Ethereum Price Forecast: ETH declines in light of Israeli attack, increased accumulation could fuel recovery

Ethereum price today: $3,650

- Ethereum investors sell due to potential price risk from Israel's attack on the Syrian navy.

- Ethereum accumulation addresses see a spike in growth as researcher leaves to join Solana.

- Ethereum could overcome the $4,093 yearly high resistance if it retests the key level again.

Ethereum (ETH) is down nearly 1% on Tuesday as the recent market drawdown is potentially due to investors de-risking following Israel's attack on the Syrian navy. The top altcoin could recover quickly as the balance of its accumulation addresses have grown steadily, reaching 19.5 million ETH.

Ethereum declines alongside Israeli attack, but increased accumulation could fuel recovery

The recent Ethereum market downturn could potentially be from risk perceptions surrounding Israel's attack on the Syrian navy. According to The New York Times, Israel aimed to destroy alleged chemical weapons stockpiles in Syria to keep them out of extremist control.

Ethereum investors may be de-risking by selling their assets in case Israel's attack has a sustained wider market impact. However, if the risk-averse attitude is not sustained, ETH could quickly recover and rally toward new highs.

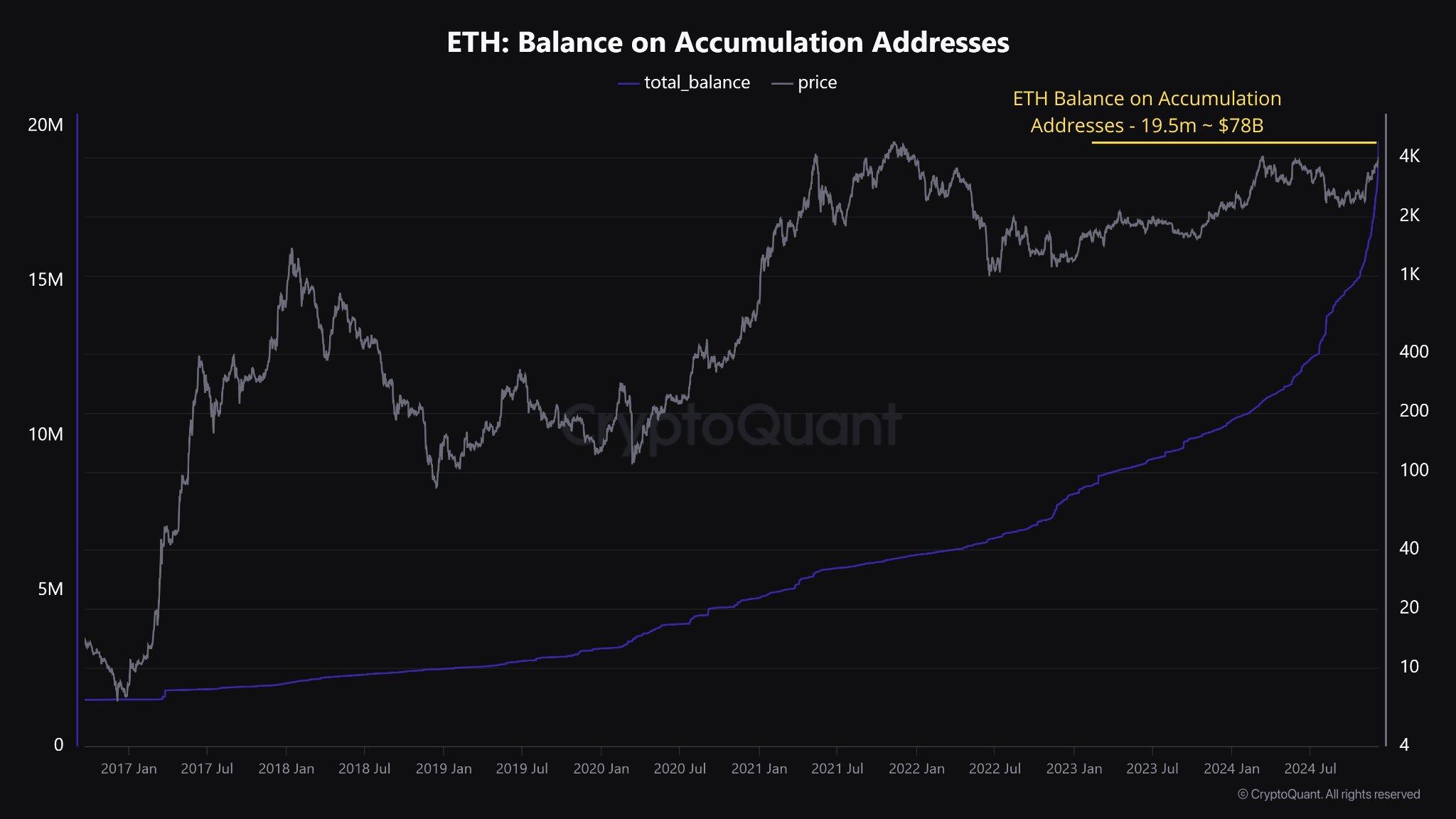

Despite recent price declines, the ETH balance on accumulation addresses — addresses with inflows and zero outflows — has spiked in the past few weeks, rising to 19.5 million ETH, per CryptoQuant analysts.

"If the trend continues, Ethereum could potentially hit a new all-time high (ATH)," the analysts wrote.

ETH Accumulation Addresses Total Balance | CryptoQuant

A similar trend is evidenced in US spot Ethereum exchange-traded funds (ETFs), which posted net inflows of $149.8 million on Monday — marking 11 consecutive days of positive flows, per Coinglass data. This shows that institutional investors are still bullish on ETH despite the recent price decline.

Meanwhile, Ethereum researcher Max Resnick announced that he would be leaving his role as head of research at Consensys subsidiary Special Mechanisms Group to join Solana research firm Anza. Resnick, an L1 scaling advocate who has been heavily critical of Ethereum's Layer 2 scaling approach, wrote in an X post on December 9 that he's "taking his talents to Solana."

Last week was my last week at Consensys. Today is my first day at @anza_xyz.

— Max Resnick (@MaxResnick1) December 9, 2024

I’m taking my talents to Solana.

In my first 100 days, I plan on writing a spec for as much of the Solana protocol as I can get to, prioritizing fee markets and consensus implementations where I…

Ethereum Price Forecast: ETH could overcome its yearly high resistance of $4,093 if it retests key level

Ethereum continued its recent downtrend, declining over 1% in the past 24 hours after seeing $141.34 million in liquidations. The total amount of long liquidations reached $113.30 million, while short liquidations accounted for $28.04 million.

ETH is moving toward the $3,550 level, which has served as a key support level in the past two weeks. If ETH bounces off this level, it could rally to retest its $4,093 yearly high resistance.

ETH/USDT 4-hour chart

ETH faced significant selling activity after reaching the $4,093 level on Friday. With most weak hands washed out by the recent selling, ETH could retest and overcome this level. However, if the $3,550 support level fails, the next key level to watch is the $3,252 level.

The Relative Strength Index (RSI) is below its neutral level, indicating dominant bearish momentum.

A candlestick close below $3,252 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.