Crypto Today: Bitcoin holds $104K as XRP, AVAX and Solana traders take profits

- The cryptocurrency sector valuation declined 4% on Wednesday, dropping toward $3.8 trillion.

- While Bitcoin price dipped 2% to consolidate around the $104,600 mark, top altcoins like XRP, AVAX and SOL suffered excess of 5% losses on the day.

- The sell-the-news frenzy comes as the Fed projects fewer rate cuts in 2025.

Altcoin market updates: Solana, XRP AVAX among top losers, Fed triggers sell-the-news frenzy

As the US central bank’s governors on Wednesday projected fewer rate cuts in 2025, crypto traders opted to take profits off the table.

This effectively ended a week-long rally that has seen Bitcoin (BTC), Ripple (XRP) and Avalanche (AVAX) all score double-digit gains since December 10.

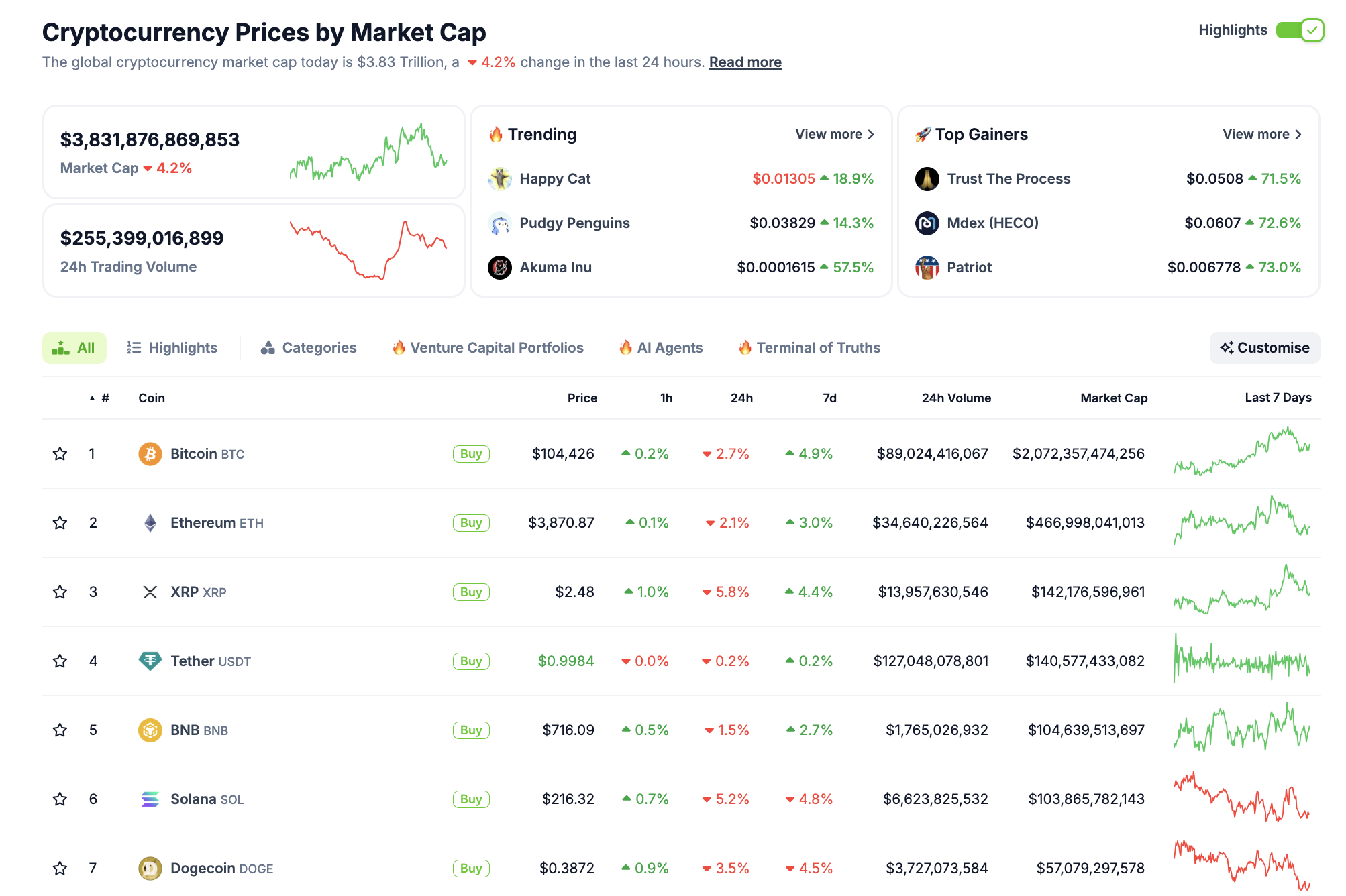

Crypto Market Performance | December 18, 2024 | Source: Coingecko

According to data aggregated by Coingecko, the global crypto market capitalization declined 4.2% on Wednesday, reflecting a sector wide sell-off after the US Fed cut its main policy rate by 25 basis points but projected fewer cuts next year.

- XRP price dipped 5.2%, tumbling under the $2.50 mark as market euphoria peaked after the RLUSD stablecoin’s official launch on December 17.

- Solana (SOL) price also declined by 5% before finding support around the $215 level.

- Avalanche traders also booked profits on Wednesday, sparking a 5.6% price retracement before settling at the $47 level.

Chart of the day: Bitcoin traders maintain positive outlook despite Fed Jitters

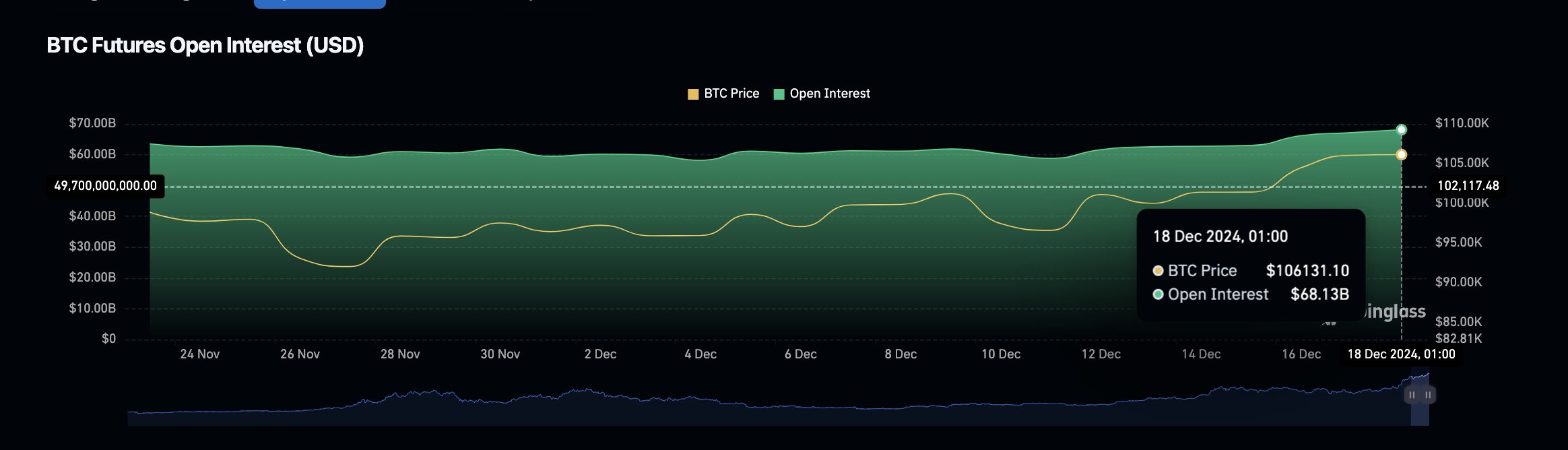

As the US Fed meeting kicked off on Tuesday, the market had priced in a 25-basis-point rate cut, which has come to pass. Widespread anxiety around this major market event had already triggered a 4.2% outflow from the global crypto sector valuation over the last 24 hours. However, market data suggests the majority of speculative traders still maintain a positive outlook on Bitcoin’s short-term price prospects.

While Bitcoin price dipped below the $105,000 mark, the Coinglass chart below shows speculative traders continue to drive more capital inflows toward the BTC futures markets.

Bitcoin (BTC) Open Interest vs. Price | Source: Coinglass

As shown in the chart above, Bitcoin open interest rose to a new all-time high of $68.1 billion on Wednesday, reflecting $5 billion of inflows within the last 48 hours.

When Open Interest continues to increase amid a price pullback, it signals resilient bullish sentiment among short-term speculative traders. The move could set the stage for a rapid breakout in the coming trading sessions for two main reasons.

First, rising Open Interest amid a price correction suggests that traders are accumulating leveraged long positions, anticipating a rebound rather than exiting the market. This reinforces a "buy-the-dip" phenomenon that often precedes a sharp recovery.

If Bitcoin maintains its position above the $100,000 psychological support, a breakout toward the $110,000 resistance becomes increasingly likely.

.

Crypto news updates:

Ohio Lawmaker Proposes State-Backed Bitcoin Reserve to Safeguard Public Funds

Ohio State Representative Derek Merrin has introduced the Ohio Bitcoin Reserve Act, a bill aiming to establish a state-backed Bitcoin reserve.

The proposed legislation would allow Ohio to invest surplus funds in Bitcoin as a hedge against the devaluation of the US Dollar.

Merrin emphasized the importance of Bitcoin in preserving the value of public funds, stating it provides a robust supplement to traditional investment portfolios amid inflationary pressures.

The proposal mirrors growing state-level interest in Bitcoin, with Texas and Pennsylvania pursuing similar initiatives.

It also aligns with broader Republican strategies, including President-elect Donald Trump’s expected push for a national Bitcoin reserve and Senator Cynthia Lummis’ draft bill advocating for 1 million BTC purchases over five years.

Bitcoin’s impressive 155% growth this year — spurred by a 50% post-election surge — strengthens its appeal as a strategic asset.

Arthur Hayes Predicts Major Crypto Sell-Off During Trump’s Inauguration

Arthur Hayes, former BitMEX CEO and CIO of Maelstrom, warns of a significant crypto market sell-off around Donald Trump’s inauguration on January 20, 2025.

Hayes attributes this potential downturn to a growing disconnect between investor expectations for pro-crypto policies under Trump’s administration and the slow pace of political realities.

While Bitcoin surged following Trump’s electoral win, buoyed by optimism around favorable regulations, Hayes anticipates a sharp market correction as traders recalibrate their outlook.

Citing limited time for Trump to enact sweeping crypto reforms, Hayes believes the inauguration will serve as a tipping point for investor sentiment.

He revealed plans to reduce Maelstrom’s crypto holdings ahead of the event to mitigate risks.

Hayes’ forecast signals caution for bullish traders who have fueled Bitcoin’s post-election rally, underscoring the importance of balancing speculative enthusiasm with realistic policy timelines.

Trump-Backed World Liberty Financial Adopts sUSDe Stablecoin for DeFi Expansion

Donald Trump-backed crypto platform World Liberty Financial (WLFI) is integrating Ethena’s sUSDe stablecoin as a core collateral asset within its DeFi ecosystem.

The move, pending governance approval, would enable sUSDe deposits with dual rewards in sUSDe and WLFI’s native WLF tokens.

These incentives aim to boost liquidity and attract new users to WLFI’s upcoming Aave v3 instance.

Should governance reject the proposal, WLFI and Ethena plan to pursue alternative collaboration opportunities for mutual integration.

WLFI has also expanded its digital asset portfolio as part of its growth strategy, investing $500,000 in Ethena and $250,000 in Ondo Finance.

The platform’s total holdings now stand at $83 million, with Ethereum (ETH) accounting for the largest share at $57 million, according to Arkham Intelligence.