Bitcoin Price Forecast: BTC recovers above $85,000 while institutional investors offload their holdings

- Bitcoin price recovers and trades around $86,000 on Thursday after falling nearly 15% at one point this week.

- President Trump’s ongoing tariff news and falling institutional demand fueled the BTC’s correction.

- Traders should be cautious as further downturns could see BTC at around the $73,000 level.

Bitcoin (BTC) recovers slightly and trades around $86,000 at the time of writing on Thursday after falling nearly 15% at one point this week. US President Donald Trump’s ongoing tariff news and falling institutional demand fueled the BTC’s correction. Traders should be cautious as further downturns could see BTC at around the $73,000 level. However, the RSI indicator brings hope as it reaches oversold conditions.

Bitcoin dipped below $85,000 as Trump likely to impose 25% tariffs on the European Union

Bitcoin declined 5% on Wednesday, reaching a low of $82,256. This headwind in Bitcoin price was fueled by US President Donald Trump’s fresh tariff headlines. Trump reiterated his insistence on 25% tariffs on Canada and Mexico, which has been postponed until April 2, and added the European Union (EU) to the mixed list of countries from which he would penalize US consumers for importing. The US President confirmed a 25% tariff would be imposed on Europe “on autos and other things” and the “details on EU tariffs coming soon.”

“Despite a fresh doubling down on his plans to fund the US deficit spending with import taxes, President Trump has also kicked his own tariff can down the road for a fourth straight time, deciding that tariffs on Canadian and Mexican imports won’t go into effect until April,” says Joshua Gibson, an analyst at FXStreet on a post.

Institutional investors offload their BTC holdings, increasing selling pressure

Bitcoin fell for three straight days this week from its Monday high of $96,500 to Wednesday’s low of $82,256. This price correction was supported by falling institutional demand and rising selling pressure.

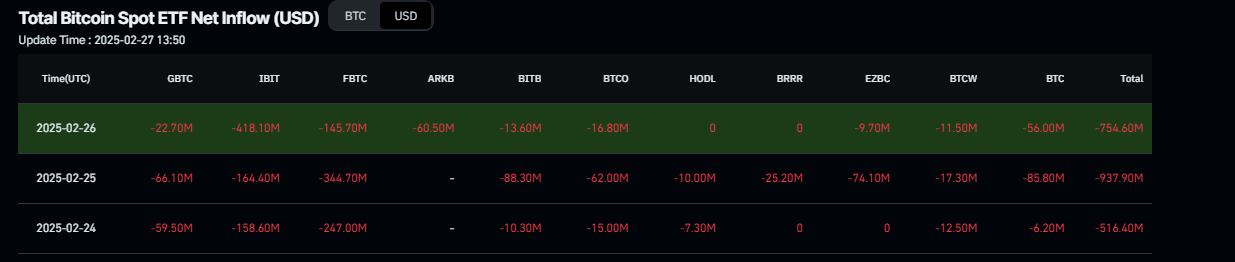

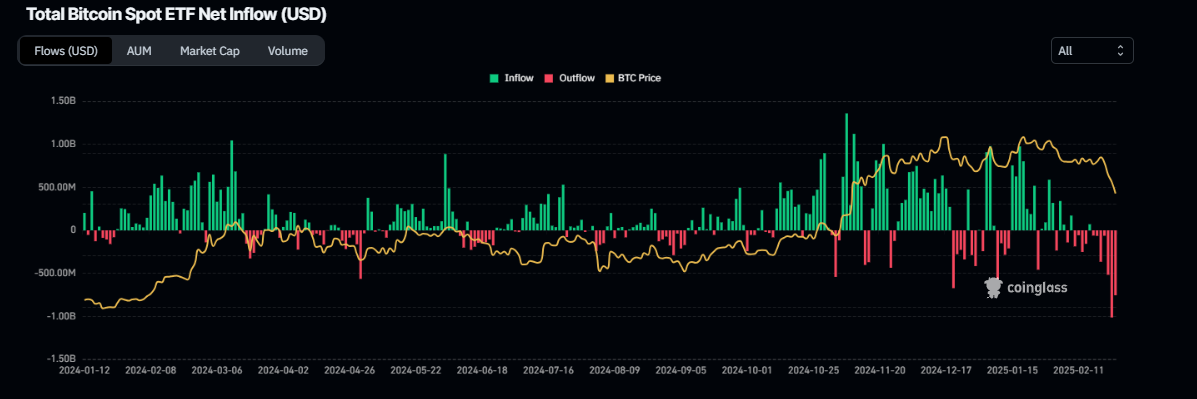

According to Coinglass data, Bitcoin spot Exchange Traded Funds (ETF) data recorded net outflows of $2.2 billion in the last three days this week, continuing its ongoing sell-off from over the past weeks. If the magnitude of the outflow continues and intensifies, the Bitcoin price could see further corrections.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

Whispers of stagflation gaining traction on the street — QCP’s Capital report

QCP’s Capital report on Wednesday highlights that a global risk-off move has sent equities, Gold, and BTC lower “with whispers of stagflation gaining traction on the street.”

The report continued that the soft data suggests tariffs already weigh on consumer sentiment, as reflected in the Consumer Confidence Index miss (98 vs. 103 expected). Meanwhile, short-term inflation expectations remain elevated across consumer surveys.

The analyst states, “While it’s too early to confirm a stagflationary trajectory, the market’s reaction to recent developments signals growing unease”.

The analyst further explains that the US tariff has further dampened sentiment and expectations of tougher actions against China, and investors are reducing risk exposure amid heightened uncertainty. Limited marginal buyers could be seen for risk assets in this environment, increasing the likelihood of further downside as crowded trades unwind.

“BTC continues to trade in line with risk assets, and ETF outflows confirm a lack of conviction. In volatile markets, crypto remains the first asset to be liquidated as traders rush to reduce exposure,” says QCP’s Capital analyst.

Bitcoin Price Forecast: Will BTC correct towards $73,000 or recover?

Bitcoin price broke out of its prolonged consolidation phase, slipping below the $94,000 support level and closing at $91,552 after a 4.89% decline on Monday. BTC continued its correction by 8.22% in the next two days, reaching a low of $82,256 on Wednesday. At the time of writing on Thursday, it recovers slightly, trading at around $86,300.

If BTC continues its correction, it could extend the decline to test its next support level at $73,000.

The daily chart’s Relative Strength Index (RSI) indicator reads 30 after reaching oversold conditions and points upwards, indicating significant selling pressure but technically may be due for a potential reversal or bounce. However, traders should be cautious as the RSI may remain below oversold levels and continue correcting.

BTC/USDT daily chart

However, if BTC recovers, it could extend the recovery to retest the $100,000 psychological level.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.