Ripple whale accumulation could catalyze XRP gains

- Ripple whales bought over 50 million XRP tokens within a 24-hour time frame between August 26 and 27.

- Previously, Ripple whales had shed their holdings in seven days, increasing selling pressure on the asset.

- XRP hovers around $0.60 at the time of writing, rallies 1.12% on Tuesday.

Ripple (XRP) lost key support at $0.65 early in August. Since then the altcoin is trading sideways. Key market movers like whale accumulation, XRP supply distribution and on-chain activity are likely influencing the altcoin’s price.

XRP extends gains by 1.12% on the day, hovering close to support at $0.60.

Daily digest market movers: Ripple whales begin accumulating XRP again

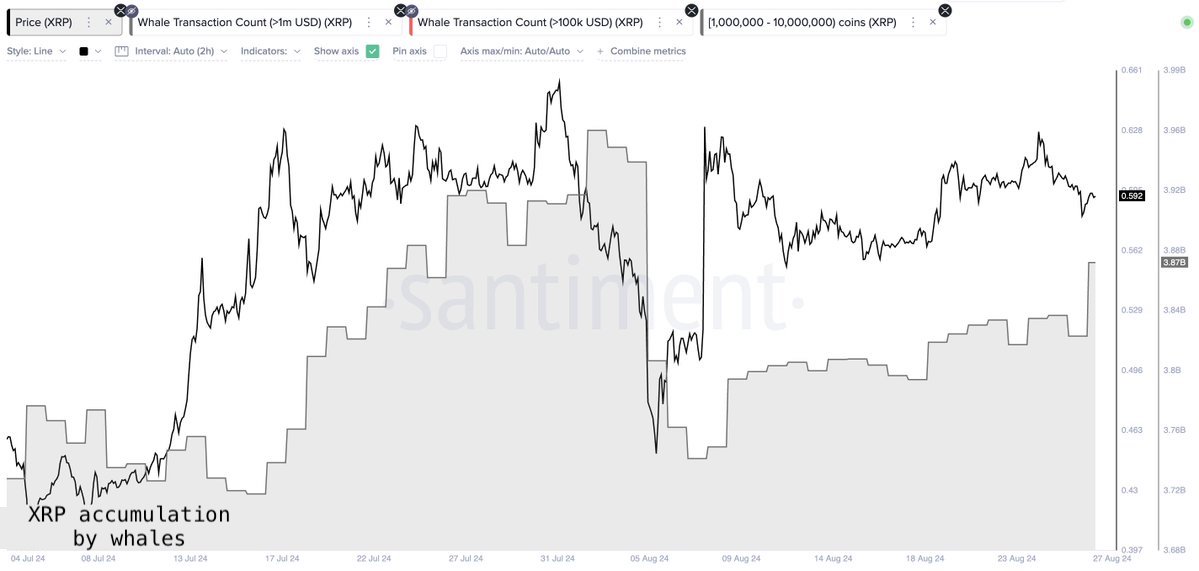

- Ripple whales distributed nearly 140 million XRP tokens between August 19 and 26. The large wallet investors have started accumulating the altcoin again. Whales collected over 50 million XRP within a 24-hour time frame between August 26 and 27, per Santiment data.

- Ripple slips under $0.60 whales dump 140 million XRP tokens in seven days

XRP whales accumulate the altcoin

- Typically, accumulation by whales is considered bullish for the asset. When whales distribute their supply and engage in profit-taking, it increases selling pressure on the asset, like the events of August 19 and 26.

- XRP whales are likely gearing up for an increase in the altcoin’s price.

- Social dominance, a metric that helps ascertain the cryptocurrency’s dominance in conversations on social media platforms, rose to 2% on August 27.

- XRP’s social dominance is at its highest level in two weeks, per Santiment data. This is indicative of higher mindshare among traders and crypto market participants.

[20.43.42, 27 Aug, 2024]-638603716363760320.png)

XRP social dominance

Technical analysis: XRP eyes return to $0.65

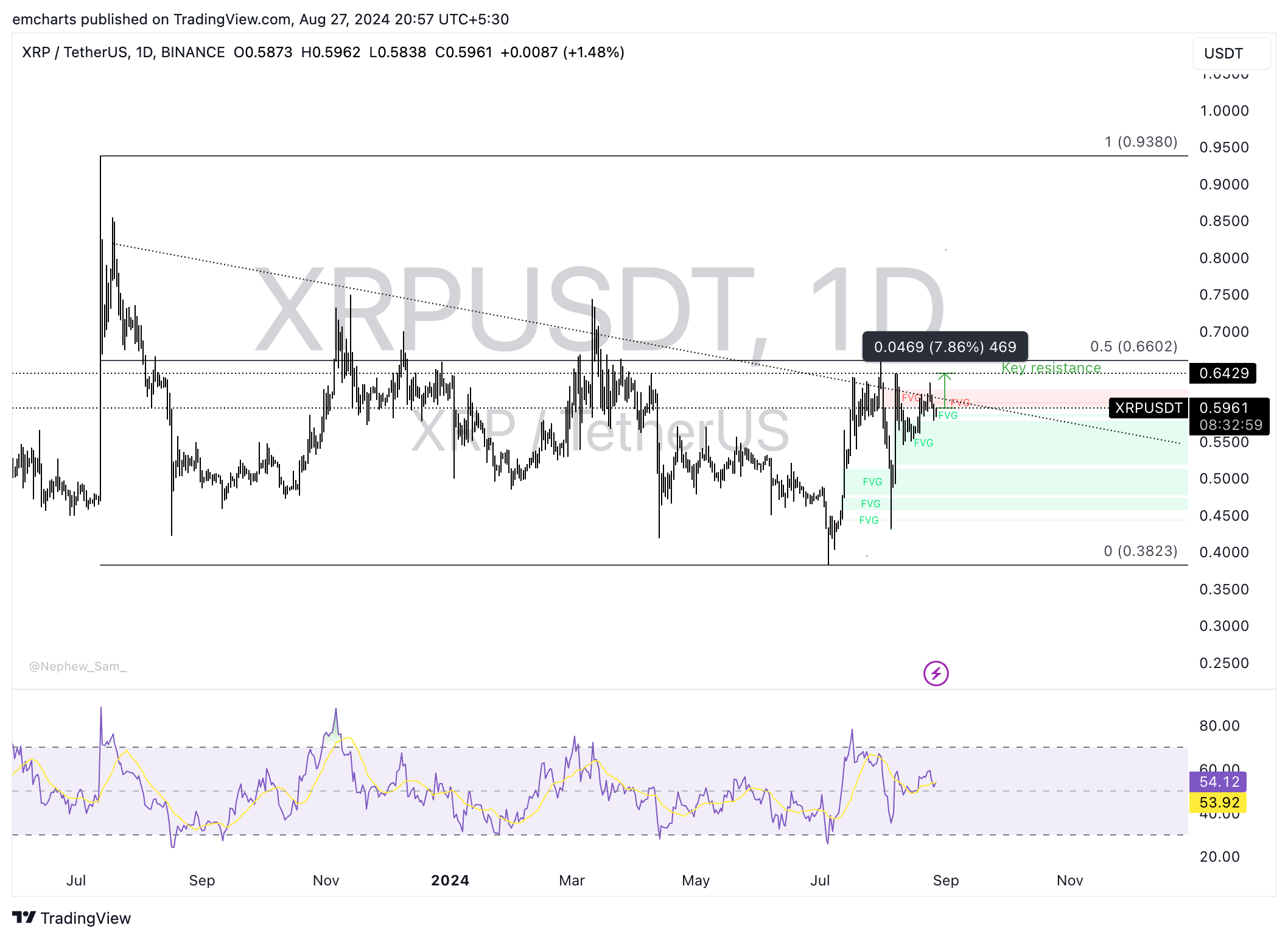

XRP Ledger’s native token is in a multi-month downward trend as seen in the XRP/USDT daily chart. The altcoin slipped under $0.65, a key level, on August 3. Since then Ripple’s token failed to make a comeback.

XRP could return to $0.6439, an important resistance level, tested a few times in the past two weeks. This represents nearly 8% gains from the current level.

Ripple could rally toward $0.6602, the 50% Fibonacci retracement of the drop from the July 2023 top of $0.9380 to the July 2024 low of $0.3823. The Relative Strength Index (RSI) is above 50 on the daily timeframe, which moderately supports a bullish thesis for Ripple.

XRP/USDT daily chart

The altcoin could find support in the imbalance zone between $0.5188 and $0.5785, if there is a correction in XRP. Further decline could push the altcoin closer to testing the August lows of $0.4319.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.