Ethereum Price Forecast: ETH may not sustain recent 10% decline despite panic selling from short-term holders

Ethereum price today: $3,370

- Ethereum short-term holders have been panic selling, with some realized losses crossing $60 million.

- The quietness of long-term holders and plunging exchange reserves indicate the price decline could be temporary.

- ETH could decline to the $3,000 psychological level after validating a double top pattern on the daily time frame.

Ethereum (ETH) declined below the $3,550 key support level on Thursday following bearish pressure from the Federal Reserve's (Fed) rate cut decision. However, on-chain analysis shows that the price decline may not last long as long-term holders have stayed quiet despite the bearish sentiment.

Ethereum on-chain metrics indicate price decline could be temporary

Ethereum is on track to record one of its worst weekly performances since the last week of July after seeing declines of over 10% in the past four days.

The decline was accelerated by the Fed's adjustment of its projected rate cuts in 2025 from four to two despite cutting rates by 25 basis points on Wednesday.

The effect has been appalling on ETH compared to most other crypto assets in the top ten, shaving off its recent gains against Bitcoin and Solana.

Dormant Coins Circulation metric shows most of the recent selling activity comes from investors that purchased ETH within the past year or short-term holders (STH), as reflected by the slight uptick in Dormant Coins aged 90, 180, and 365 days.

[20.42.48, 19 Dec, 2024]-638702376627061585.png)

ETH Dormant Coin Circulation (STH) | Santiment

ETH's Network Realized Profit/Loss reveals most of these STHs are selling at a loss, with realized losses crossing $60 million in the past two days.

However, long-term holders (LTH) remained put in the face of the recent price dip as reflected by their downtrend in the chart below. As opposed to panic selling during price declines, LTHs have partially been booking profits whenever ETH saw a notable rise in the past few months.

[20.42.53, 19 Dec, 2024]-638702377164969148.png)

ETH Dormant Coin Circulation (LTH) | Santiment

Since LTHs aren't part of the recent selling activity, the decline may not last long as prices historically tend to recover quickly on such occasions. Hence, it's important to keep an eye on their behavior in the coming days. If they fail to join the selling train, a recovery could happen quickly.

Additionally, Ethereum exchange reserves have been plunging downward in the past three days, indicating investors are buying the dip.

-638702377679687647.png)

Ethereum Exchange Reserve | CryptoQuant

A similar trend is also visible in ETH's exchange net flows, which shows that exchanges like Binance, OKX, Bybit, Kraken and Bitstamp have been seeing higher withdrawals, per Coinglass data.

Meanwhile, Ethereum ETFs stretched their inflow streak to eighteen consecutive days with net inflows of $2.5 million on Wednesday.

Ethereum Price Forecast: ETH could decline to $3,000 following double top validation

Ethereum sustained liquidations worth over $220 million in the past 24 hours, with liquidated long positions accounting for nearly $200 million, per Coinglass data.

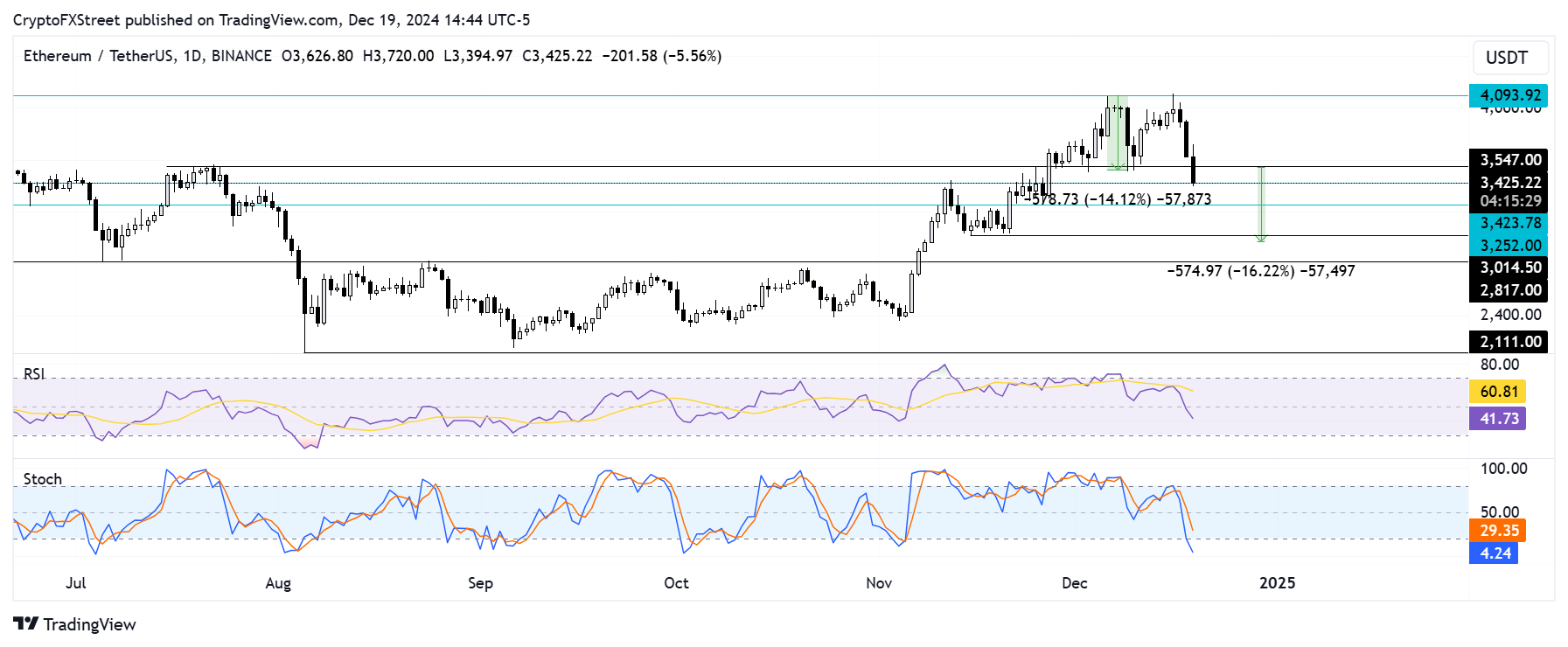

ETH has crossed below the $3,550 support level with a high volume decline as market participants are still reacting to the Fed's hawkish rate cut decision for 2025.

ETH/USDT daily chart

The decline validates a double top pattern which ETH formed within the past two weeks.

After seeing a rejection near its yearly high resistance of $4,093 on December 6, ETH formed a trough by declining to the neckline support level near $3,550. ETH bounced off $3,550 and rallied briefly before sustaining another rejection at $4,093.

With the recent high volume decline below the neckline support at $3,550, ETH could sustain a decline toward the support near the $3,000 psychological level if buyers fail to outweigh sellers. This target is obtained by measuring the height of the decline from the price top to its neckline.

However, the $3,250 support level could help prevent such declines.

The Relative Strength Index (RSI) is declining below its neutral level, indicating rising bearish momentum.

Notably, the RSI on the daily chart is developing a trend where ETH often sustains a decline when it sees a rejection near its yellow moving average line.

On the other hand, the Stochastic Oscillator (Stoch) has crossed into the oversold region, indicating prices could soon see a recovery from the recent decline.

A daily candlestick close above $3,550 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.