SUI Price Forecast: SUI pulls $325M from Ethereum amid Bitcoin staking integration

- SUI price rose 12.9% in the last 48 hours, briefly breaching the $3.50 mark on Wednesday.

- On-chain data shows investors bridged over $325 million worth of assets from Ethereum in the last 30 days.

- The current leg of the SUI rally began after the team announced Bitcoin staking integration in November 2025.

SUI price rose 12.9% in the last 48 hours, briefly breaching the $3.50 mark on Wednesday. Amid news of Bitcoin Staking integration, on-chain data show rapid inflows toward the SUI DeFi ecosystem.

SUI price surges 12.9% amid Bitcoin staking integration

Sui decoupled from the broader market downtrend on November 26 to entertain double-digit gains to reclaim the $3.50 level.

The current leg of the SUI price rally began on November 25 after the team announced a milestone partnership with Babylon Labs and Lombard Protocol to bring Bitcoin staking integration to its DeFi ecosystem.

Through this partnership, SUI is poised to attract liquidity from the $1.8 trillion Bitcoin market by using Babylon’s staking protocol to offer lending, borrowing and trading services.

SUI price action | SUIUSDT (Binance)

As markets reacted, SUI price breached the $3.60 mark within the daily time frame on Wednesday.

According to the announcement, from December 1, SUI users staking Bitcoin users will receive LBTC, Lombard Protocol’s liquid staking token. This is a token directly minted on the Sui network and pegged 1:1 to BTC spot prices.

Investors bridged assets worth $325M from Ethereum to SUI over 30 days

At first glance, the price rally is largely propelled by recent rising speculative demand for SUI as the Bitcoin launch date approaches.

However, a closer look at the underlying on-chain data shows that SUI has attracted considerable capital inflows since the market rally began in early November.

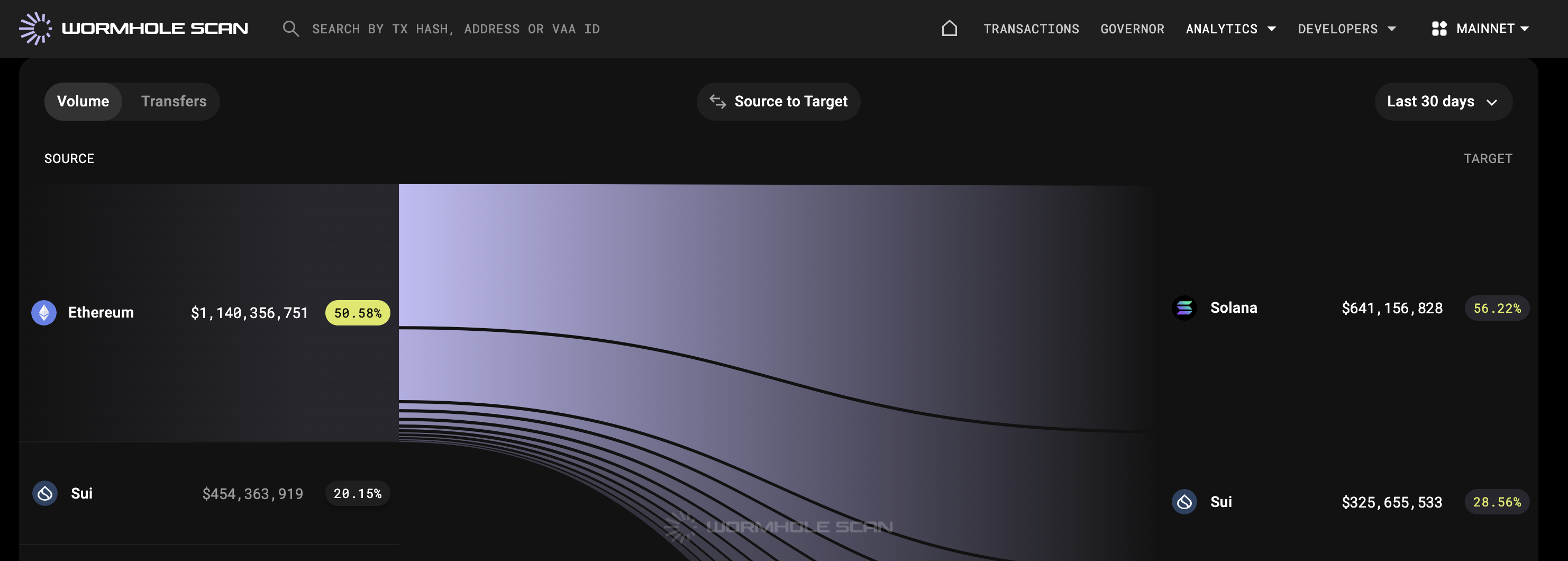

Affirming this narrative, the chart below tracks the directional flow of bridged assets across major (Ethereum Virtual Machine) EVM-compatible blockchains.

Bridged assets data | Source: Wormhole

Behind Solana, SUI has recorded the second-highest inflow of funds bridged from the Ethereum network over the past month.

The chart above shows that SUI pulled over $325 million inflows during that period.

When an asset experiences increased inflows of bridged assets, it often signals bullish momentum for several reasons.

First, higher inflows enhance the asset’s liquidity across the ecosystem. With more liquidity, trading, lending and borrowing activities become more efficient, thus reducing price volatility.

Such conditions attract both retail users and institutional investors, fueling further growth.

More so, SUI’s $325 million of inflows reflect growing adoption and utility of the blockchain’s ecosystem. Users typically migrate assets to take advantage of specific features such as innovative DeFi protocols, competitive transaction costs or unique staking opportunities.

SUI price forecast: $4 breakout ahead

With SUI set to add Bitcoin staking to its stack of DeFi services, the capital inflows are poised to increase further, potentially driving prices into a prolonged rally.

Validating this positive outlook, technical indicators on the SUI/USDT daily chart shows strengthening Accumulation/Distribution Line (ADL) and a narrowing price range within the Keltner Channels, hinting at an imminent breakout toward $4.00 in the coming sessions.

If SUI price can establish a steady support base at $3.25, situated near the lower Keltner Channel band, the bullish momentum could intensify.

SUI Price Forecast | SUIUSDT (Binance)

The upward movement signal also aligns with an increasing Accumulation/Distribution Line (ADL), indicating rising buying pressure.

The current price at $3.39 suggests a gradual recovery, as bulls target the next resistance at $3.96, near the upper Keltner Channel band.

If a breakout above $3.96 is accompanied by a spike in trading volumes, the psychological resistance at the $4.50 mark becomes the immediate target,

Conversely, a drop below $3.25 would invalidate the bullish setup with the next support at $2.53 providing a critical safety net.