Bitcoin Price Forecast: Shows signs of weakness below $67,000

Bitcoin price today: $66,700

- Bitcoin continues to trade down for the third consecutive day following rejection from the $70,000 mark.

- In an interview with CNBC, billionaire hedge fund manager Paul Tudor is bullish on Gold and Bitcoin.

- Reports highlight how the upcoming US elections can affect the overall crypto markets.

Bitcoin (BTC) trades in the red for the third consecutive day on Wednesday after facing rejection at the $70,000 level on Monday. In a CNBC interview, billionaire hedge fund manager Paul Tudor Jones expressed his bullish outlook on Gold and Bitcoin. Reports also suggest that the upcoming US elections could affect the largest cryptocurrency by market capitalization.

Paul Tudor Jones backs Gold and Bitcoin in an interview

Billionaire hedge fund manager Paul Tudor Jones warns that the US increasing national debt will likely lead to significantly higher inflation.

In an interview with CNBC on Tuesday, Jones said, “I think all roads lead to inflation,” citing rising government debt as a major factor. He explained that the US can only manage this debt by growing the economy through inflation.

He said, “I’m longing gold, I’m longing Bitcoin,” warning that bonds, especially long-term government ones, won’t perform well in an inflationary situation.

JUST IN: Billionaire Paul Tudor Jones says "I'm long gold, I'm long #Bitcoin." pic.twitter.com/5xn9vCYWNI

— Watcher.Guru (@WatcherGuru) October 22, 2024

QCP Capital’s report on Tuesday highlights how the upcoming US elections can affect the crypto market.

“The election creates a zero-sum scenario for equities, with sector winners dependent on the outcome. In contrast, both candidates are more crypto-friendly than the previous administration, so any weakness in equities may prompt capital to reallocate to crypto.”, says the report.

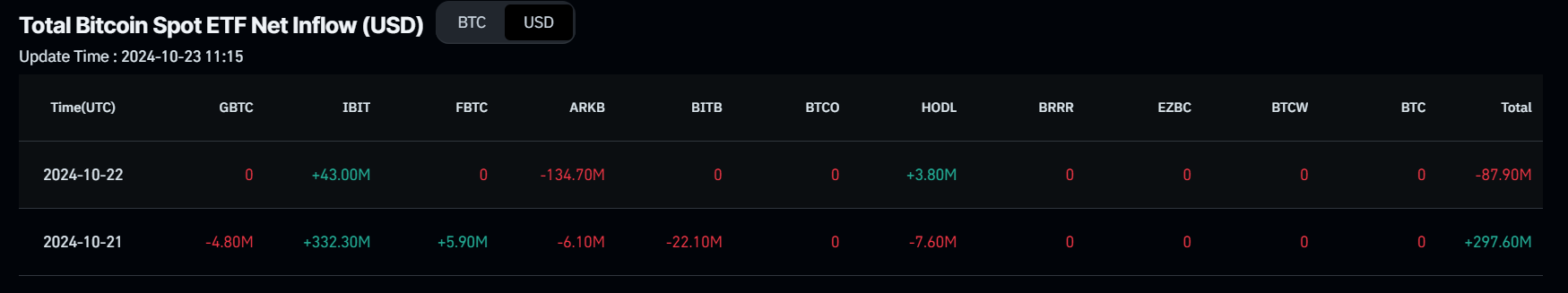

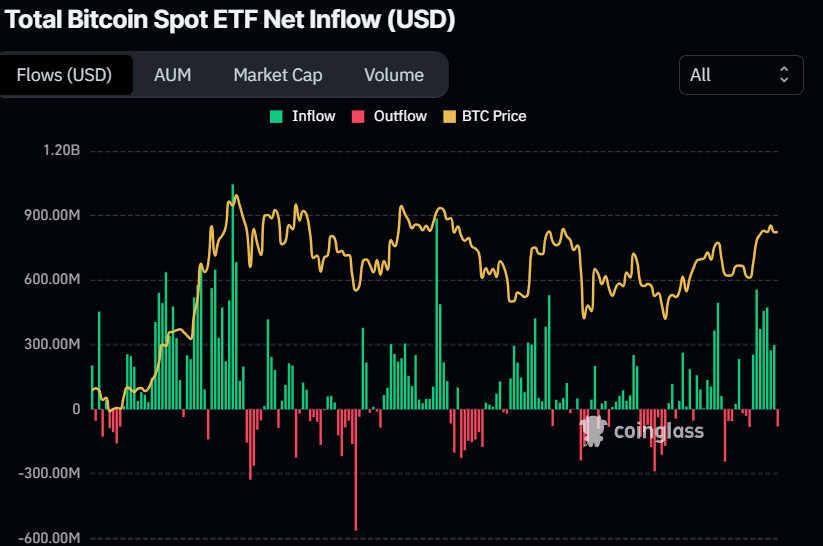

Institutional demand for Bitcoin recorded a mild decline on Tuesday. According to Coinglass ETF data, the US spot Exchange Traded Funds (ETFs) experienced a minor outflow of $87.90 million, ending a streak of seven consecutive days of inflows. If this outflow trend persists or increases, it could lead to a further decline in Bitcoin’s price.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

Bitcoin Price Forecast: Technical outlook suggests weakness ahead

Bitcoin price declined by 2.3% through Tuesday after encountering resistance at the key psychological level of $70,000 on Monday. As of Wednesday, it edges down to trade around $66,722.

If BTC continues its retracement, it could decline further to retest its next psychological support level at $66,000.

The Relative Strength Index (RSI) indicator on the daily chart reads 58 and points downwards after rejecting the overbought level of 70 on Sunday, indicating weakness in bullish momentum. If it continues to decline and closes below its neutral level of 50, it could lead to a sharp decline in Bitcoin’s price.

BTC/USDT daily chart

Conversely, if BTC breaks and closes above $70,079 (July 29 high), it could rally to its next key barrier, which is already the all-time high of $73,777 seen in mid-March.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.