Ethereum Price Forecast: RWA tokenization could boost ETH's price in 2025, Bitwise

- Ethereum could capture $100 billion fees from RWA tokenization, says Bitwise.

- Key whales holding 57% of ETH's supply have continued to increase their holdings.

- ETH could rally above $4,300 if it maintains an extended move above its yearly resistance at $4,093.

Ethereum (ETH) is down 3% on Tuesday following Bitwise predictions of increased RWA tokenization boosting appeal for the top altcoin. Meanwhile, large whales have continued accumulating ETH in the past month.

Ethereum could power increased RWA tokenization in 2025

In a recent memo to investors, Bitwise Senior Investment Strategist Juan Leon predicted that Ethereum could be the largest benefactor of the recent trend of real-world assets (RWA) tokenization.

Trillion-dollar asset manager BlackRock already boasts $578 million in its BUIDL tokenized Treasury fund, while RWA projects like Ondo Finance have surpassed $600 million in total value locked (TVL). As a result, Bitwise believes that tokenized funds will be a major theme in 2025, with "Ethereum as the driving force behind it."

"[Ethereum] currently holds a commanding 81% market share in tokenized assets, and its long track record and large, distributed validator network gives asset managers confidence in its security and reliability as they migrate assets on-chain," noted Leon.

Additionally, the memo highlighted that the $100 trillion RWA market could contribute fees of over $100 billion annually to Ethereum if it moves on-chain.

"With the incoming pro-crypto SEC expected to provide the regulatory clarity needed to accelerate tokenization, investors who stake a claim on Ethereum now may find themselves handsomely rewarded in the period ahead," Leon concluded.

Meanwhile, Santiment data revealed that Ethereum's key holders have continued accumulating ETH, suggesting strong anticipation for signs of a bullish run.

The data suggests that 104 wallets currently hold at least 100K ETH, which accounts for 57% of the entire ETH in circulation. Notably, these holdings also include DeFi and staking wallets, suggesting that investors may not be looking to sell their tokens anytime soon.

There are currently 104 whale wallets holding at least 100K Ethereum. Their combined holdings currently sit at 57.35% of all existing ETH tokens, currently worth ~$333.1B.

— Santiment (@santimentfeed) December 17, 2024

Meanwhile, wallets with 100-100K hold their lowest ratio of supply in history, 33.46%. And sub-100 ETH… pic.twitter.com/9qDN3lotQy

Furthermore, Ethereum ETFs continued their streak of inflows, achieving 16 consecutive days of positive flows with a net inflow of $51.1 million on Monday, according to Coinglass data.

Ethereum Price Forecast: ETH could rally to $4,380 if it maintains a close above the $4,093 resistance

Ethereum is down 3% after sustaining $48.82 million in liquidations in the past 24 hours. The total amount of liquidated long positions accounted for $40.66 million, while short liquidations are at $8.16 million.

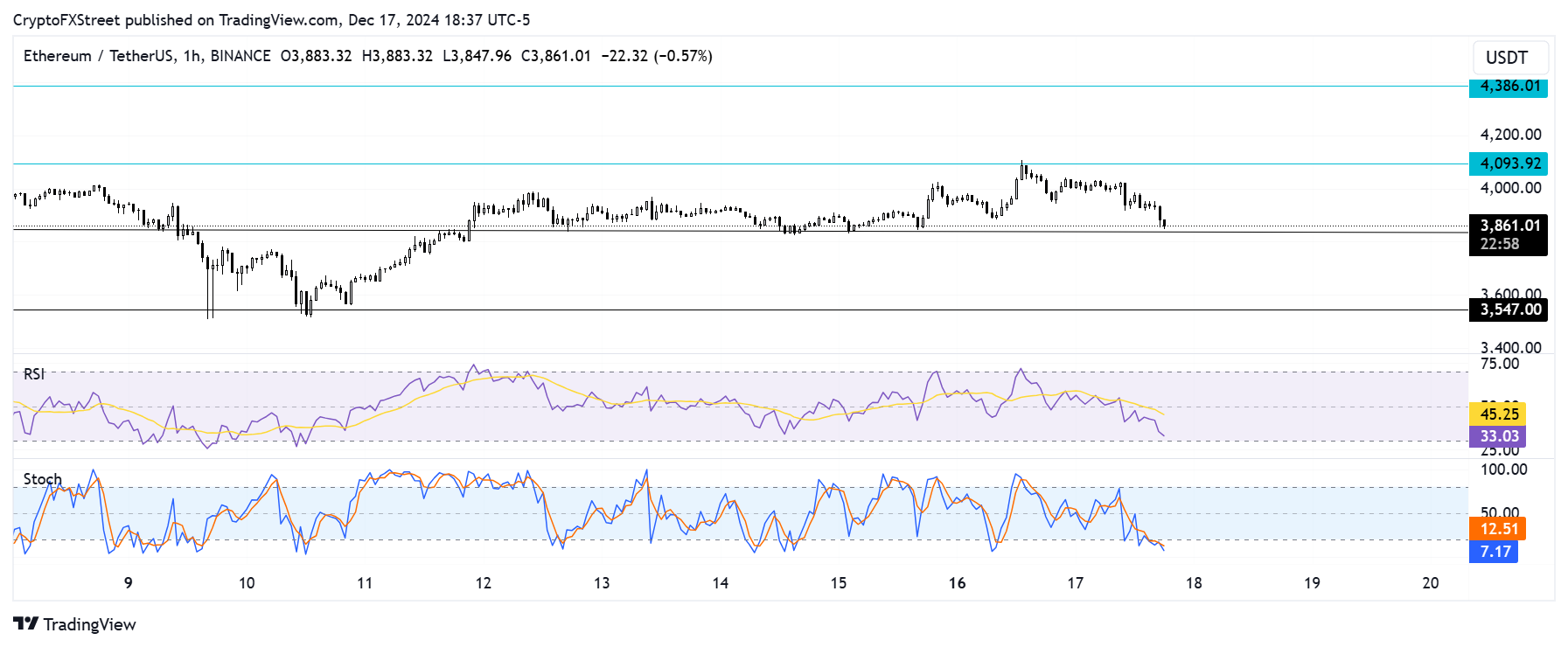

The top altcoin has been consolidating within a key rectangle channel in the past seven days after testing and failing to sustain a move above its yearly high resistance at $4,093.

ETH/USDT hourly chart

A sustained breakout above this level could see ETH rally toward $4,380. However, a breach of the support level near $3,820 could see a decline toward the support level near $3,550.

The Relative Strength Index (RSI) is below its neutral level, indicating bullish sentiment is waning. The Stochastic Oscillator is in the oversold region. Historically, prices have quickly recovered when the Stoch on the hourly chart enters the oversold region.

A daily candlestick close below $3,550 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.