Litecoin Price Prediction: Whales spotted moving 84 million LTC amid Trump-fuelled market dip

- Litecoin price rose 24% in the last 24 hours, defying the broader crypto market's bearish sentiment.

- Whales moved 84.8 million LTC on Tuesday, capitalizing on the price dip after Trump’s latest tariff announcement.

- With institutions accumulating LTC ahead of potential ETF launch, bears could struggle to push a near-term reversal below $120.

Litecoin price surged 24% in the last 24 hours, defying bearish sentiment across the broader crypto markets. With institutions accumulating LTC ahead of a potential ETF launch, bears could struggle to force a near-term reversal below $120.

Litecoin (LTC) posts 24% gains despite macro market risks

Litecoin (LTC) has displayed a strong performance in February 2025, even as the broader crypto market struggled.

The primary catalyst is speculation surrounding a Litecoin spot ETF, which could see approval from the United States (US) Securities and Exchange Commission (SEC). As a proof-of-work coin without the inflationary risks of Solana and Ripple (XRP), Litecoin has attracted fresh attention from institutional investors.

Traders have priced in a 90% probability of ETF approval, fueling a unique price action.

This dynamic became more evident after President Donald Trump announced new tariffs on Monday.

While major assets like Bitcoin (BTC) and Ethereum (ETH) dropped to multi-month lows, ETF buzz around Solana and XRP failed to prevent further declines. Meanwhile, Litecoin defied the downtrend, posting notable gains during the same period.

Litecoin (LTC) price action

Litecoin's price surged from $106 on Tuesday to a high of $132 on Thursday, marking a 24% increase.

Although LTC has pulled back slightly below $130, rising market volumes suggest that buying momentum remains strong.

LTC whales move 84 million amid Trump-fueled market dip

Litecoin's rally stands out amid the broader market downturn. While BTC and ETH struggle, LTC's surge suggests an internal catalyst driving demand.

On-chain data reveals that whale investors played a critical role in this movement.

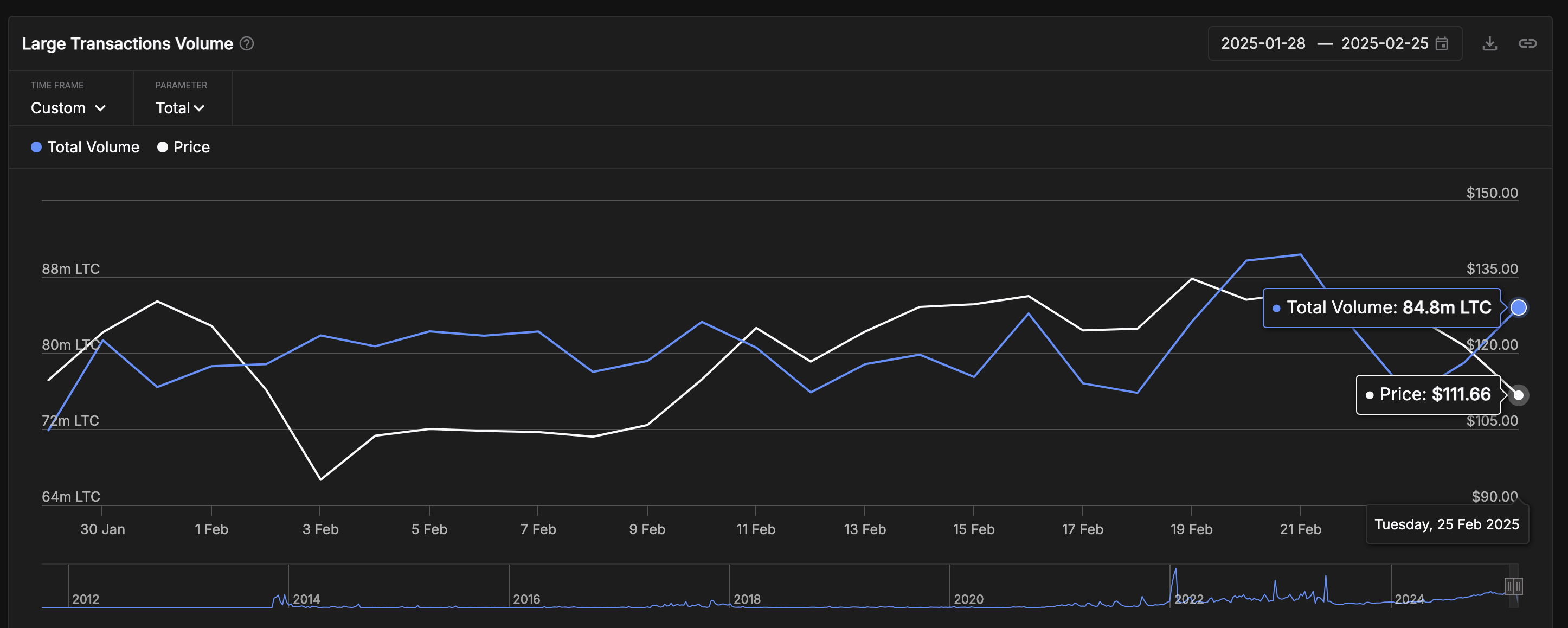

IntoTheBlock’s Large Transactions metric, which tracks the total value of transactions exceeding $100,000, provides insight into whale activity.

Data shows that whales transacted 75.5 million LTC when the crypto market plunged following Trump’s tariff announcement.

Instead of joining the sell-off, whales increased buying pressure as prices dropped.

Litecoin price vs. LTC whales | Source: IntoTheBlock

By Wednesday, whale demand had climbed to 84.8 million LTC, worth approximately $900 million at current prices.

This suggests that whales saw the dip as an opportunity to accumulate LTC at a discount.

The sharp rise in whale transactions during a period of low market confidence has played a crucial role in Litecoin’s price surge.

While other assets struggled, this influx of institutional demand propelled LTC higher.

With Litecoin’s ETF launch date still uncertain, many investors who accumulated LTC during the dip may choose to hold until approval is confirmed.

If institutional accumulation continues, Litecoin price appears well-positioned for sustained bullish momentum.

Litecoin Price Forecast: More gains ahead if $120 support holds

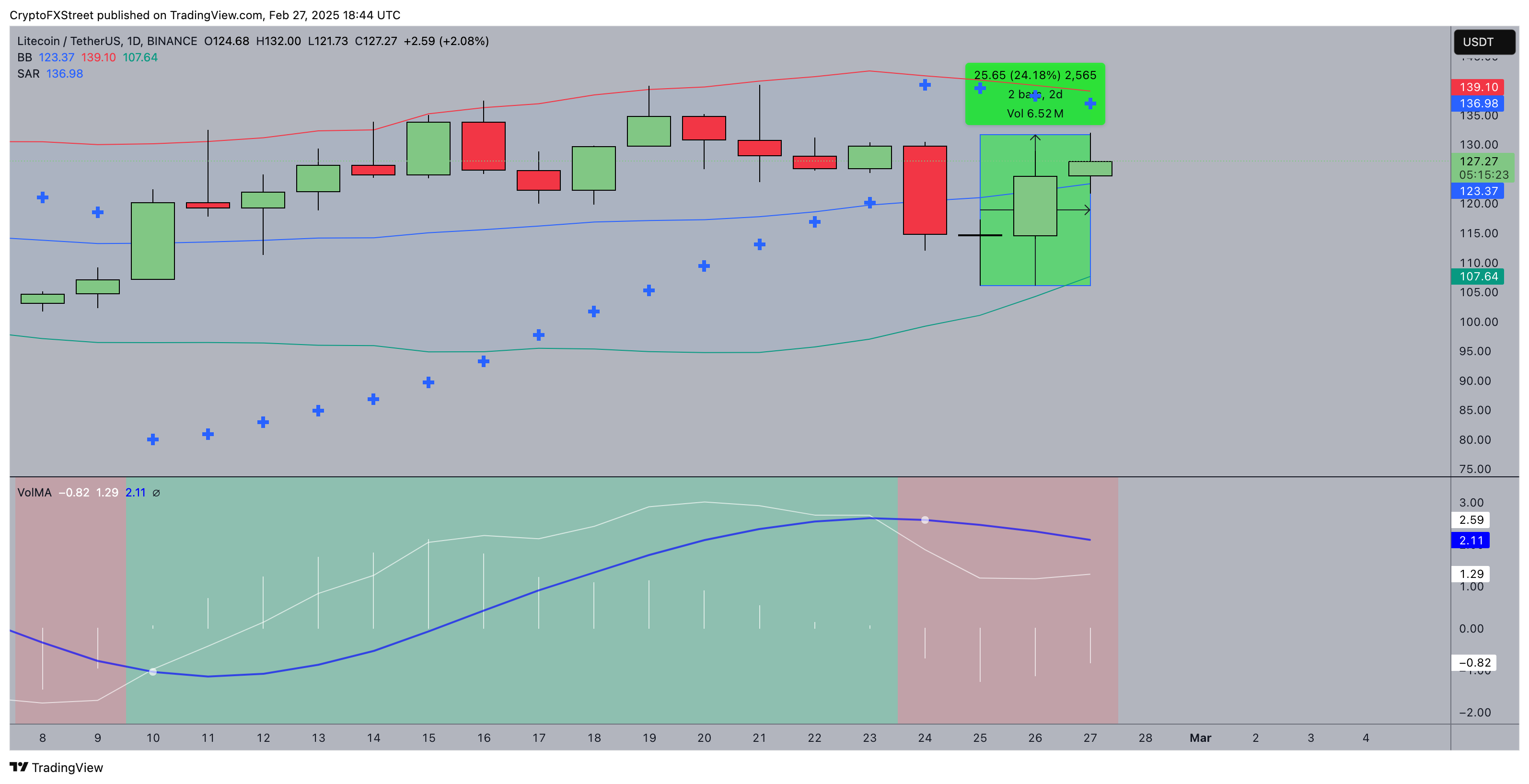

Litecoin price surged 24.18% over the last 48 hours, briefly reclaiming the $132 level after rebounding from a low of $106.

Technical indicators affirm the LTC price action remains poised for another leg-up as it currently trades within the Bollinger Bands' midrange, with the lower band at $107.64 acting as strong support.

A sustained hold above $120 could signal further upside, with the upper Bollinger Band at $139.10 as the next key resistance.

Litecoin Price Forecast

Parabolic SAR dots remain below Litecoin’s price, indicating the current rally has not yet reached overbought conditions.

This suggests further upside potential if buying momentum sustains. Volume Moving Average (VolMA) shows a sharp increase, aligning with the breakout from the recent dip.

The 6.52 million volume spike reflects renewed investor interest, further reinforcing bullish sentiment.

If Litecoin price stays above $123.37, the midline of the Bollinger Bands, it could consolidate before another push toward $135-$140.

However, failure to hold this level could trigger a retest of $120. A breakdown below this critical support would expose Litecoin to downside risks, potentially dragging it toward $110.

Overall, the trend remains cautiously bullish unless $120 support is lost.