Bitcoin Price Forecast: BTC steadies as Microsoft shareholders vote on investment proposal looms

Bitcoin price today: $97,800

- Bitcoin price hovers around $97,800 on Tuesday after declining almost 4% on Monday.

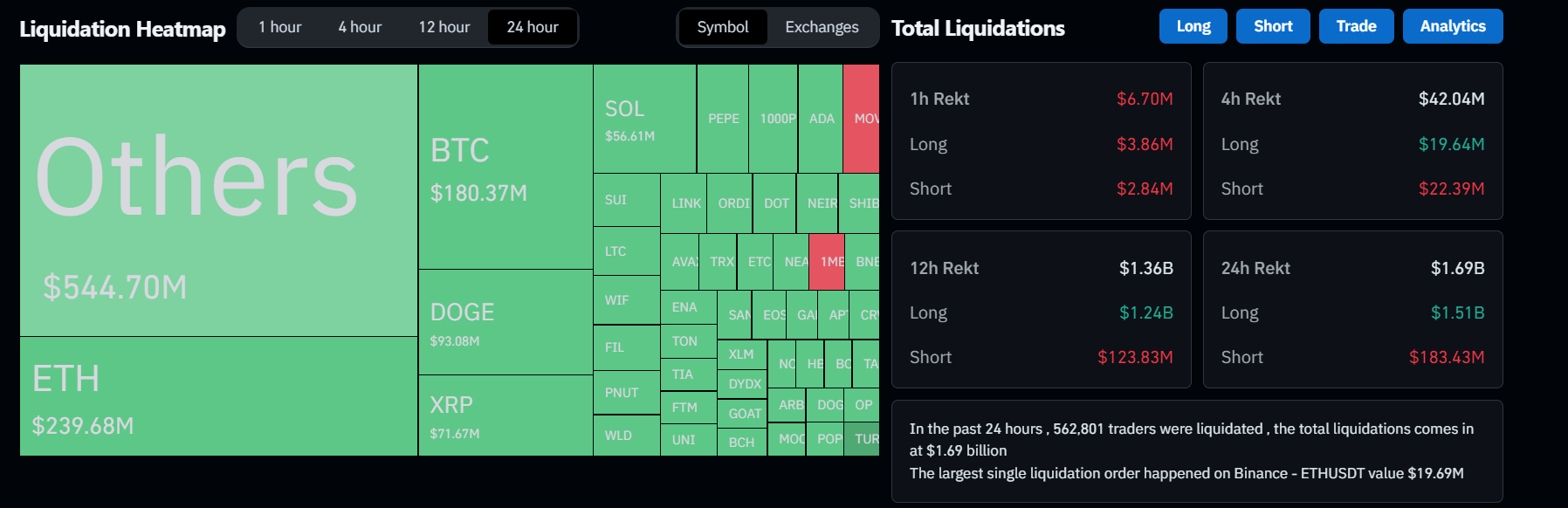

- BTC's recent drop triggered over $1.69 billion in liquidations, including $180 million in BTC alone.

- Reports highlight Microsoft shareholders' vote on Tuesday to add BTC to the balance sheet, which, if approved, could be a surprise to the topside.

Bitcoin (BTC) hovers around $97,800 on Tuesday after almost a 4% drop on Monday as traders look at the upcoming Microsoft (MSFT) shareholders' vote on Tuesday to add BTC to the balance sheet, a move that, if approved, could catalyze a further rally.

Monday’s drop in BTC price triggered $1.69 billion in liquidations in the overall crypto market, affecting 562,801 traders, including $180 million in BTC alone. Despite the fall, strong institutional demand persists, with more than $480 million in inflows into Bitcoin Spot Exchange Traded Funds (ETFs).

Bitcoin expects volatility following Microsoft shareholders’ vote

Bitcoin price hovers around $97,800 on Tuesday after reaching an all-time high of $104,088 last week. The recent surge has caught the attention of big corporations like Microsoft and Amazon into Bitcoin. Last week, Michael Saylor, co-founder of MicroStrategy, presented to Microsoft’s board why the tech giant should buy Bitcoin.

Microsoft shareholders vote today on adding BTC to the balance sheet. Despite the company’s board recommendation against it, its approval would be a potential upside surprise for Bitcoin, analysts at QCP said. “Adding to the intrigue, Amazon shareholders reportedly push for Bitcoin adoption as a reserve asset,” they said.

Bitcoin plunges to $94,150, erasing $1.69 billion from crypto market

Bitcoin price started this week on the back foot, reaching a low of $94,150 on Monday. The drop triggered a wave of liquidations across the crypto market, resulting in over 562,801 traders being liquidated with over $1.69 billion in total liquidations and more than $180 million specifically in BTC, according to data from CoinGlass.

Liquidation Heatmap chart. Source: Coinglass

This selling pressure could be seen as a result of BTC holders' profit-taking. Santiment’s Network Realized Profit/Loss (NPL) indicator suggests holders book profits at the top. BTC’s NPL metric spiked again on Monday after its recent spike last Thursday, indicating that holders are, on average, selling at a significant profit. If the NPL metrics spike continues, BTC price could decline in the short term.

[13.18.28, 10 Dec, 2024]-638694300676723470.png)

Bitcoin Network Realized Profit/Loss chart. Source: Santiment

“The market has undergone a healthy deleveraging phase, significantly reducing the funding rates in the contract market,” said Ryan Lee, Chief Analyst at Bitget Research, in an exclusive interview with FXStreet.

“The release of the US November Consumer Price Index (CPI) data is a key event this week, as it will influence expectations around a potential rate cut in December. We expect some risk aversion ahead of the CPI release, but also keep an eye on Microsoft’s audit of Bitcoin investment proposals, which could significantly impact Bitcoin’s short-term price trajectory,” he said.

Lee projects Bitcoin price to range between $92,000 and $105,000 this week.

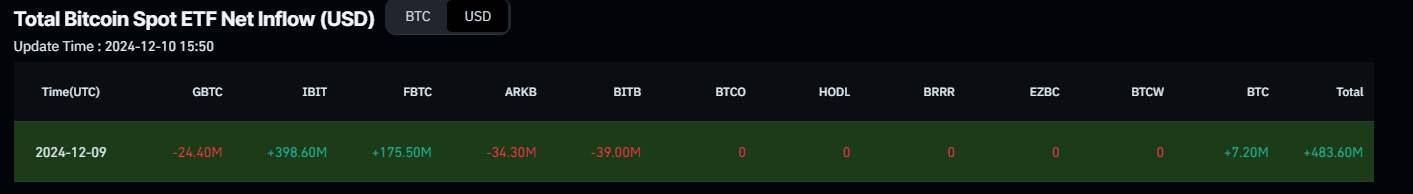

Institutional investors added more BTC

Although the holders booked profit and Bitcoin reached a low of $94,150 on Monday, institutional investors added more. According to Coinglass, Bitcoin Spot Exchange Traded Funds (ETF) data recorded an inflow of $483.60 million on Monday. If this magnitude of inflow persists, demand for Bitcoin will increase, leading to a recovery in its price.

Total Bitcoin Spot ETF Net inflow chart. Source: Coinglass

Moreover, in the same period, MicroStrategy announced that it had acquired 21,550 BTC worth $2.1 billion at an average price of $98,783 per Bitcoin. The company currently holds 423,650 BTC, acquired for $25.6 billion at an average price of $60,324 per Bitcoin.

MicroStrategy has acquired 21,550 BTC for ~$2.1 billion at ~$98,783 per #bitcoin and has achieved BTC Yield of 43.2% QTD and 68.7% YTD. As of 12/8/2024, we hodl 423,650 $BTC acquired for ~$25.6 billion at ~$60,324 per bitcoin. $MSTR https://t.co/8r7bFqMFof

— Michael Saylor⚡️ (@saylor) December 9, 2024

Bitcoin Price Forecast: RSI shows weakness in bulls

Bitcoin price declined 3.79%, reaching a low of $94,150 on Monday. At the time of writing on Tuesday, it recovers slightly, trading around $97,800.

However, traders should be cautious as the Relative Strength Index on the daily chart shows signs of weakness. The recent uptrend in Bitcoin price since mid-November reflects a falling RSI level during the same period, indicating diminishing bullish strength. Moreover, if the RSI daily closes below the neutral level of 50, it generally indicates bearish momentum is gaining traction.

If BTC continues its decline and closes below the $90,000 support level, it could extend losses towards the next support level of $85,000.

BTC/USDT daily chart

However, if BTC continues its recovery and closes above $104,088, it could extend the rally toward a new all-time high of $119,510. This level aligns with the 141.4% Fibonacci extension line drawn from the November 4 low of $66,835 to Thursday’s all-time high of $104,088.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.