Crypto Today: BTC holds $95K, Cardano sets $700M record, Tron and Avalanche advance.

The cryptocurrency sector valuation hit $3.48 trillion on Tuesday, reflecting a $40 billion increase.

Bitcoin price fell below $95,000 as investors increasingly lean towards altcoins.

In the derivatives markets, 216,337 traders were liquidated, with total liquidations coming in at $591.56 million.

Altcoin market updates: Bitcoin consolidates at $95K as Tron and Avalanche emerged as top performers

Bitcoin price consolidated around the $95,000 mark on Tuesday, as traders continue to rotate profits towards the altcoin markets. Positive sentiment surrounding potential altcoin ETF approvals in 2025 has sparked a major accumulation wave across the altcoin markets.

- While XRP price retreated to find support at the $2.50 mark, Cardano (ADA), Avalanche (AVAX) and Tron (TRX) all registered considerable gains.

- Tron (TRX) was the standout performer, scoring 25% gains and leapfrogging AVAX to become the 10th largest crypto asset by market capitalization.

- Avalanche (AVAX) price surged 11% on Tuesday, after AVA Labs CEO hinted at potential collaboration with the Donald Trump administration.

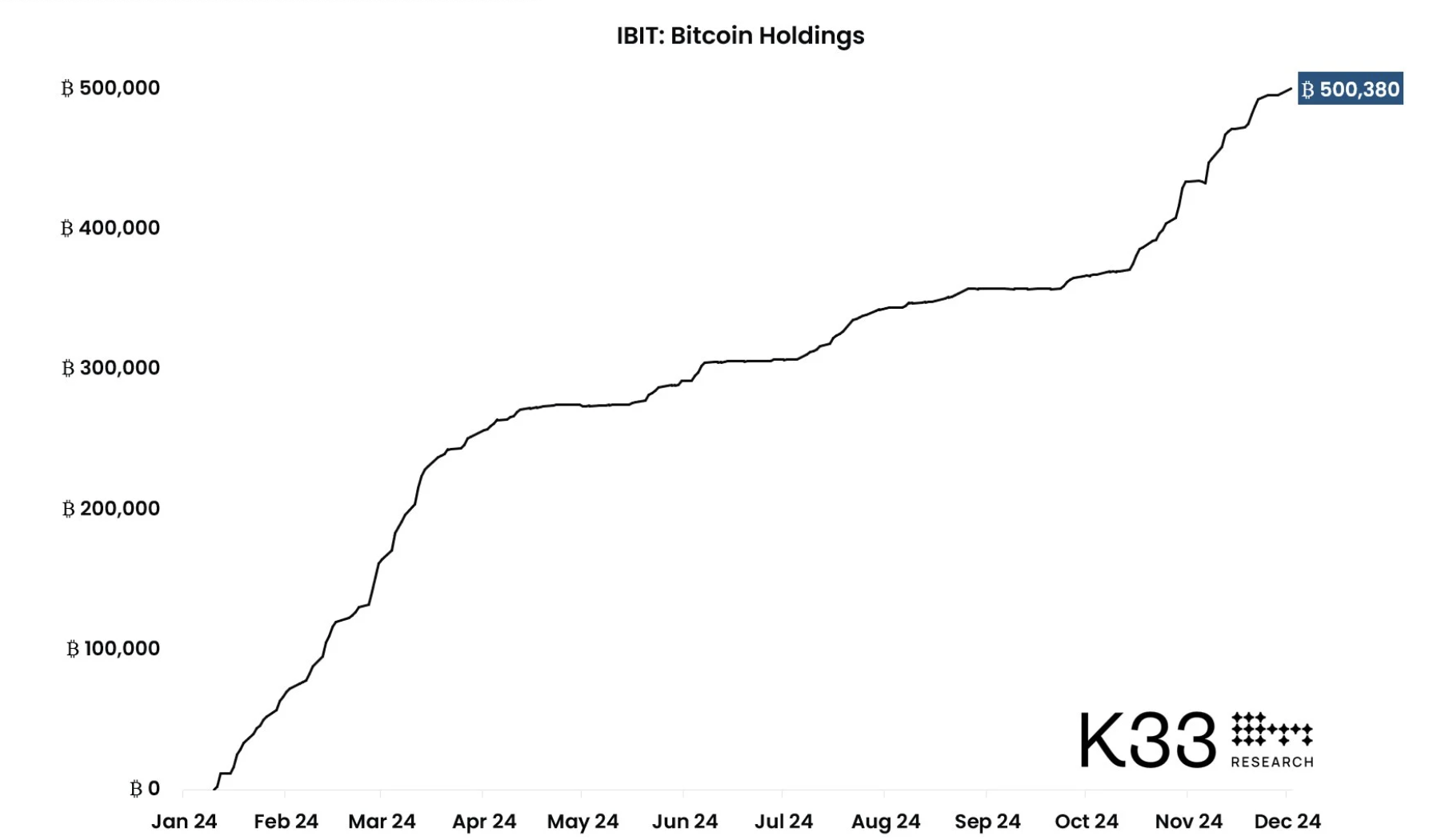

Chart of the day: Blackrock hits 500,000 BTC Milestone

BlackRock’s IBIT spot Bitcoin ETF has reached a significant milestone, surpassing 500,000 BTC in assets under management (AUM). Launched on January 11, 2024, the fund has grown rapidly, now holding $48 billion worth of Bitcoin, approximately 2.38% of Bitcoin's total 21 million supply.

Blackrock (IBIT) ETF Holdings as of | Dec 3 2024 | Source: K3 research

“BlackRock surpassing 500,000 BTC is yet another huge milestone after a tremendous launch year. It remains the third strongest ETF instrument in the U.S. measured by YTD flow, ahead of Invesco's $314 billion behemoth QQQ.” - K33 Head of Research, Vetle Lunde

Monday's net inflow of 3,526 BTC, propelled IBIT past the 500,000 BTC milestone, means that BlackRock’s Bitcoin ETF has now surpassed MicroStrategy’s BTC holdings, despite the latter’s three-year head start.

Crypto news updates:

Coinbase Ends USDC Yield Program in Europe Amid MiCA Compliance Crackdown

Coinbase is discontinuing its USDC yield program across the European Economic Area (EEA) by December 1, in response to the European Union's Markets in Crypto-Assets (MiCA) regulations. MiCA explicitly prohibits offering interest on stablecoins, forcing crypto firms to adjust their operations ahead of the December 30, 2024, compliance deadline.

This move reflects the growing regulatory challenges in Europe’s stablecoin market, as seen with Tether recently discontinuing its euro-pegged token. Meanwhile, new competitors like Schuman Financial are seizing the opportunity by launching euro-pegged stablecoins to fill the void.

These regulatory shifts mark a significant transformation for stablecoin providers in Europe, where compliance requirements are becoming increasingly stringent. Coinbase’s exit highlights the difficulties of aligning yield programs with MiCA’s framework, while the rise of new euro-pegged offerings suggests ongoing innovation despite the crackdown.

Taiwan to Implement New Anti-Money Laundering Rules for Crypto Providers on Nov. 30

Taiwan’s Financial Supervisory Commission (FSC) will implement new anti-money laundering (AML) regulations for crypto providers on November 30, advancing the timeline by one month.

The rules require both domestic and international virtual asset service providers (VASPs) to register for AML compliance, with non-compliance punishable by imprisonment and hefty fines. This initiative aims to tighten regulatory oversight, enhance fraud prevention, and align Taiwan’s crypto sector with global AML standards.

The accelerated rollout underscores Taiwan’s commitment to combating illicit activity in the digital asset space.

By imposing stringent registration requirements and penalties, the FSC seeks to reinforce investor protection and establish a more transparent crypto market.

This regulatory push mirrors broader global trends as governments worldwide intensify their efforts to regulate the crypto industry.

US Government Transfers $1.9 Billion in Bitcoin to Coinbase

A US government-linked crypto wallet transferred approximately 20,000 Bitcoin, worth $1.9 billion, to Coinbase Prime, according to Arkham Intelligence.

The Bitcoin holdings originated from assets seized from Silk Road, a notorious dark web marketplace shut down in 2013.

The transfer included an initial test of 0.001 BTC, valued at $97, followed by a larger transaction of 19,800 BTC to an intermediary wallet before reaching Coinbase.

Despite the transfer, the wallet still holds around $18 billion in Bitcoin, alongside other assets like Ethereum (worth $217 million) and USDT ($122 million).

This movement follows a similar transfer in August when the government sent 10,000 BTC, worth $600 million, to Coinbase. The recent transaction has triggered market speculation, as Bitcoin’s price dropped below $95,000 following the news.