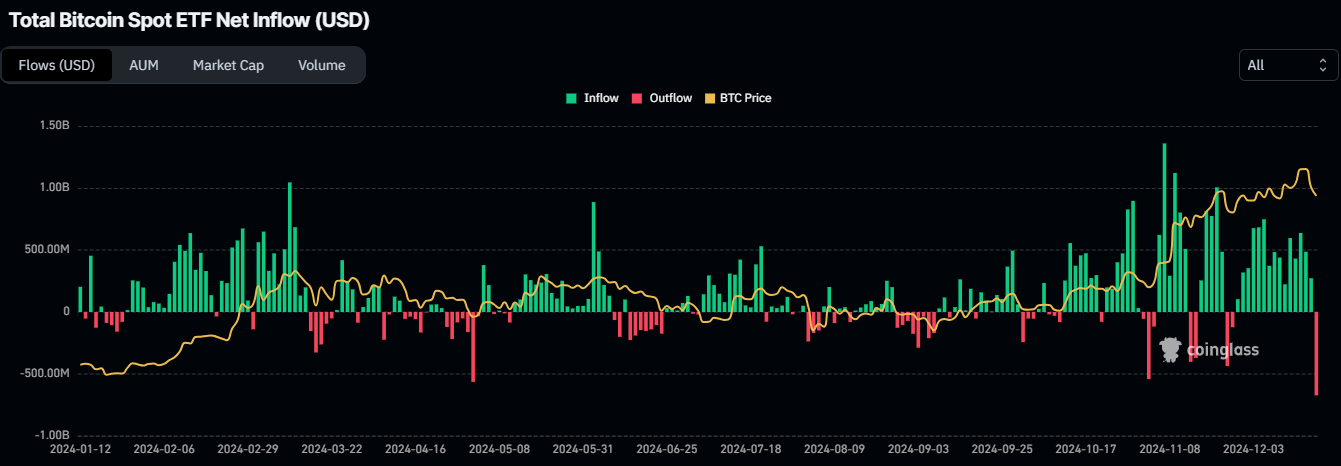

Bitcoin (BTC) price continues to edge down, trading below $95,000 on Friday and on the way towards its worst week since the end of August. This recent price pullback was fueled by the hawkish rate-cut decision by the US Federal Reserve (Fed) on Wednesday, which was followed by the highest single-day outflow ($671.90) from Bitcoin US spot Exchange Traded Funds (ETFs) on Thursday. The technical outlook suggests that the correction is set to continue, targeting the $90,000 level.

Bitcoin’s institutional demand shows early signs of weakness

Bitcoin price reached a new all-time high of $108,353 on Tuesday but could not maintain its bullish momentum and corrected more than 8% until Thursday. As of Friday, it continues its pullback, trading below $95,000.

Institutional demand showed some signs of weakness this week. According to Coinglass, Bitcoin Spot Exchange Traded Funds (ETF) data recorded three straight days of inflows totaling $759.4 until Wednesday, but saw a massive outflow of $671.90 million on Thursday. This outflow broke a streak of inflows since November 27 and was the highest single-day outflow since the launch of Bitcoin’s spot ETFs in January.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

“If I’m a trader and I see those ETF inflows start to slow down, I’d say we’ll have some weakness,” Eric Turner, CEO of crypto research and data analytics company Messari told FXStreet in an exclusive interview.

Turner explained that looking at ETF volumes will be very telling because one of the reasons behind the smoothing of the volatility of Bitcoin is this new source of capital through ETFs.

“We’ve seen some dips recently, but we really haven’t seen what we’ve seen in the past when Bitcoin went down 10% to 20% in a day,” Turner said.

Bitcoin correction intensifies as macro conditions add pressure

Bitcoin price pullback this week was fueled by the hawkish rate-cut decision by the US Federal Reserve (Fed) after Wednesday’s Federal Open Market Committee (FOMC) meeting. As expected, the Fed reduced the federal funds rate to a lower range of 4.25% to 4.50% but signaled a slowdown in interest rate cuts in 2025, leading risky assets like Bitcoin to decline.

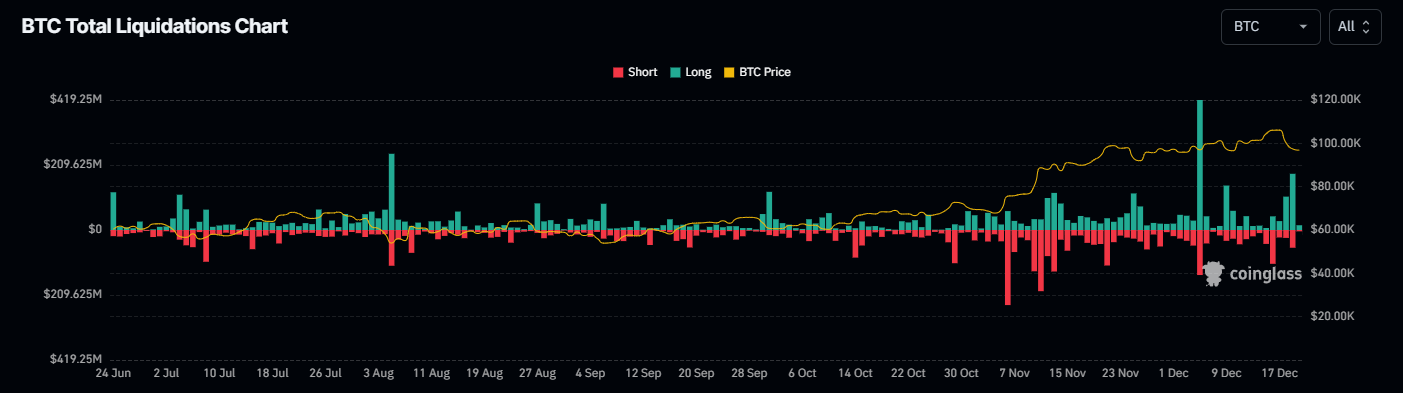

The correction in Bitcoin’s price on Wednesday and Thursday triggered a wave of liquidations, resulting in over $1.68 billion in total liquidations and more than $371.51 million specifically in BTC, according to data from CoinGlass.

Total Liquidation Chart. Source: Coinglass

Bitcoin Total Liquidation chart. Source: Coinglass

Apart from this hawkish projection, Fed Chair Jerome Powell said that the Fed “is not allowed to own Bitcoin.” Powell’s comments indicated that the Fed cannot own Bitcoin and has no intention of changing this policy, leading to negative reactions in the cryptocurrency.

JUST IN: Fed Chair Jerome Powell says "we're not allowed to own #Bitcoin" pic.twitter.com/SQnNfqnTni

— Bitcoin Magazine (@BitcoinMagazine) December 18, 2024

Messari’s CEO Turner further explained that is it possible that Bitcoin experiences some volatility at the beginning of the year and that macroeconomic data and flows into the space primarily via the ETFs would be the key signs to watch for in the short term.

Bitcoin corporate demand stays resilient

Corporate demand for Bitcoin stayed strong despite its price decline this week. At the start of this week on Monday, Michael Salyor’s MicroStrategy (MSTR) announced that the company had purchased an additional 15,350 BTC for around $1.5 billion. MSTR currently holds 439,000 BTC, acquired for $27.1 billion at an average price of $61,725 per Bitcoin.

MicroStrategy has acquired 15,350 BTC for ~$1.5 billion at ~$100,386 per #bitcoin and has achieved BTC Yield of 46.4% QTD and 72.4% YTD. As of 12/15/2024, we hodl 439,000 $BTC acquired for ~$27.1 billion at ~$61,725 per bitcoin. $MSTR https://t.co/SaWLNBVkrl

— Michael Saylor⚡️ (@saylor) December 16, 2024

During the same period, Riot Platforms also announced that it had added 667 BTC at an average price of $101,135 per BTC. Currently, Riot holds 17,429 BTC valued at $1.8 billion.

With the additional proceeds from Riot’s upsized $594 million, 0.75% coupon convertible bond issue, the Company has acquired 667 BTC at an average price of $101,135 per BTC. As a result, Riot has increased its holdings to 17,429 BTC, currently valued at $1.8 billion based on the… pic.twitter.com/t68Uy8nbHU

— Riot Platforms, Inc. (@RiotPlatforms) December 16, 2024

According to Lookonchain data, Marathon Digital (MARA) added 1,627 BTC worth $166 million on Wednesday. At the same time, three whale wallets bought 1,153 BTC worth $120 million after the price pullback.

On-chain data shows that Marathon Digital(@MARAHoldings) has accumulated 1,627 $BTC($166M) in the past 8 hours.https://t.co/9DlN5ZPsBz pic.twitter.com/3KQUfyJnJY

— Lookonchain (@lookonchain) December 19, 2024

3 whales bought 1,153 $BTC($120M) after the $BTC price pullback.

— Lookonchain (@lookonchain) December 18, 2024

bc1qkv...t44v withdrew 501 $BTC($52.24M) from #Bitfinex 30 minutes ago.

bc1pjq...sjpc withdrew 551.5 $BTC($57.28M) from #Binance in the past 2 hours.

1L7gnf...xeTs withdrew 100 $BTC($10.42M) from $Binance 1 hour… pic.twitter.com/FEyp8BvwI6

On Thursday, Hut 8 Corp (HUT), an energy infrastructure and Bitcoin miners company announced that it purchased 990 BTC worth $100 million at an average price of $101,710 per Bitcoin on Wednesday. Combined with the Bitcoin held before this purchase, Hut 8’s strategic Bitcoin reserve now totals 10,096 BTC with a market value of more than $1 billion.

Will Bitcoin nosedive to $90K?

Bitcoin price reached a new all-time high (ATH) of $108,353 on Tuesday and declined 7.8% in the next two days, closing below the $100K support level. At the time of writing on Friday, it continues to trade down below $95,000.

If BTC continues its correction, it could extend the decline to retest the $90,000 support level.

The Relative Strength Index (RSI) on the daily chart falls to 45, below its neutral level of 50, and points downwards, indicating bearish momentum. The Moving Average Convergence Divergence (MACD) indicator also showed a bearish crossover on Wednesday, suggesting an impending downward trend.

BTC/USDT daily chart

However, If BTC recovers and closes above $100,000, it could extend the rally to retest its all-time high (ATH) of $108,353.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.