Toncoin Price Forecast: Crypto whales spotted buying $30M TON in 4 days, amid Gensler’s exit

- Toncoin price opened trading at $6.2 on Monday, up 27% since Gary Gensler's exit confirmation on November 21;

- Since November 21, whales have acquired 459,980 TON (~$30 million), raising demand to 60-day peaks.

- Following a brief pull-back, TON Volume Delta has flipped positive, signaling potential continuation of the upward trend.

Toncoin price opened trading at $6.2 on Monday, up 27% since Gary Gensler's exit confirmation on November 21. On-chain data trends suggest a $7 breakout could follow as whale investors have scaled up demand for TON considerably over the last 5 days.

Toncoin price flips $6 resistance as Gensler’s exit sparks demand

Along with the likes of Ripple (XRP), Cardano (ADA) and Binance Coin (BNB), Toncoin is another megacap project that has attracted considerable demand since the confirmation of Gary Gensler’s exit.

In August 2024, TON founder Pavel Durov was arrested in France over failure to prevent criminal activity on the Telegram messaging app.

While Durov has since been released, TON price had sunk 20% amid the allegations, and failed to recover the $6 price milestone, until last week.

Toncoin price analysis | TONUSDT (Binance)

On November 23, barely 48 hours after Gensler’s exit was announced, TON price entered a major breakout to a new 90-day top of $6.6.

While a weekend profit-taking saw Toncoin price dip below $5.9 in the early hours of November 25, bulls have promptly secured 5.6% rebound to reclaim $6.1 level at the time of publication.

Crypto whales acquire 459,980 TON in 4 day buying spree

While traders continue to re-route capital towards mid-cap assets this week, Toncoin price appears poised to advance towards the $7 milestone.

Looking beyond recent price action, large corporate investors have increased demand for TON considerably, since Gensler’s exit confirmation enhanced investor confidence in crypto assets that have been impeded by regulatory scrutiny in recent years.

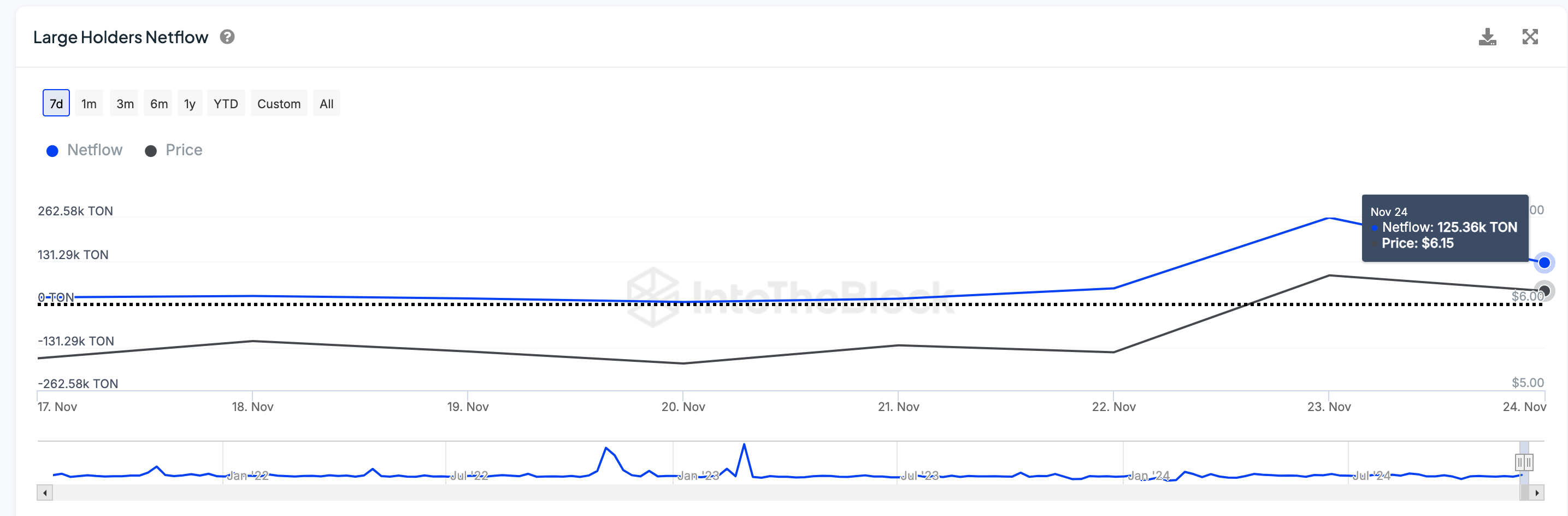

Lending credence to this stance, IntoTheBlock’s Large Holder netflow count data tracks the daily net purchases of whale wallets controlling at least 0.1% of TON circulating supply.

Toncoin price vs. Whale Netflows | IntoTheBlock

As depicted above the whales after weeks of flat activity, the whales netflows began buying TON in considerably larger volumes on November 21; shortly after news of Gensler’s exit broke.

By November 23, the whale acquired 262,580 TON worth approximately $1.7 million, the highest single-day inflow in 63-days dating back to September 18.

Between November 21 and November 24, the whale wallets on the toncoin network acquired an additional 459,980 TON worth approximately $30 million when valued at the 4-day average price for $6.30 per coin.

When whales make such large purchases around key market events, it signals expectations of future or prolonged bullish impacts.

More so if retail traders begin to mirror whale’s long positions, TON price could potentially move to reclaim $7, for the first time since Durov’s arrest in August.

TON Price Forecast: $7 breakout ahead if this happens

Amid a sustained 30 million whale buying spree between November 21-24, TON’s price has gained positive momentum.

Market optimism after SEC Chair Gensler’s exit, suggests growing bullish sentiment for altcoins.

In terms of short-term price projection, the widening Bollinger Bands indicate increased price volatility.

With Toncoin currently trading near the upper band at $6.15, sustained close above $6.20 for Toncoin price could confirm bullish momentum, setting the stage for a rally toward $7—a level last seen in August.

Toncoin price forecast | TONUSD

More so, the Volume delta flipping positive as price rebound above $6, signals renewed buying moment, which could potentially form a local low and begin a new leg-up phase.

However, failure to hold support near $5.45, the mid-Bollinger band, could invalidate the bullish thesis, potentially retesting $4.67 as the next support.

In summary, bulls need to maintain control above $6.20 to keep the $7 breakout scenario, especially if the ongoing whale accumulation trend draws retail interest.