Ethereum named most actively developed crypto project, price stays below key trendline

- Ethereum is the most actively developed crypto project, per Santiment data.

- Centralization of ETH within a few wallets not bearish but signals high staking activity.

- Ethereum crossed below a key trendline that suggests its price could decline toward $2,000.

Ethereum (ETH) is down 0.5% on Friday, following recent data showing it is the most actively developed crypto project. ETH also ranks among the top centralized cryptocurrencies by supply concentration.

Daily digest market movers: ETH ETF outflows, high DevActivity, increased staking

Ethereum ranks first among the top crypto projects in terms of development activity, per Santiment data. While developer activity declined by 0.6% in the past month, its DevActivity events crossed 180K.

The number two project with the most DevActivity, BNB Chain, ranks far behind with only 90.1K events. High DevActivity within a project often translates to its technology growth, which could positively impact price.

Top Crypto Projects by Developer Activity

Santiment data also ranks Ethereum fifth among the top centralized cryptocurrencies. Centralization here refers to concentrated mining power among a few stakeholders or most of a coin's supply residing within a few wallets.

In Ethereum's case, Santiment data shows that 44% of its supply resides within ten key wallets. While the centralization of tokens within a few wallets is often interpreted as a bearish signal, Ethereum's can be considered bullish. Most of its large holders are staking platforms that allow investors to contribute to Mainnet's security and earn yields in return, as noted by Santiment. Also, high staking activity reduces the supply pressure of ETH and can cause price surges during periods of heightened demand.

Meanwhile, Ethereum exchange-traded funds (ETFs) returned to negative flows on Thursday after posting outflows of $1.7 million. Flows were limited to Grayscale's ETHE and ETH Mini Trust, as other issuers recorded neither outflows nor inflows.

In other news, Ethereum co-founder Vitalik Buterin has potentially depleted his ETH holdings from 325K ETH three years ago to 240K ETH worth $592 million as of Friday, per Lookonchain data.

ETH technical analysis: Ethereum falls below key trendline

Ethereum is trading around $2,510 on Friday, down 0.5% on the day. ETH 24-hour liquidation is $43.8 million, with long and short liquidations accounting for $34 million and $9.82 million.

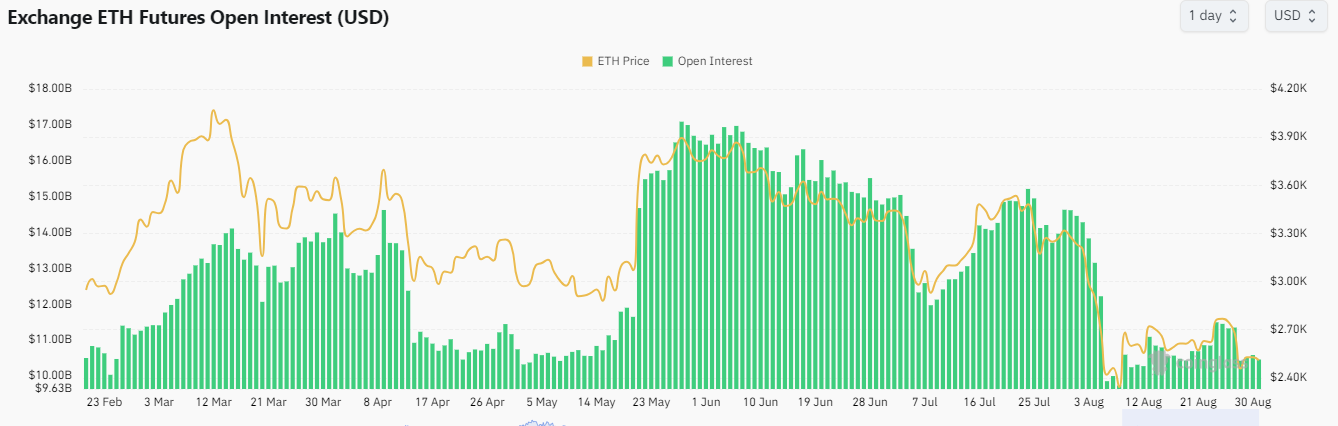

ETH open interest (OI) declined by 5% in the past 24 hours and is currently at $10.39 billion. Open interest is the total worth of unsettled positions in a derivatives market.

Only six days have seen lower OI since May 5. The declining OI shows traders are more cautious, especially after the crash on August 5 wiped out several long positions.

ETH Exchange Open Interest

On the daily chart, ETH has fallen below a descending key trendline extending from May 27 to September 30. The trendline suggests ETH could decline toward the $2,000 to $2,300 range before staging a rally.

ETH posted similar declines from August to November 2022 and July to October 2023 before eventually staging a rally on both occasions. If ETH repeats the same pattern, it could stage a massive rally. On the way up, ETH faces resistance around the horizontal line at $2,817. A successful move above this level could see ETH tackle the resistance at $3,542.

ETH/USDT Daily chart

Meanwhile, ETH is still trading within a key symmetry triangle that extends from November 2021. If ETH rises above the higher descending trendline of the symmetry triangle, it could set a new all-time high.

The Awesome Oscillator (AO) is posting consecutive increasing red bars below the zero line, indicating dominant bearish momentum. The Relative Strength Index (RSI) is at 36 and declining, meaning bearish momentum is prevalent.

A daily candlestick close below the support around $2,111 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.