EUR/USD corrects as Trump tariff fears increase safe-haven appeal

- EUR/USD declines to near 1.0450 as the US Dollar strengthens on risk-aversion mood.

- Market sentiment turned cautious after Trump imposed tariffs on Columbia overnight.

- Investors will keenly focus on the Fed’s and the ECB’s policy meetings later this week.

EUR/USD corrects to near 1.0450 in Monday’s European session after revisiting a six-week high near 1.0520 on Friday. The major currency pair faces pressure as the US Dollar (USD) starts the week on a positive note amid risk-off market sentiment. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, strives to recover from last week’s losses and jumps to near 107.75.

The safe-haven appeal of the US Dollar has increased as United States (US) President Donald Trump's tariff fears have returned. Trump imposed 25% tariffs on its South American trading partner Columbia overnight after the country refused to accept military flights carrying deportees from the US. However, the White House later reported that the Colombian government agreed to “Trump’s terms of accepting illegal immigrants”, and Trump’s proposed tariffs were “now on hold”, Associated Press (AP) reported.

The Greenback also attracts bids on Monday as market sentiment is cautious, with investors awaiting interest rate decisions from the Federal Reserve (Fed) and the European Central Bank (ECB) on Wednesday and Thursday, respectively.

According to the CME FedWatch tool, the Fed is certain to keep interest rates unchanged in the range of 4.25%-4.50%. Investors will pay close attention to Fed Chair Jerome Powell’s press conference to determine whether policymakers are comfortable with Trump’s call for immediate rate cuts.

On the US economic front, investors will focus this week on the Durable Goods Orders and the Personal Consumer Expenditure Price Index (PCE) data for December and the preliminary Q4 Gross Domestic Product (GDP) data.

Daily digest market movers: EUR/USD declines ahead of Fed-ECB policy meetings

- The downside move in the EUR/USD pair at the start of the week is driven by a decent recovery in the US Dollar. Meanwhile, the Euro (EUR) trades lackluster ahead of the ECB’s monetary policy decision. The ECB is widely anticipated to reduce its Deposit Facility rate by 25 basis points (bps) to 2.75%, with the Main Refinancing Operations Rate sliding to 2.9%. This would be the fourth interest rate cut by the ECB in a row.

- Traders are confident that the ECB will cut interest rates on Thursday, as Eurozone inflation has remained under control and growth prospects remain sluggish. Market participants will focus on ECB President Christine Lagarde’s press conference for fresh guidance on interest rates and how the central bank will counter the consequences of Trump’s tariffs on the Eurozone. Meanwhile, investors have also priced in three more interest rate cuts this year, coming in the remaining three meetings in the first half of the year.

- Investors will also focus on preliminary Eurozone Q4 GDP data, which will be released on Thursday. Economists expect the shared bloc to have grown by 1% compared to the same quarter last year. In the previous quarter, the economy expanded by 0.9%.

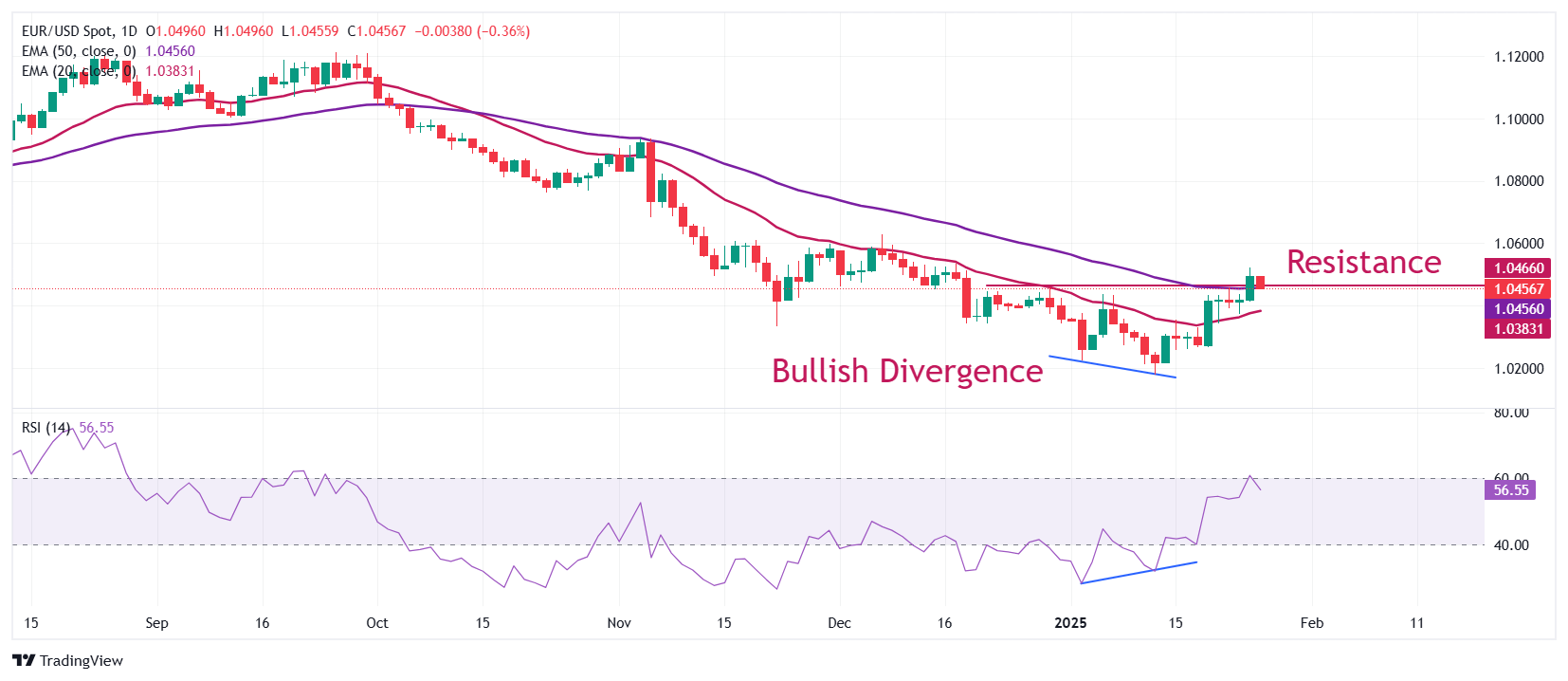

Technical Analysis: EUR/USD falls from 1.0500 while the near-term outlook remains bullish

EUR/USD falls to near 1.0450 on Monday after posting a fresh monthly high near 1.0520 on Friday. The major currency pair wobbles around the 50-day Exponential Moving Average (EMA), which trades near 1.0460. The near-term outlook of the pair remains firm as it holds the 20-day EMA, which trades around 1.0383.

The pair entered a bullish reversal after breaking the January 6 high of 1.0437, which confirmed a divergence between the asset’s price and the 14-day Relative Strength Index (RSI). On January 13, the RSI formed a higher low, while the pair made lower lows.

Looking down, the January 20 low of 1.0266 will be the key support zone for the pair. Conversely, the December 6 high of 1.0630 will be the key barrier for the Euro bulls.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.