Crypto Today: Bitcoin consolidates near $61,000, Ethereum hovers around $2,400, XRP adds nearly 3%

- Bitcoin holds steady at around $61,000 on Thursday, noting $30.6 million outflows across ETFs the prior day.

- Ethereum ranges below $2,400 as all Ether ETFs noted neutral flows on Wednesday.

- XRP adds 3% to its value and trades above $0.5300 on Thursday.

Bitcoin, Ethereum and XRP updates

- Bitcoin (BTC) Spot Exchange Traded Funds (ETFs) observed $30.6 million in outflows on Wednesday. The largest crypto-asset by market capitalization trades at $61,039 at the time of writing on Thursday and adds nearly 0.6% value on the day.

- Ethereum (ETH) Spot ETFs recorded neutral flows the prior day, while ETH trades at $2,391 at the time of writing on Thursday.

- XRP trades at $0.5381, adding nearly 3% value on Thursday.

Chart of the day: Uniswap (UNI)

Uniswap ranks among tokens that yielded relatively high gains for holders in the last 24 hours. UNI added over 10% to its value sometime in this period, trading at $8.081 at the time of writing on Thursday. UNI broke out of its downward trend on October 5.

UNI gears for extended gains and eyes for a rally to the upper boundary of the Fair Value Gap (FVG) between $8.799 and $8.585. UNI could rally by over 10% from the current price level.

The Moving Average Convergence Divergence (MACD) indicator shows green histogram bars, signaling underlying positive momentum in UNI’s price trend.

UNI/USDT daily chart

If Uniswap closes below the 50-day Exponential Moving Average (EMA) at $7.196 the bullish thesis for UNI could be invalidated.

Market updates

- Ronin Network, a Web3 gaming ecosystem, is adopting Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to secure the bridge. The Ronin community selected the bridge through a competitive process.

.@Ronin_Network—a leading Web3 gaming ecosystem—is adopting #Chainlink CCIP as its canonical cross-chain infrastructure to secure the Ronin bridge.

— Chainlink (@chainlink) October 10, 2024

CCIP was selected by the Ronin validator community after a competitive bridge selection process.https://t.co/brdI1Rzllm pic.twitter.com/JbjaqrFo4v

- The Federal Bureau of Investigation (FBI) launched a token NexFundAI as bait to catch market manipulators. The agency identified the manipulator of the SAITAMA token, according to on-chain data.

The #FBI launched a token named #NexFundAI as "bait" to catch market manipulation.

— Lookonchain (@lookonchain) October 10, 2024

On-chain data shows that a wallet that manipulated $SAITAMA to earn more than $11M once funded the NexFundAI deployer with 0.01 $ETH. #Saitamainu

The manipulator wallet spent only $7,357 to buy… pic.twitter.com/IeFstAdBLd

- Crypto Fear & Greed Index turned to “fear” from “neutral” on Thursday. This means sentiment among traders has shifted, if it turns to “Extreme fear” it marks a buying opportunity.

Industry updates

- Uniswap announced the launch of Unichain, a new Layer 2 token designed for DeFi.

Introducing @unichain — a new L2 designed for DeFi ✨

— Uniswap Labs (@Uniswap) October 10, 2024

Fast blocks (250ms), cross-chain interoperability, and a decentralized validator network

Built to be the home for liquidity across chains pic.twitter.com/lqfJh6Ltio

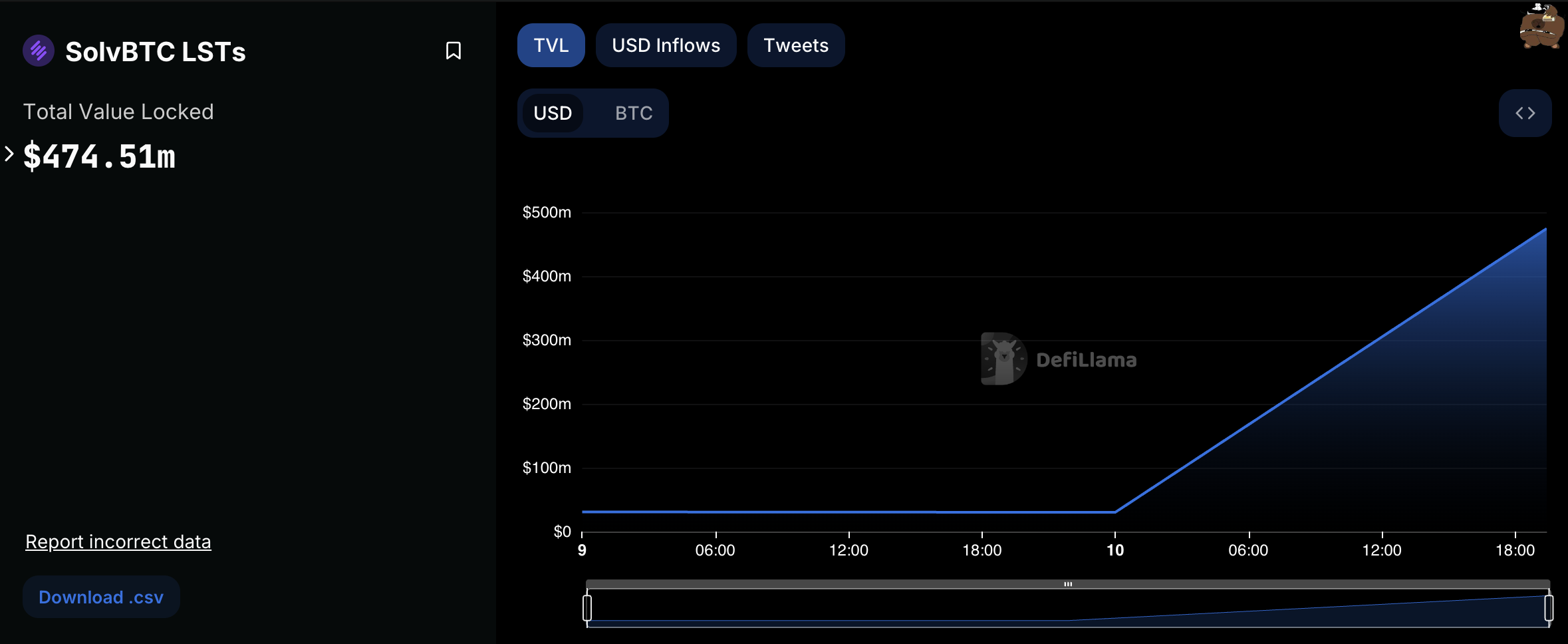

- Bitcoin staking protocol Solv surpassed $470 million in Total Value Locked (TVL) according to data from DeFiLlama.

SolvBTC LSTs TVL

- Bitget Exchange is set to update listing standards and evaluate Fully Diluted Value (FDV), financing background, token unlocking schedule, and financial, security, compliance, political, and ethical risks according to the official announcement.