Bitcoin offers diversity for traditional investors: BlackRock

- BlackRock released a white paper suggesting Bitcoin as a unique diversifier and why it appeals to investors.

- The paper argues that Bitcoin can neither be described as a risk-on nor a risk-off asset.

- BlackRock suggests that Bitcoin can serve as a hedge against US federal deficits and debts.

Bitcoin (BTC) is trading above $60,000 on Wednesday following the release of BlackRock's latest white paper, which addresses some of the top crypto assets' unique advantages to investors compared to traditional asset classes.

Bitcoin's potential as a decentralized asset

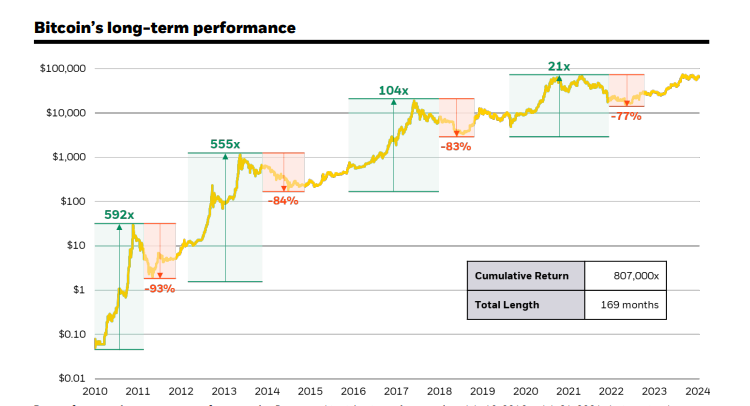

In its research paper, "Bitcoin: A Unique Diversifier," trillion-dollar asset manager BlackRock examined Bitcoin's 15-year investment history and how it offers unique features that differentiate it from other asset classes.

BlackRock suggested that Bitcoin does not fall into the risk-on or risk-off asset class largely because its long-term return drivers are unrelated to other sources.

"While bitcoin has shown instances of short-term co-movements with equities and other 'risk assets,' over the longer term its fundamental drivers are starkly different, and in many cases inverted, versus most traditional investment assets," BlackRock analysts wrote.

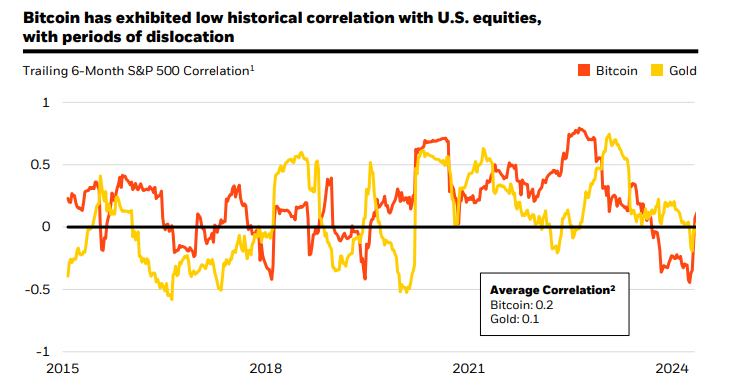

Bitcoin’s correlation with US equities

The paper also states that Bitcoin's long-term correlation with traditional assets, such as bonds and equities, has been low, but its historical returns have been higher than those of every other asset class. In seven out of the last ten years, Bitcoin has outperformed every other major asset class, realizing profits above 100%.

However, three of those ten years involved cycles in which Bitcoin fumbled among these other assets, ending as the worst-performing asset. This was characterized by four drawdowns in which its price dropped below 50%.

Bitcoin’s long-term performance

Furthermore, BlackRock notes that Bitcoin's uniqueness as a non-sovereign, decentralized and fixed-supply asset makes it a good alternative to traditional financial assets. One reason for this conclusion is Bitcoin's uncorrelation to the fortunes of any country or centralized system. This makes it reliable in times of macroeconomic crises such as bank crises, currency debasement, and sovereign economic crises.

Additionally, the paper considers Bitcoin's role as an alternative to the US dollar, especially because of increased investors' concerns over the US federal deficits and debts. This is also rampant in other countries with increasing debt accumulation, leading investors to seek an uncorrelated reserve asset.

"Because of these attributes, bitcoin has been seen by some investors as a 'flight to safety' in times of fear amid some of the most disruptive global events over the last five years," noted BlackRock.

However, the analysts noted that Bitcoin's benefits come with several risks, including high volatility, unclear regulatory status and a relatively new technology with an "immature ecosystem."