Ethereum ETFs have new demand and could see high growth in coming week, says analyst

- Ethereum ETFs' volume and inflows have been healthy despite ETHE heavy outflows, says Bloomberg analyst Eric Balchunas.

- Ethereum ETFs' inflows are not from ETHE outflows, says analyst.

- Ethereum options expiry may trigger weekend volatility, but prices look set to improve in the long term.

Ethereum (ETH) is up nearly 5% on Friday following speculations that ETH ETFs' inflows have been outflows from Grayscale Ethereum Trust (ETHE).

Daily Digest Market Movers: Why Ethereum ETFs may not be 'small potatoes'

Ethereum ETFs took the major headline across the crypto market and parts of the traditional market this week as the banner of Bitwise Ethereum ETF (ETHW) was hung outside the New York Stock Exchange on Thursday.

The flag of ETH is raised over Wall Street.

— Balaji (@balajis) July 26, 2024

And the SEC surrenders to a more powerful regulator.

Because it is Ethereum that now provides standardized market access to all Internet participants.

The network defeats the state.pic.twitter.com/7nlQCxXvWz

Ethereum ETFs' debut week saw the products raking in a trading volume of over $800 million for four consecutive days. The "New Eight" weren't able to muster enough inflows like the "New Nine Bitcoin ETFs" to offset outflows from Grayscale Ethereum Trust (ETHE). However, their inflows and trading volume are healthy, noted Bloomberg analyst Eric Balchunas.

Some crypto community members speculated that Ethereum ETFs may not have real demand as inflows into the "New Eight'' may be outflows from ETHE. However, Balchunas debunked the sentiment, noting that two-thirds of the inflows may be new demand as ETHE outflows are probably from hedge funds.

"A big chunk of the outflows are HFs who arbed the $ETHE discount, and they've no interest in being long eth so they taking their profit and leaving," wrote Balchunas in an X post. He also believes ETH investors shouldn't focus on the first few weeks of outflows but lean on how issuers like BlackRock and Fidelity would preach the ETH investment case.

With the high rate of ETHE outflows, many expect its effect to taper off more quickly than that of GBTC. Hence, ETH's price could reflect the demand from ETF investors more quickly than Bitcoin's. However, this also means its price could experience steeper short-term declines than Bitcoin's post-ETF launch.

ETH Technical Analysis: Ethereum options expiry could trigger weekend volatility

Ethereum is trading around $3,250 on Friday, up nearly 5% on the day. ETH 24-hour liquidations reached $52.18 million, with long and short liquidations accounting for $30.13 million and $21.87 million, respectively, according to Coinglass' data.

ETH options with a notional value of $1.57 billion and a Put/Call Ratio of 0.46 expired today. Such heavy end-of-month options expiries often trigger high volatility, so ETH could experience huge price swings over the weekend.

The outlook appears to be turning positive for ETH after its recent rise, but outflows from ETHE could continue to weigh down on its price. As a result, ETH could enter a horizontal trend tilted towards the upside if the wider crypto market sentiment is positive. However, if the wider market turns bearish or uncertain, ETH could test support ranging from $2,852 to $2,803.

ETH/USDT Daily chart

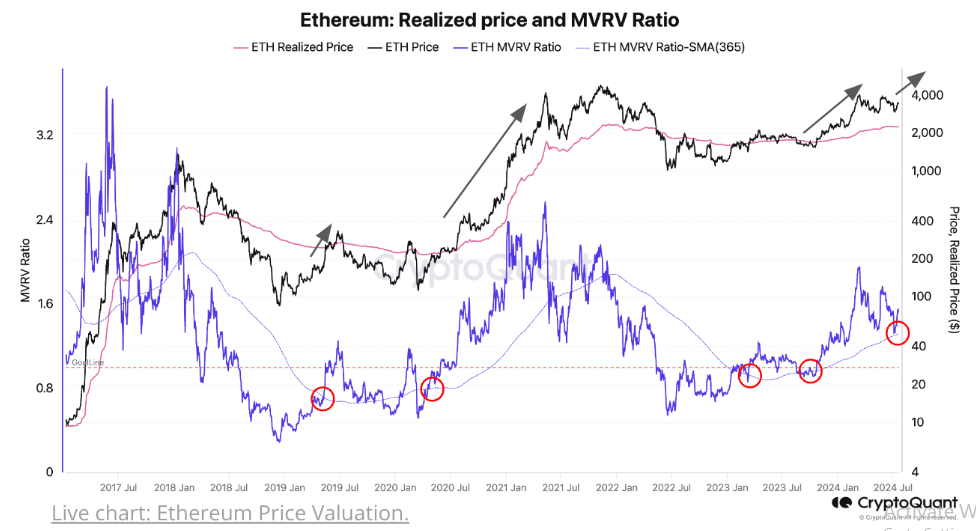

In the long term, ETH could rally in the coming months after its Market Value to Realized Value (MVRV) Ratio bounced off its 365-day moving average. According to data from CryptoQuant, a price rally has often followed such a move as it indicates "price may have found a local bottom and could continue to increase."

ETH Realized Price and MVRV Ratio

ETH could rise to $3,282 in the short term to liquidate $65.42 million worth of short positions.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.