EUR/USD tanks post-Fed decision, sellers eye 1.0400

- EUR/USD sees a sharp decline after the Federal Reserve cuts rates by 25 basis points but indicates a slower pace for future reductions.

- Cleveland Fed President Beth Hammack cast a dissenting vote, preferring to keep rates steady.

- The Fed's Summary of Economic Projections (SEP) suggests only two rate cuts in 2025 and 2026.

The EUR/USD fell sharply, from around 1.0500, after the Federal Reserve lowered borrowing costs but adopted a cautious stance on the interest rates path in 2025. At the time of writing, the pair trades volatile at around the 1.0400 – 1.0500 range, below its opening price.

EUR/USD pair tumbles into the 1.0400 – 1.0500 range following a Federal Reserve rate cut accompanied by a guarded outlook for 2025

The Federal Reserve cut rates by 25 basis points to the 4.25%-4.50% range, yet the decision was not unanimous, as Cleveland Fed President Beth Hammack voted to keep rates unchanged. T

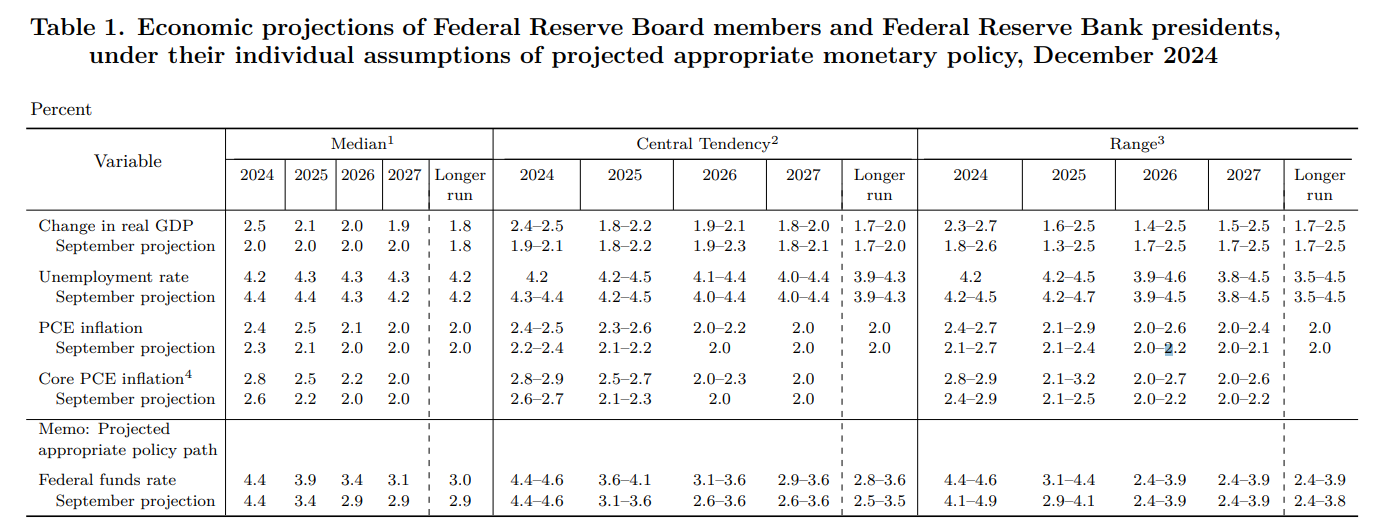

There was little change in the statement compared to the last meeting, though traders were focused on the Summary of Economic Projections (SEP).

The central bank's monetary policy statement revealed that economic activity continued to expand solidly and acknowledged the labor market conditions had eased. Despite the improvement in employment, Fed policymakers decided to keep the language of “The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance.”

Meanwhile, the SEP showed that officials penciled just two rate cuts in 2025 and 2026, driving the fed funds rate to 3.4% in 24 months.

SEP

Source: Federal Reserve

Next is the Fed Chair Jerome Powell's press conference, which would be scrutinized for traders to look for cues regarding the monetary policy for the upcoming year.

EUR/USD Reaction to Fed’s decision

The EUR/USD has plunged sharply, clearing the 1.0450 psychological level, extending its losses toward the day's lows at 1.0410. The pair would remain trading volatile, as Fed Chair Powell takes the stand. Immediate resistance is seen at the December 13 low of 1.0452, and support at 1.0400. If cleared, the next support would be the YTD low of 1.0331.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.64% | 0.53% | 0.54% | 0.50% | 1.00% | 1.08% | 0.54% | |

| EUR | -0.64% | -0.11% | -0.10% | -0.14% | 0.35% | 0.43% | -0.10% | |

| GBP | -0.53% | 0.11% | 0.00% | -0.03% | 0.46% | 0.54% | 0.00% | |

| JPY | -0.54% | 0.10% | 0.00% | -0.05% | 0.44% | 0.54% | -0.02% | |

| CAD | -0.50% | 0.14% | 0.03% | 0.05% | 0.49% | 0.57% | 0.04% | |

| AUD | -1.00% | -0.35% | -0.46% | -0.44% | -0.49% | 0.07% | -0.47% | |

| NZD | -1.08% | -0.43% | -0.54% | -0.54% | -0.57% | -0.07% | -0.53% | |

| CHF | -0.54% | 0.10% | -0.01% | 0.02% | -0.04% | 0.47% | 0.53% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).