Ethereum Price Forecast: ETH nears its all-time high, sees record ETF inflows and high preference than Bitcoin

Ethereum price today: $4,030

- Ethereum has become more attractive to investors than Bitcoin since the US elections, noted Bybit.

- Ethereum ETFs posted their highest single-day net inflows after raking in $428.5 million.

- Ethereum could soon reach a new all-time high if it surpasses the yearly high resistance of $4,093.

Ethereum (ETH) trades above $4,000 for the first since March on Friday after seeing record ETF inflows and higher preference from investors over Bitcoin.

Investors are showing more preference for Ethereum over Bitcoin

Since the US elections, Ethereum has outshined Bitcoin, with its growth accelerating after SEC Chair Gary Gensler announced he would retire on January 20, Bybit noted in a December 5 "Volatility Review" report. The report noted that traders are beginning to reallocate their preferences to ETH, as revealed by the notable ETH/BTC ratio shift.

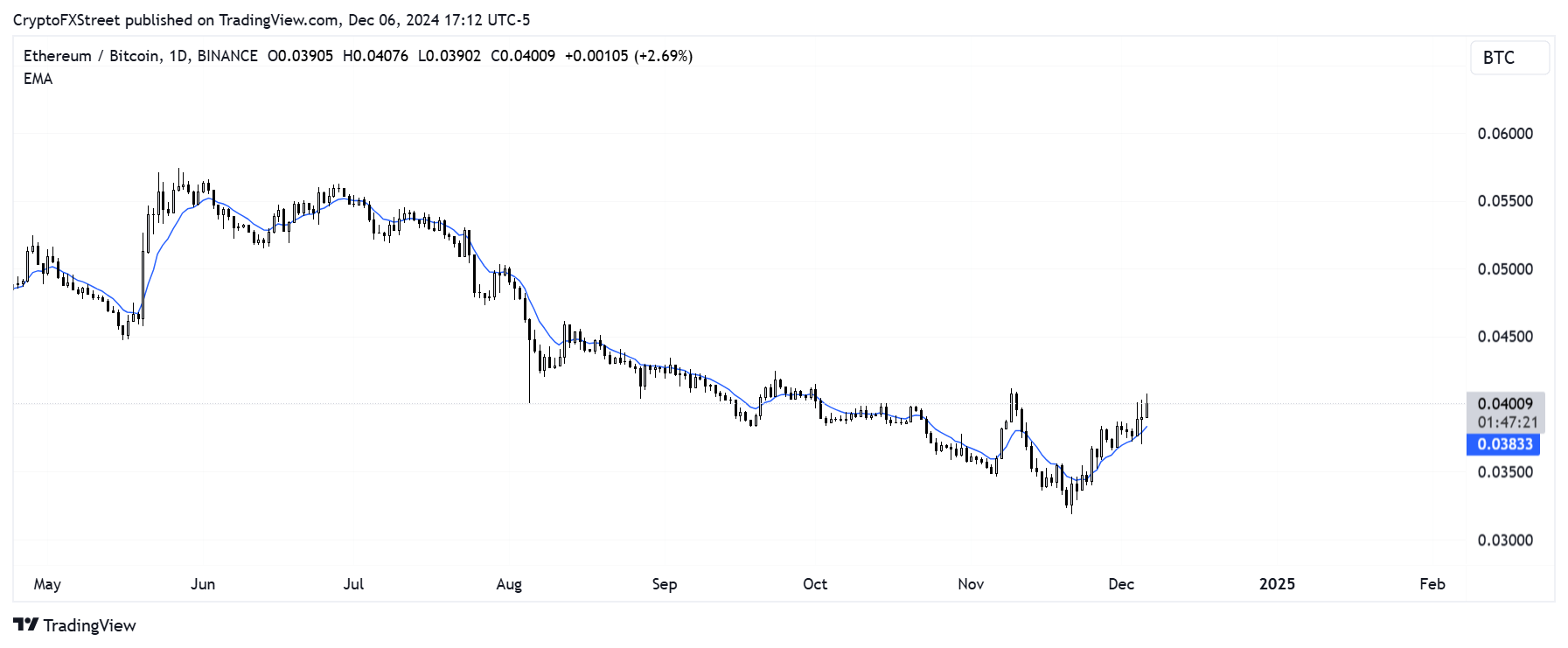

The ratio has sprung from a low of 0.31 on November 19 to over 0.4 on Friday. The outperformance of ETH against Bitcoin has also seen a drop in Bitcoin dominance, leading to speculations of the beginning of an altcoin season.

ETH/BTC daily chart

"The skew in options pricing has shifted in favor of calls for both BTC and ETH, but ETH's skew has remained more robust," wrote Bybit. "This suggests a stronger bullish sentiment for ETH, as traders are positioning more aggressively for its price appreciation compared to that of Bitcoin."

Meanwhile, Ethereum surged above $4,000 on Friday for the first time since March following a significant uptick in demand from institutional investors through ETFs.

Ethereum ETFs recorded their highest-ever single-day net inflows on Thursday after raking in $428.5 million, per Coinglass data. The products have now posted nine consecutive days of positive flows, with their cumulative net inflows crossing the $1 billion mark for the time since launch.

Ethereum Price Forecast: ETH likely to see new all-time high if it overcomes yearly high resistance

Ethereum rallied over 5% in the past 24 hours, sparking futures liquidations worth $75.14 million, per Coinglass data. The amount of liquidated long positions is $44.6 million, and short liquidations stretched to $30.54 million.

ETH is testing its yearly high resistance of $4,093 after surging above the descending trendline upper resistance of a cup and handle pattern.

ETH/USDT weekly chart

If ETH overcomes this resistance, it could extend the rally to its all-time high resistance at $4,868. A successful move above $4,868 could see ETH move to $5,627.

The Relative Strength Index (RSI) and Awesome Oscillator (AO) momentum indicators are above their neutral levels, indicating dominant bullish sentiment.

A weekly candlestick close below the $2,817 support level will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.