Ethereum Price Forecast: Demand boost is needed to extend gains

Ethereum price today:$2,600

- Ethereum price declines as it faces resistance around the descending trendline at $2,820.

- The total amount of ETH held in accumulation addresses reaches a new all-time high.

- The US Ethereum spot ETF recorded a mild rise in inflows of $78.8 million last week.

Ethereum (ETH) trades roughly 3% down on Monday, erasing the gains registered on Sunday, as it approaches its descending trendline and following a rally of over 11% last week. From an on-chain and technical perspective, the correction could prove short-lived as there are signs of growing investor confidence in ETH, with US spot Exchange Traded Funds (ETFs) recording mild inflows and the total amount of ETH held in accumulation addresses reaching a new all-time high.

Ethereum accumulation addresses reach new all-time high

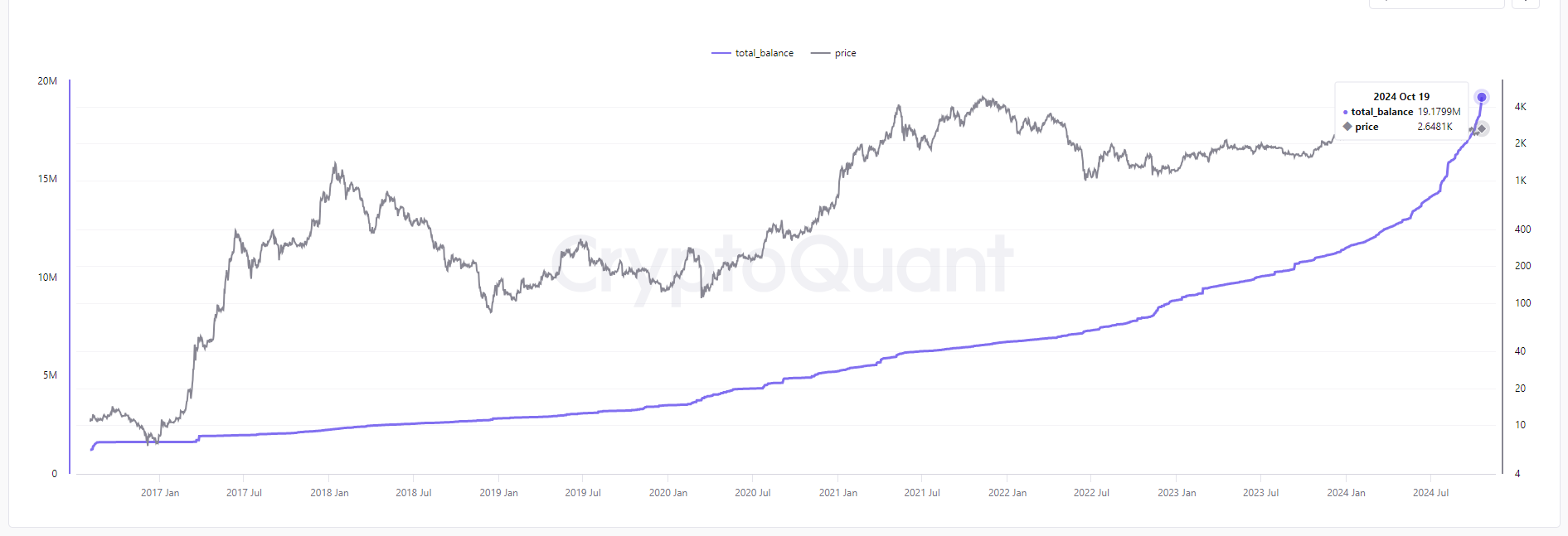

The total amount of Ethereum held in accumulation addresses surpassed 19.17 million on Monday, reaching a new all-time high and nearly doubling from just 11.5 million ETH in January, according to CryptoQuant data. This surge suggests increasing investor confidence in Ethereum, further enhancing its bullish price outlook.

Ethereum total balance chart. Source: CryptoQuant

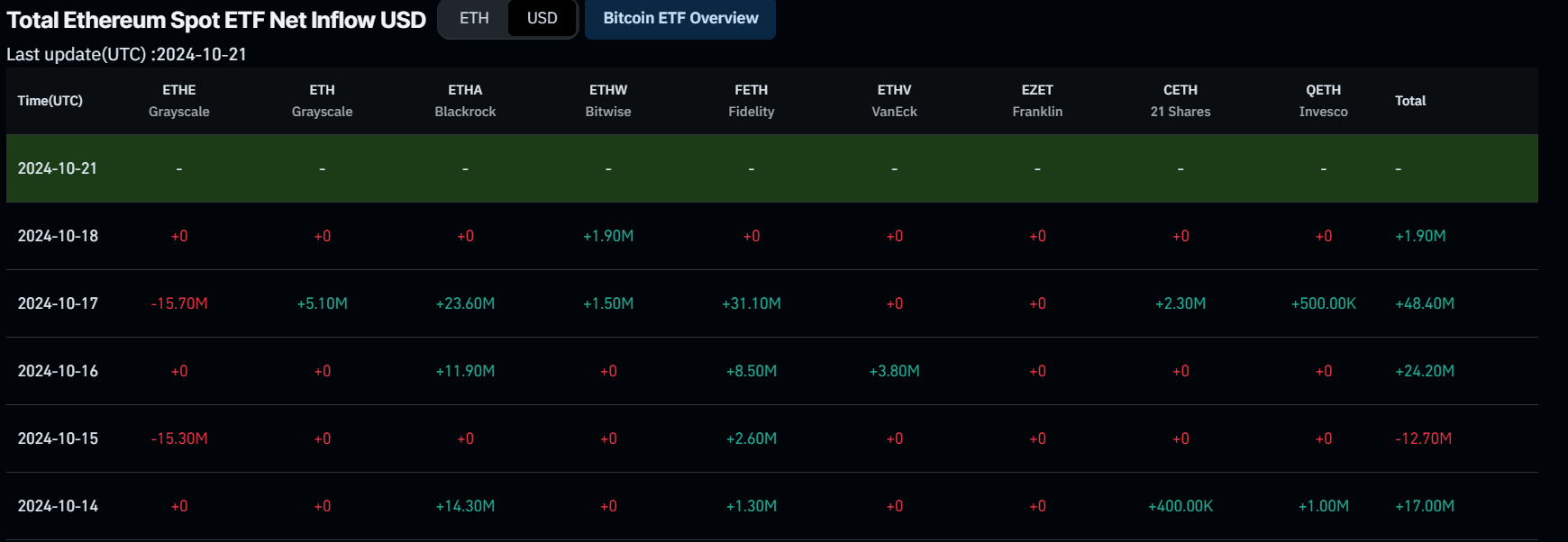

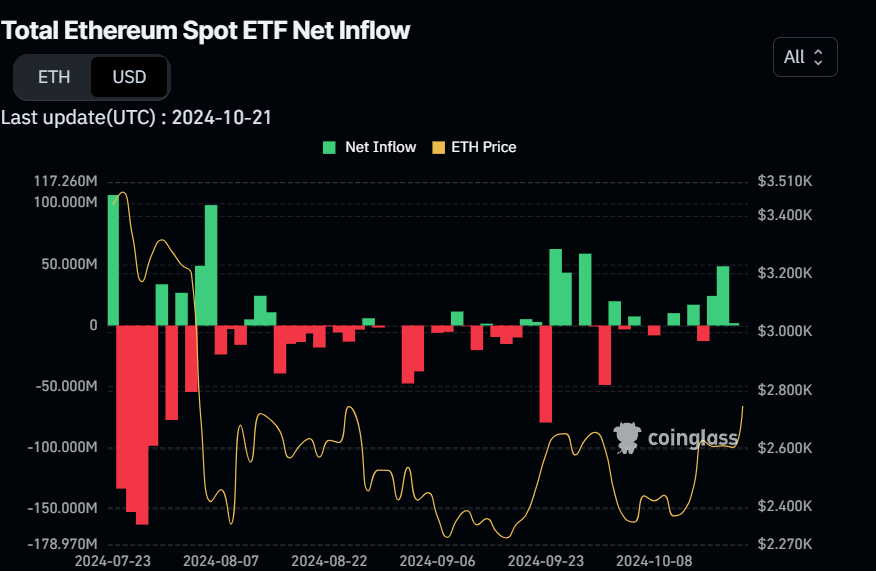

Institutional demand supported Ethereum’s price last week. According to Coinglass data, the US spot ETF recorded a mild rise in inflow of $78.8 million last week compared to $1.9 million the previous week. The magnitude of inflows must increase for Ethereum’s price to rally ahead.

Total Ethereum Spot ETF netflow chart. Source: Coinglass

Ethereum Price Forecast: Approaches its descending trendline close above suggests rally ahead

Ethereum price faces resistance around its descending trendline on Monday (drawn by joining multiple high levels from the end of May) after finding support around its 50-day Exponential Moving Average (EMA) of $2,561 on October 15.

If ETH breaks and closes above its descending trendline around $2,820, it could first rally to retest its daily resistance level at $2,927. A successful close above this level could extend the rally to retest its weekly resistance at $3,236.

The Relative Strength Index (RSI) indicator on the daily chart is at 60, pointing downwards from its overbought level of 70, indicating bullish momentum is weakening. However, the rally will continue if the RSI bounces back and rises. If it continues to decline and closes below its neutral level of 50, it could lead to a sharp decline in Ethereum price.

ETH/USDT daily chart

If ETH fails to close above the descending trendline, it could decline to retest its 50-EMA support at $2,561.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.