Ripple donates $25 million to crypto super PAC again amid record profit-taking levels among XRP investors

- Ripple invested another $25 million in pro-crypto Fairshake super PAC.

- The elevated profit levels of XRP’s total supply could see investors realize profits rapidly, causing a potential price decline.

- XRP could see a new all-time high at $3.57 if bulls can stage a rally above the 2021 high of $1.96.

Ripple's XRP is down 6% on Tuesday following record profit-taking among investors as its percentage of total supply in profit reached very high levels in the past week. This follows Ripple Labs donating another $25 million to the pro-crypto Fairshake super PAC.

Ripple donates to Fairshake super PAC, realized XRP profits reach record levels

Ripple co-founder and CEO, Brad Garlinghouse, announced that the company contributed another $25 million to the crypto-focused Fairshake super political action committee (PAC). This marks Ripple Labs third donation to the Fairshake super PAC over the past year.

Fairshake proved instrumental in helping support pro-crypto candidates to gain victory in the recent 2024 US elections. "Electing pro-crypto, pro-growth and pro-innovation candidates is a no-brainer, and to continue that momentum, Ripple is contributing another $25M to Fairshake," wrote Garlinghouse in an X post on Tuesday.

Fairshake is the most successful multi-candidate, bipartisan Super PAC in American history.

— Brad Garlinghouse (@bgarlinghouse) November 26, 2024

Electing pro-crypto, pro-growth and pro-innovation candidates is a no-brainer, and to continue that momentum, Ripple is contributing another $25M to Fairshake. Onwards!

Ripple chief legal officer, Stuart Alderoty, noted that the company was among the first supporters of Fairshake before it became successful.

"When Fairshake first started, Ripple committed to being a top tier supporter; before anyone knew what impact it might have," Alderoty wrote in a Tuesday X post. "Innovation is here to stay and we will remain a strong force in DC for years to come."

Ripple's donation follows record profit-taking from investors after XRP's price growth in the past week. According to Santiment data, XRP investors realized over $1.5 billion in profits in the past week — the highest since April 2021.

[21.32.22, 26 Nov, 2024]-638682532513916679.png)

XRP Network Realized Profits/Loss | Santiment

The increased profit-taking could be from long-term holders who have held onto their tokens all through XRP's downturn since 2022. Additionally, the percentage of XRP supply in profit crossed 99% over the weekend and its Market Value to Realized Value (MVRV) ratio — which measures the average profit or loss of all XRP holders — reached 217%.

[21.32.13, 26 Nov, 2024]-638682533083868566.png)

XRP %Total Supply in Profit & MVRV | Santiment

With almost the total supply seeing profit at elevated levels, investors could realize profits rapidly if the market sees a slight downturn or consolidates for a while.

XRP could rally to a new all-time high if bulls beat recent selling pressure

XRP is testing the $1.35 support level after sustaining a 6% decline in the past 24 hours. The decline sparked $20.75 million in XRP's 24 hours futures liquidations with liquidated long and short positions accounting for $15.07 million and $5.68 million, respectively, per Coinglass data.

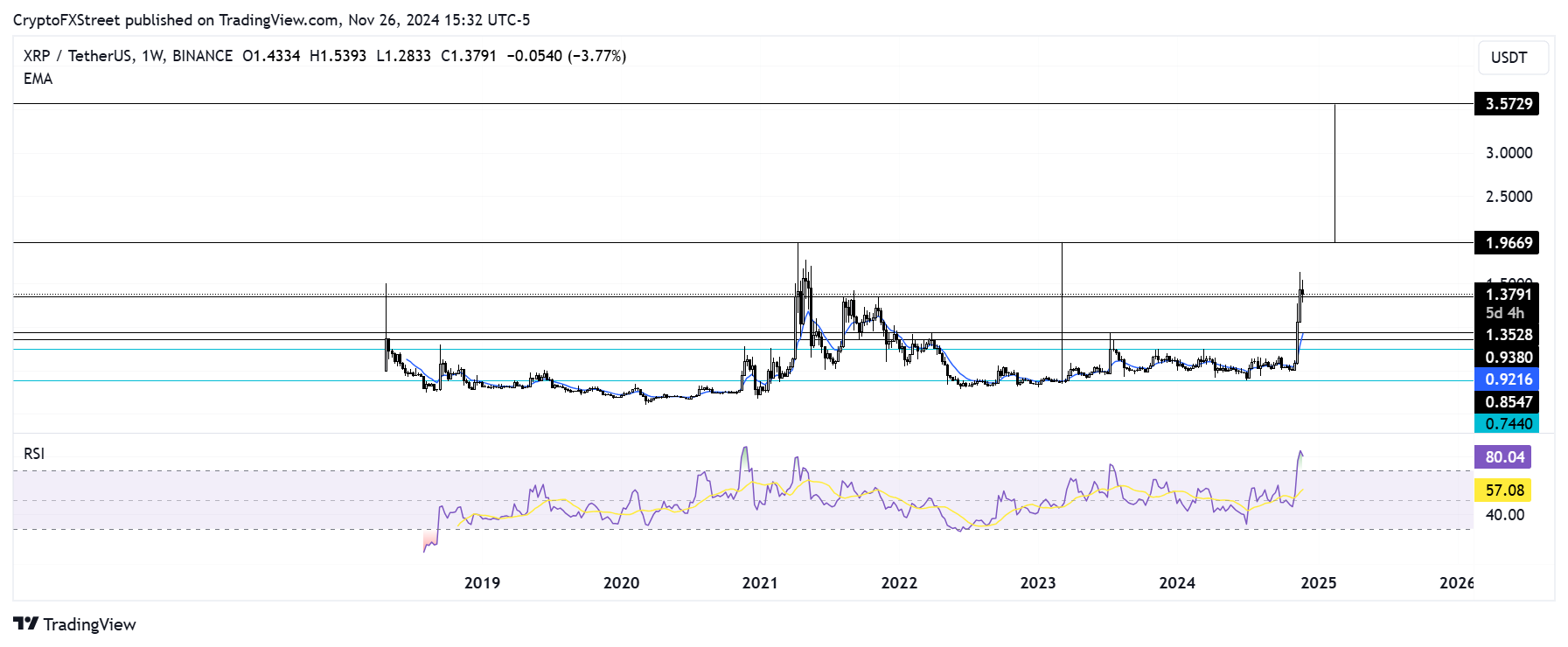

XRP has been struggling to reclaim its 2021 high of $1.96 as selling pressure has risen slightly following its recent two-week 100% rally.

XRP/USDT weekly chart

If XRP bulls can stage a rally above $1.96, it will validate a rounded bottom pattern, meaning the remittance-based token could rally to set a new all-time high at $3.57.

The Relative Strength Index (RSI) is in the overbought region, indicating XRP's price could see a correction.

A weekly candlestick close below $0.938 will invalidate the bullish thesis.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.