Ethereum could be second most successful ETF category in history after Gemini's $5 billion inflow prediction

- Ethereum ETFs set for $5 billion in net inflows, says Gemini.

- Ethereum Foundation shed its holdings again, bringing its total sales since January to 2,266 ETH.

- Ethereum may decline to $3,378 to target a $3.75 million liquidation pool.

Ethereum (ETH) is down more than 1.4% on Tuesday following another ETH sale from the Ethereum Foundation. Meanwhile, crypto exchange Gemini's recent report reveals that ETH ETF could see about $5 billion in net inflows within six months of launch.

Daily digest market movers: ETH ETF inflows prediction, Ethereum Foundation sheds holdings

In a report on Monday, crypto exchange Gemini predicted that spot Ethereum ETFs could attract a net inflow of $5 billion within their first six months of trading.

When combined with the conversion of Grayscale's Ethereum Trust, Gemini analysts predicted that ETH ETFs would have total assets under management (AUM) of around $13 billion to $15 billion in six months.

The report suggested that if ETH ETFs captured a net inflow of $7.5 billion in six months, it would indicate a "significant upside surprise," while a net inflow of $3 billion would be a disappointment.

Gemini analysts predicted the inflows could trigger a 20% rise in the ETH/BTC ratio to 0.067 from its current lows.

"Given the AUM comparable in international ETF markets, robust on-chain dynamics, and differentiating factors such as a thriving stablecoin environment, there is favorable risk-reward of an ETH catch-up trade in the months to come," said Gemini.

Meanwhile, Bloomberg analyst James Seyffart held onto his earlier estimate that ETH ETFs would only capture about 20-25% of the flows seen in Bitcoin ETFs. He noted that such a move would make ETH ETFs the second most successful ETF category in history behind Bitcoin ETFs.

The Securities & Exchange Commission (SEC) approved 19b-4 filings of spot ETH ETFs in May but needs to greenlight issuers S-1 registration statements before the products can go live in the US.

According to Spot On Chain, the Ethereum Foundation resumed selling ETH on Tuesday after swapping 100 ETH for 343,934 DAI. This adds to a long list of ETH sales — 2,266 ETH worth $6.56 million — the Foundation has made since the beginning of the year.

While the sale seems insignificant, some traders often use the Foundation's move as a proxy for when to shed their holdings.

ETH technical analysis: Ethereum could take slight downturn before rebounding

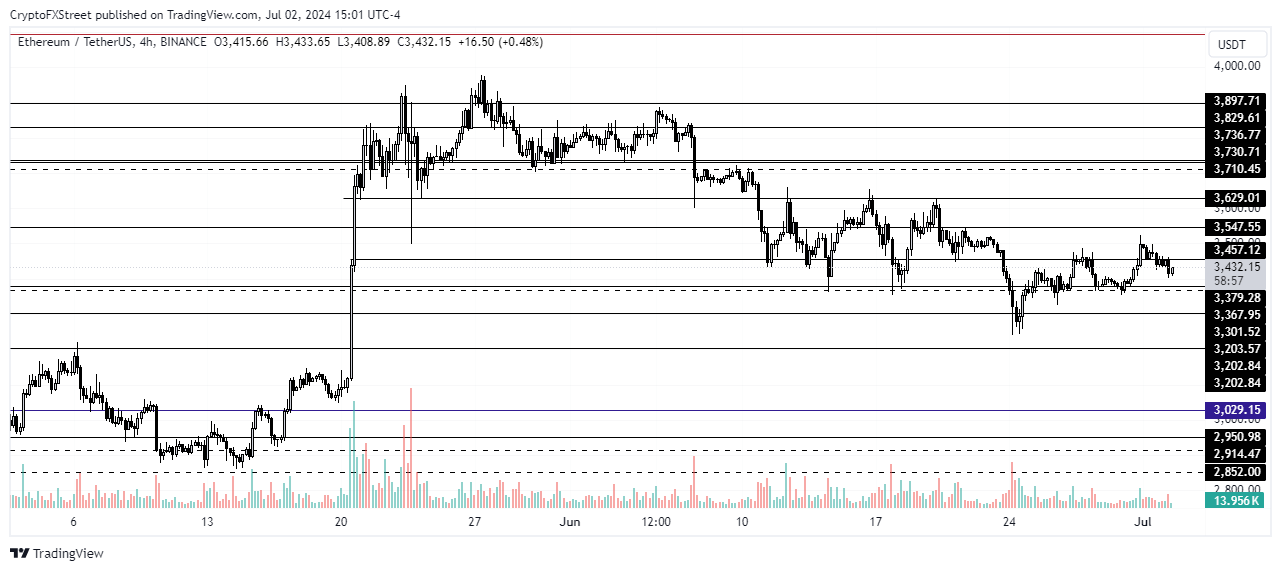

Ethereum is trading around $3,412, down more than 1% on Tuesday after it failed to move past key resistance at the $3,547 level.

ETH saw a rejection around $3,523, triggering about $14.81 million in long liquidations, according to Coinglass data. On the other hand, short liquidations have slowed down, accounting for only 33% of ETH's total liquidation in the past 24 hours.

ETH may target the $3.75 million liquidation pool at around $3,378 before rebounding. This aligns with ETH's 4-hour chart, which shows that $3,739 is a key support level. IntoTheBlock's data also shows that 3.71 million addresses acquired about 3.33 million ETH around this price.

ETH/USDT 4-hour chart

Zooming out, ETH has to overcome the $3,629 resistance — a price level it had failed to sustain any significant move above in the past three weeks — to give credence to bullish sentiment surrounding the potential spot ETH ETF launch.

The $3,203 serves as a key support on the downside as a potential move below it may spark prevailing bearish sentiment.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.