EUR/USD tests further downside as European business sentiment backslides

- EUR/USD eased down for a fourth straight day on Monday.

- Markets are hoping for easing tariff tensions from the Trump administration.

- EU and US PMI survey results came in mixed as the economic outlook remains uncertain.

EUR/USD roiled on Monday, testing below the 1.0800 handle as market sentiment continues to grapple with mixed economic data and still-cooking tariff concerns. Investors found some relief after US President Donald Trump hinted that tariff exemptions to his own previously-unavoidable tariffs slated for April 2, but Purchasing Managers Index (PMI) survey results continues to warn that more problems may be on the horizon.

US President Donald Trump has again hit investors with a fresh batch of on-again, off-again tariff threats. Investors have latched onto the suggestion that Donald Trump might be looking at tariff exemptions for his own trade policy “strategy”, bolstering market sentiment enough to keep the Greenback under wraps.

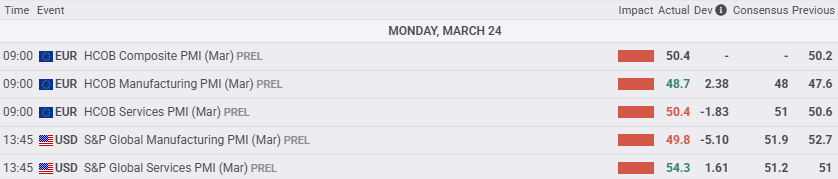

Pan-European PMI data soured overall in March, with the Manufacturing PMI rising to 48.7 but still holding in contraction territory. The Services component ticked lower to 50.4, whereas median market forecasts were hoping for a rebound to 51.0

US Manufacturing PMI survey results sank faster than expected in March as tariff threats take a bite out of the physical production outlook. The Manufacturing PMI for March sank to a three-month low of 49.8, slipping back into economic contraction territory as businesses grow increasingly worried about the economic landscape. The Services PMI came in better than expected, rising to 54.3, it’s own three-month high as services operators expect to be able to fully pass on tariff cost increases to consumers.

The economic data docket remains firmly mid-tier heading through the midweek market sessions, but traders will be keeping an eye on looming US Personal Consumption Expenditure Price Index inflation figures due on Friday.

EUR/USD price forecast

EUR/USD has shed weight for four straight trading days, declining from it’s latest swing high into 1.0950. Fiber is testing back into the 1.0800 handle, but is still trading well north of the 200-day Exponential Moving Average (EMA) near 1.0675.

EUR/USD is still trading 5.8% above its last major swing low below 1.0200 in January, however the bull run may be set to end as technical oscillators accelerate to the downside.

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.