SOL Price Forecast: Solana holds $200 support as Binance lists ACT and PNUT

Solana market updates:

- Solana price retraced 6% on November 12, halting a seven-day rally that saw SOL flip XRP to become the third-largest cryptocurrency by market capitalization.

- Despite the market-wide pull back, Solana is showing signs of holding the $200 support.

- On-chain data shows SOL Receivers (buyers) continue to exceed Senders (sellers).

- Binance listed two newly-launched Solana memecoins, ACT and PUNT, on November 11.

Solana price retraced 7% from $225 to $205 on Tuesday, halting a seven-day winning streak that saw SOL become the third-largest cryptocurrency by market capitalization.

However, on-chain data trends suggest SOL could avoid dipping below the vital $200 support following Binance’s recent listing of two newly-launched memecoins hosted on the Solana network.

Solana Price tumbles 6% as post-election Crypto rally halts

The global crypto market has been on an uptrend since November 5, propelled by positive tailwinds from Donald Trump’s win at the polls.

Amid the seven-day rally, Solana attained two major milestones. First, SOL’s market capitalization crossed the $100 billion mark for the first time in three years.

Secondly, Solana has emerged as one of the best performing megacap digital assets, and its market valuation has rapidly overtaken Ripple (XRP) to become the third-largest cryptocurrency network.

However, the seven-day winning streak hit a snag on Tuesday as a sharp profit-taking wave among Bitcoin traders triggered cascading liquidations across the altcoin market.

Solana price action, November 2024 | SOLUSD

The SOLUSD daily chart above shows how Solana price rose 43.9% from $156 on November 5 to a three-year peak of $225 in the early hours of November 12.

Following the market-wide pullback, Solana price has now retraced 6% toward the $212 level at the time of publication.

While Solana’s overbought status has heightened risk of a prolonged correction phase, on-chain data trends suggest steady demand for its native memecoins could potentially absorb sell-side pressure in the near-term.

SOL maintains steady demand as Binance lists ACT and PNUT

While prominent altcoins like Cardano (ADA) and Shiba Inu (SHIB) succumbed to double-digit corrections within the daily time frame on Tuesday, a Binance announcement has offered Solana bulls a lifeline.

On Monday, the Binance exchange announced the listing of two newly-launched Solana memecoins: The AI Prophecy (ACT) and Peanut Squirrels (PNUT).

Within 24 hours of trading on Binance, ACT and PNUT saw their market capitalizations grow by more than 400%.

At the time of writing, both assets continue to attract considerable demand, reaching $550 million and $450 million market cap, respectively.

As traders and investors flock to purchase these meme tokens, they need to acquire the native SOL coins to pay for transaction fees, thereby boosting demand and absorbing selling pressure from the market-wide correction.

Additionally, this surge in meme coin trading increases Solana’s popularity, attracting both speculative interest and long-term investors.

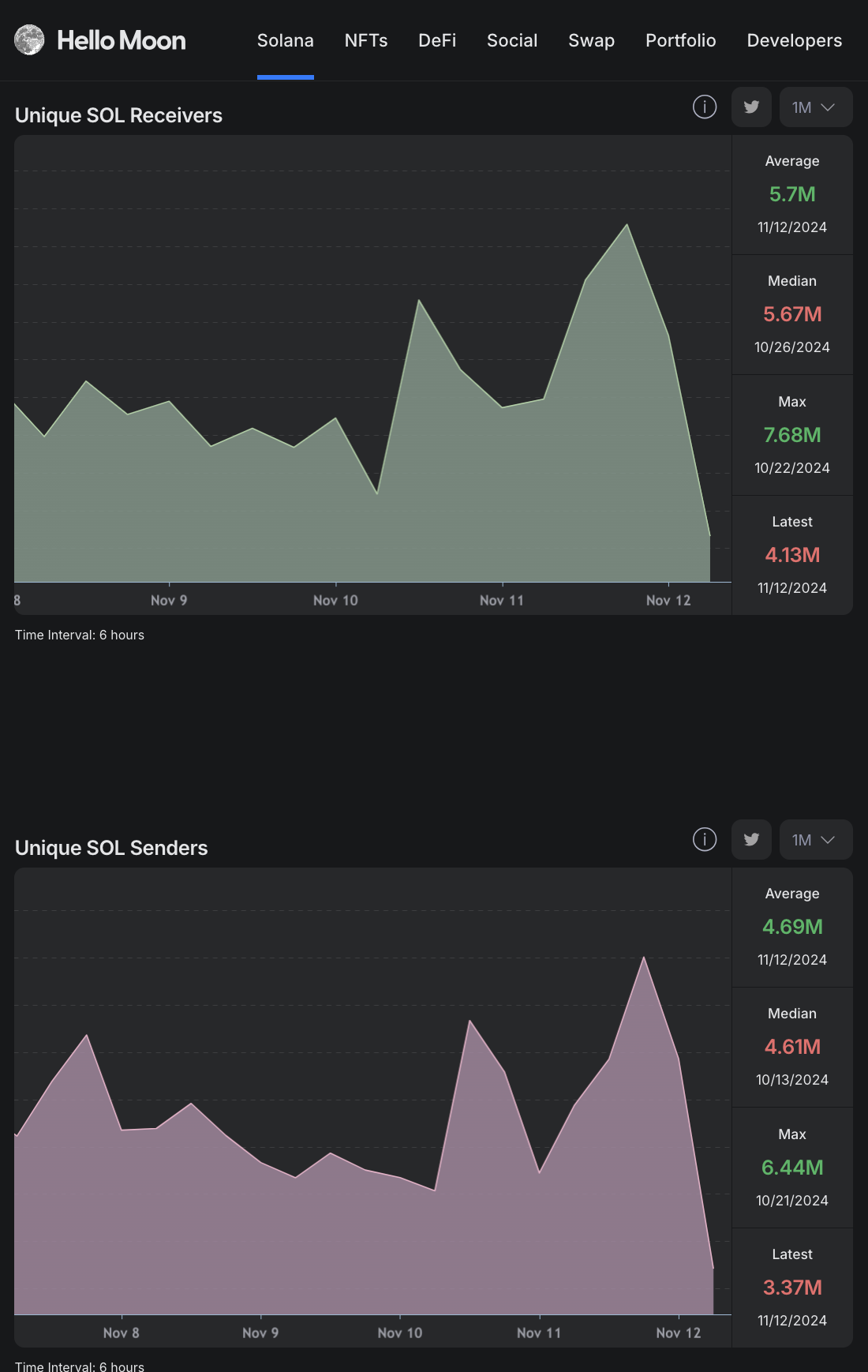

In affirmation of this stance, real-time data pulled from Hellomoon, a Solana-native blockchain analytics platform, shows that the number of active buyers on the network continue to exceed buyers amid the market pullback on Tuesday.

Solana Unique Receivers vs. Unique Senders, November 2024 | Source: Hellomoon

As depicted above, Solana’s Unique Receivers which serves as proxy for tracking the daily number of addresses that purchased SOL, stands at 4.13 million at press time on November 12. In comparison, the total Unique SOL Senders, which represents active sellers, is trending at 3.37 million addresses.

When active buyers outnumber sellers during a market downtrend, it typically signals increased accumulation by buyers, indicating potential support for a price rebound.

In Solana’s case, it appears that demand for ACT and PNUT, which sent both memecoins soaring to a combined market cap of $1 billion within 24 hours of trading on Binance, has played a vital role in holding the $200 support on Tuesday.

Solana Price Forecast: $250 breakout in play SOL closes above $214

After briefly dipping below $205 in the early hours of November 12, Solana price has rapidly reclaimed the $210, cutting its daily time frame losses to just 5%. The rising SOL buying pressure observed Binance’ listing of ACT and PNUT suggests bulls could regroup for another leg-up.

As the Tuesday correction washed out weak-hands, technical indicators on the SOLUSD daily chart also affirm Solana’s potential for another leg-up towards $250.

The widening Bollinger bands signal the presence of intense volatility and high volume trading.

However, with Solana’s price currently around $212 and still trading below the VWAP at $213.89, a continuation of bullish momentum hangs in the balance.

Solana Price Forecast | SOLUSD

For SOL to regain upward momentum for a $250 breakout attempt, it needs to close above this key resistance level.

On the downside, the Solana’s daily timeframe bottom at $205 could serve as an immediate support.

But if that initial support level fails to hold it could invalidate the bullish forecast and open doors to potential prolongs correction phase towards the 20-day moving average price around $182.