Ethereum ETFs on track to surpass expectations after impressive first-day launch

- Ethereum ETFs are on track for a successful second trading day after capturing $107 million in net inflows on launch day.

- Investors shifted attention toward ETH as its impressive first-day launch ended BTC ETFs' 12 days of consecutive net inflows.

- Ethereum price structure and options data indicate a potential brief decline before a bullish reversal.

Ethereum's (ETH) price is down 1.8% on Wednesday despite an impressive ETH ETFs' first-day launch that saw them attract $10.2 billion in assets and net inflows of $107 million.

Daily digest market movers: ETH ETFs vs Bitcoin ETFs

Ethereum ETFs are on track for a second successful trading day after an impressive first-day launch.

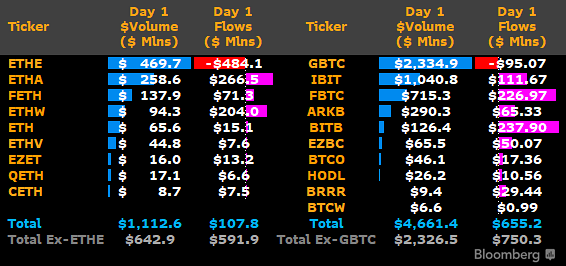

In their first day of trading, ETH ETFs raked in $10.2 billion in assets across the nine ETFs that debuted and over $1.1 billion in trading volume. The total net flows across the products were around $107 million after accounting for the massive $484 million outflows witnessed in Grayscale's ETHE.

Bloomberg analyst James Seyffart noted that ETHE experienced higher first-day outflows compared to Grayscale's GBTC because it was already trading at net asset value (NAV) upon launch. GBTC, on the other hand, was trading at a discount when BTC ETFs launched, reducing the selling pressure from holders.

When compared against Bitcoin, ETH ETFs only managed to attract 16% of BTC ETFs' $655 million first-day net flows. However, Bitwise's Juan Leone noted that ETH ETFs captured 79% of BTC ETF flows when outflows from ETHE/GBTC were excluded. With such a move, ETH ETFs may be on track to surpass analysts' earlier estimates of $3 billion to $5 billion net flows in the first six months of launch.

However, the inflow effect isn't yet visible in ETH's price despite the heavy buying from asset managers. A possible reason is the outflows from ETHE canceling out the demand pressure from other asset managers.

Bloomberg Ethereum ETFs

Meanwhile, while ETH ETFs experienced inflows yesterday, BTC ETFs suffered outflows, ending their streak of 12 consecutive days of net inflows. It appears ETH ETFs are stealing attention from the largest digital asset.

ETH Technical Analysis: Why Ethereum's price is poised for a brief drop

Ethereum is trading around $3,420 on Wednesday, down 1.8% on the day. ETH 24-hour liquidation is at $14.15 million, with long and short liquidations accounting for $8.66 million and $5.49 million, respectively, according to Coinglass data.

ETH Long/Short Ratio declined to 0.91 in the past 24 hours, indicating bearish sentiment still prevails over bulls in the market.

ETH's decline is similar to that of Bitcoin when BTC launched in January. Using the price of BTC as a proxy, ETH may see a bullish reversal to a new all-time high after a brief decline. This is also visible in ETH's daily chart, which shows signs that the largest altcoin could decline toward the $3,203 support before bouncing to attack the $3,731 key resistance.

ETH/USDT Daily chart

Deribit's options data aligns with the thesis above, as the Put/Call Ratio (PCR) for the August 9 ETH options expiry surged to 1.19. This suggests that most traders are betting for a similar BTC post-ETF decline to happen with ETH, leading to a potential self-fulfilling prophecy.

Long-dated PCR is at 0.3, with open interest concentrated around the strike prices of $4,000 and $5,000, indicating a long-term bullish sentiment among traders.

The thesis will be invalidated if ETH sustains an extended decline below the $3,203 support level.

In the short term, ETH could retest the $3,500 psychological level, at which $45 million worth of short positions risk liquidation, as prices will likely move towards a zone with a high concentration of potential liquidation levels.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.