Canadian Dollar tepid amid US holiday markets

- The Canadian Dollar is mostly flat near familiar territory on Thursday.

- Canada GDP figures due Friday to draw some attention from Loonie traders.

- Market volumes are notably thin with US markets shuttered for Thanksgiving.

The Canadian Dollar (CAD) traded thinly on Thursday, sticking to the 1.4000 handle against the Greenback as global markets grind into slow gear in the latter half of the trading week with overall market volumes crimped by a lack of flow from US institutions. US markets are shuttered in observation of the Thanksgiving holiday today, and a shortened day for American markets on Friday also bodes poorly for consistent market moves to wrap up the week.

Canada will be printing updates to Gross Domestic Product (GDP) growth figures on Friday, leaving Loonie traders in the lurch for Thursday. Still, Canadian Current Account figures came in better than expected, helping to muscle the CAD into a slightly higher stance on the day.

Daily digest market movers: Canadian Dollar propped up by holiday markets

- The Canadian Dollar gains a scant tenth of a percent on Thanksgiving Thursday.

- Market flows have dried up with the US on holiday. Friday volumes will likely be constrained as well.

- Canada’s Current Account came in at -3.23 billion in the third quarter, better than the expected -9.3 billion and rebounding from the previous quarter’s revised -4.7 billion, which was initially released at -8.4 billion.

- On Friday, Canada’s third quarter GDP growth is expected to ease to just 1.0% on an annualized basis, down from the previous 2.1%.

- On a month-on-month basis, Canadian GDP is forecast to swing up to 0.3% MoM in September compared to August’s flat 0.0% print.

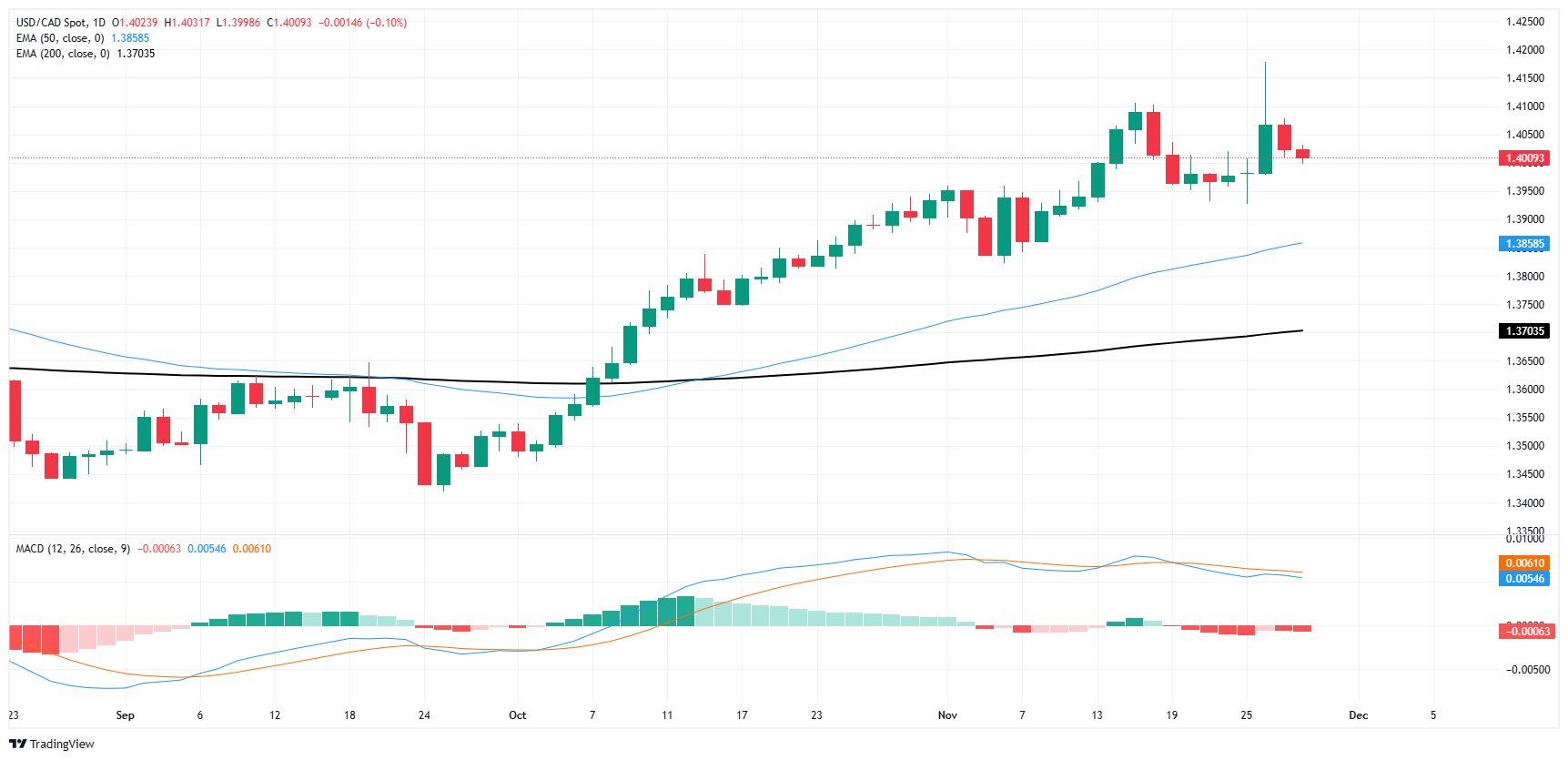

Canadian Dollar price forecast

The Canadian Dollar’s (CAD) is seeing a tepid rebound after tapping a 55-month low this week. The CAD has gained an intraday foothold against the US Dollar, dragging the USD/CAD pair back into the 1.4000 handle. The pair is still caught on the high end following a broad-market bull run in the Greenback. Still, technical traders will have an increasingly difficult time ignoring the growing potential for a cyclical turnaround in the long-term charts.

USD/CAD daily chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.