Crypto Today: SEI, Fantom and SUI emerge as top gainers, while Morocco moves to legalize crypto

- On Tuesday, the cryptocurrency sector valuation tumbled toward $3.05 trillion, down by $300 billion in the last 48 hours.

- The crypto market is on course to register two consecutive losing days for the first time since Trump’s re-election on November 5.

- Crypto market liquidations hit $570 million, with the $460 million in long positions already closed accounting for 80% of the losses.

Altcoin market updates: SEI, Fantom and SUI emerge as Bitcoin and Ethereum stumble

On Tuesday, BTC price struggled at the $93,000 support, while Ethereum fell 7% from $3,546 to $3,300. As BTC and ETH led the crypto market losses, mid-cap altcoins received considerable demand.

Driven by uncorrelated bullish catalysts, SEI, Fantom and SUI emerged the top gainers within the daily timeframe.

- SUI price surges 7.5% after Bitcoin staking integration:

On Monday, SUI Foundation announced a milestone partnership with Babylon Labs and Lombard Protocol to introduce Bitcoin staking into the network’s Defi ecosystem.

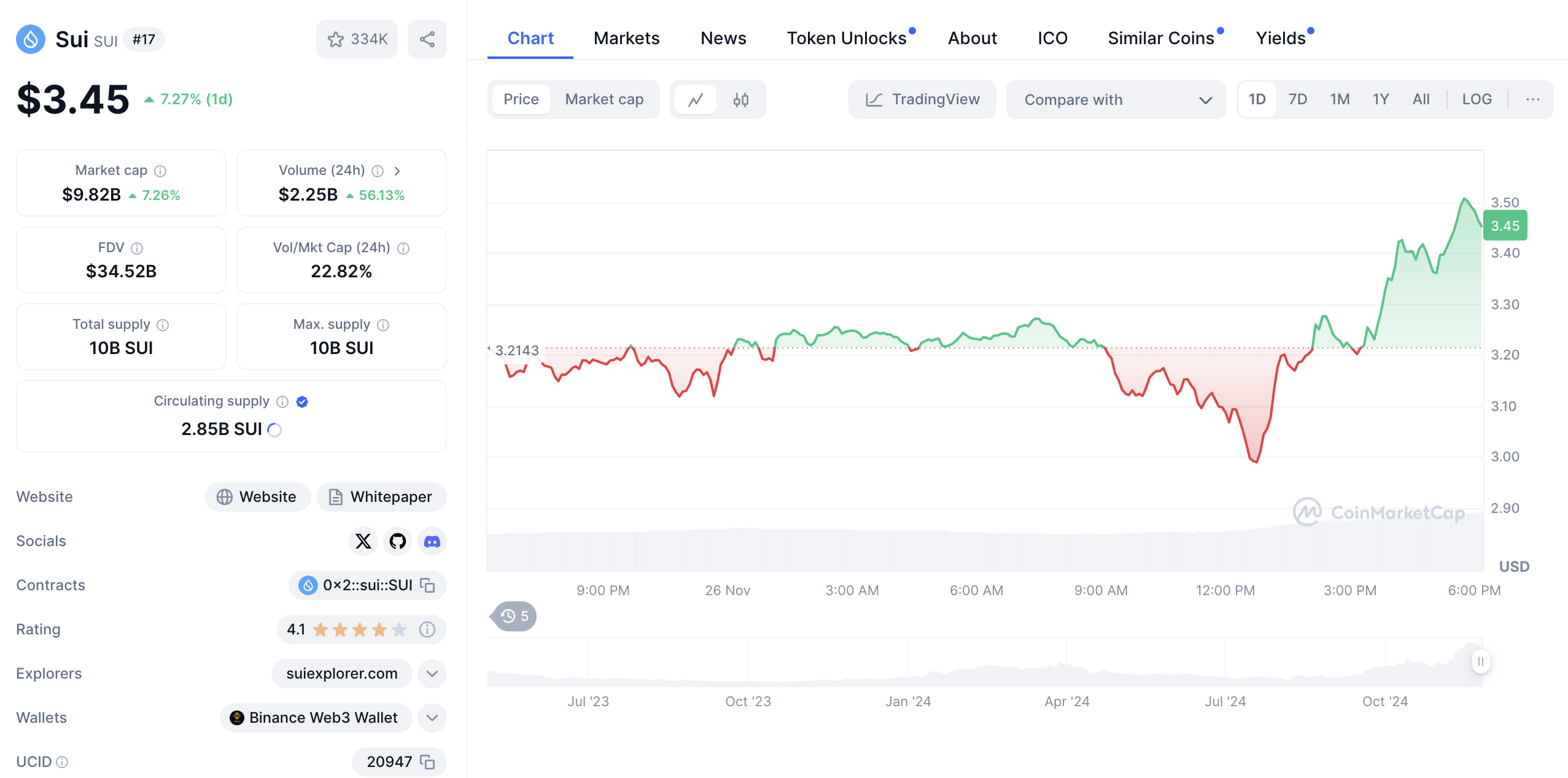

SUI price action | Coinmarketcap

With SUI poised to tap into Bitcoin’s $1.8 trillion market, bullish traders rapidly swooped in. At the time of publication, SUI price has moved past the $3.50 mark, reflecting 7.5% gains within 24 hours of the announcement.

- SEI price mirrors SUI with 14% surge

Layer-1 blockchain network SEI also recorded an impressive 14% gain on Tuesday, as SUI’s integration of Bitcoin staking spread bullish tailwinds across the global DeFi sector.

- Fantom (FTM) gains 12% on Sonic migration

Fantom (FTM) also emerged among the top-performing assets. The FTM token price rose 11.9% to breach $1 for the first time since April, according to Coinmarketcap data.

Notably, FTM’s ongoing rally began in mid-October when the team announced plans to migrate the Fantom (FTM) token to a newly issued Sonic (S) token on the new Sonic network.

Chart of the day: Litecoin whales invest $950M across 73-day buying spree

On November 23, Litecoin price broke above the $106 mark, lifted by bullish tailwinds from Securities & Exchange Commission (SEC) Chair Gary Gensler’s exit confirmation.

Assets like Solana, LTC and XRP with ongoing ETF applications all received a demand surge amid expectations that a crypto-friendly replacement for Gensler improves chances of approval verdicts.

However, on-chain data trends show that whale investors have been purchasing large amounts since mid-September, as Trump took an early lead during the presidential campaign.

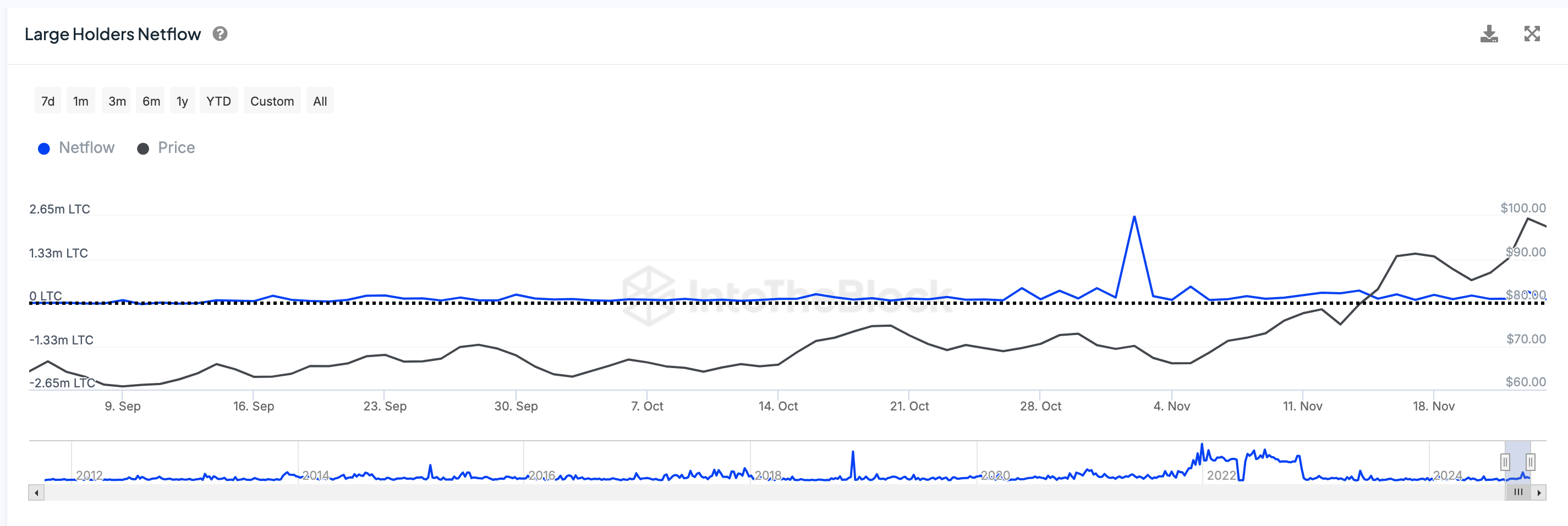

Litecoin price forecast | LTCUSD

The IntoTheBlock chart above shows that Litecoin whales have recorded positive net flows since September 14. In the 73-day buying spree, the whales have acquired 13.2 million LTC, at the average price of $946.6 million.

This suggests that large institutional investors have been acquiring large volumes of LTC, likely in hopes of front-running the potential bullish impacts of Canary Capital’s LTC ETF application approval.

While the LTC price fell as low as $89 on Tuesday, the ongoing whale accumulation spree could see Litecoin price maintain relatively high support levels as the crypto market enters a consolidation phase.

Crypto news updates:

- Morocco to legalize crypto and introduce CBDC

Morocco is set to legalize crypto assets, marking a shift from its 2017 ban, according to Reuters. The central bank, Bank Al Maghrib (BAM), is drafting legislation to create a regulated framework for cryptocurrency usage and transactions. The new law aims to bring clarity and oversight to the country’s growing interest in digital currencies.

In addition, BAM is evaluating the introduction of a central bank digital currency (CBDC) to boost financial inclusion and improve control over digital transactions.

Governor Abdellatif Jouahri told Reuters that CBDCs are being widely studied globally for their potential to achieve key public policy goals.

- Sweden-based investment firm applies for Dogecoin ETF

DeFi Technologies' subsidiary, Valour, has launched the first-ever Dogecoin (DOGE) exchange-traded product (ETP) on Sweden's Spotlight Stock Market.

This pioneering move follows the increased global awareness triggered by Elon Musk's involvement in Donald Trump’s victorious presidential campaign.

Valour’s DOGE ETP offers investors exposure to DOGE without requiring direct ownership, but it includes a management fee of 1.9%.

“In light of the recent US presidential election results and the subsequent surge in demand for Dogecoin, the launch of the Valour Dogecoin ETP on the Spotlight Stock Market aligns with our mission to provide investors with timely access to high-demand digital assets,”- Johanna Belitz, Head of Nordics at Valour.

Valour's portfolio currently includes crypto giants like Bitcoin, Ethereum and Cardano. The firm plans to expand its offerings, aligning with its goal of making diverse digital asset investments accessible globally.

- Pump.fun shuts livestreams indefinitely amid community backlash

Solana-based meme coin platform Pump.fun has indefinitely suspended its livestream feature following widespread criticism of harmful broadcasts.

The decision comes as the platform faces backlash over incidents involving threats of self-harm, violence and explicit content streamed live.

The pause aims to address growing concerns and ensure safer user experiences as the platform undergoes rapid growth.

“To ensure the absolute safety of our users, we will be pausing the live streaming functionality on the site for an indefinite time period until the moderation infrastructure is ready to deal with the heightened levels of activity”

Pump.Fun, Community notice, November 25, 2024

Pump.fun is now focusing on developing stronger safeguards and moderation systems to handle the increased demand responsibly.

The move reflects the platform's commitment to addressing community concerns and maintaining a safe digital environment.