Scalping is a trading strategy that involves opening and closing trade orders in a short period of time. Scalping is different from other types of intraday trading strategies about holding time and market analysis.

1. What is scalping trading?

First of all, you need to understand that Scalping trading is one of many trading strategies that are usually used in financial markets such as Crypto or Stock… With the same way of executing transactions (buying/selling), Scalping trading focuses on large numbers of orders, small price changes of assets, and short holding times of assets… The traders who choose Scalping trading will try to buy low and sell high or buy high and sell higher… in a short time.

With the name “scalp”, orders follow in this strategy often have the following main characteristics:

Firstly, the asset's holding time is extremely brief.. It can be a few seconds to a few minutes and in some cases up to a few hours. However, we usually close all positions before the end of the general market session or the trading day.

Second, because the holding time is short so all traders tend to make more orders during that time. Depending on their ability, traders can make from several hundred to thousands of orders in 1 day with this strategy.

Third, with the above two characteristics, traders in this strategy often make profits based on small changes in price of assets. Accumulating profits from many of the above transactions can make a large profit.

Fourth, the time frame chosen is often a short time frame, for example 1 second, 1 minute or 5 minutes…

Fifth, many traders often use trading bots to carry out this scalping trading campaign. Because the number of transactions in a day is too large, it will be difficult for a trader to do it manually.

Sixth, traders will usually use the same amount of money for all orders of scalping trading strategy.

To help you better understand the scalping trading strategy, let's look at the example below. A trader sees signals of a short-term uptrend for Bitcoin (BTC). However, instead of buying and holding for a long time, he/she will make multiple orders at the same time in a short period of time ,as follows:

Order 1: Open BTC buy order at $62,443 and place a sell order at $62,495.

Order 2: Open BTC buy order at $62,476 and place a sell order at $62,539.

…

We will place the orders closely together, adjusting the price and transaction amount accordingly. When the price reaches the expected points, the order will automatically close to take profit or cut loss.

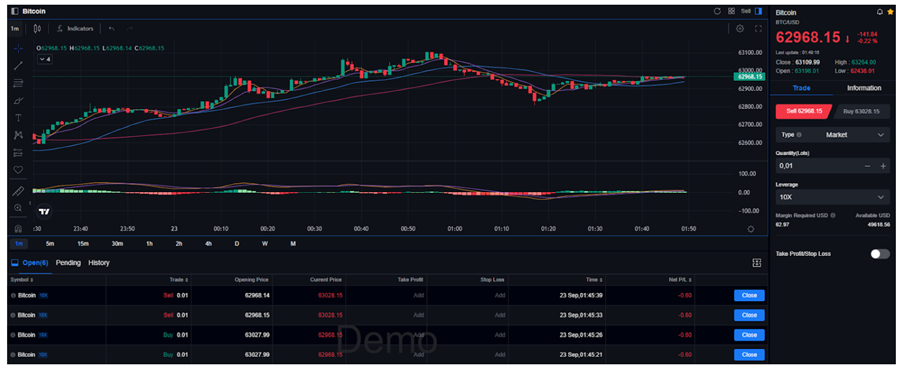

Trade BTC on Mitrade 1 minute frame.

2. How does scalping trading work?

Because of its nature, scalping can only be successful in markets that meet specific requirements. The first condition is the liquidity of an asset. The liquidity is higher, the spreads are tighter.

High liquid assets ensure scalping trading strategies efficiently because the spreads are easily covered by a small price change. Scalping trading requires relatively stable volatility because sudden price changes can be very risky for traders. That is the reason why coins, especially recently launched meme coins like CATI, DOGS, HSMTR… will take many risks to scalping trading because their price changes are too large.

As previously discussed, the scalping trading strategy is essentially the same as a traditional buying and selling activity. The difference here is that these transactions take place in a short time with a large quantity. Scalp traders would either go long by buying low and selling high, or go short by selling high and buying low.

To help you understand the process of scalping, here are the basic steps.

Open an account and choose the asset type. You can use the Mitrade platform and choose scalping trading for many types of assets such as stocks, oil, cryptocurrencies or indices... For example, you choose the asset here as Bitcoin with the BTC/USD pair. In addition, make sure you successfully deposit money on the platform to be able to start trading.

On the BTC chart, you choose a short time frame. Currently, Mitrade supports some short time frames such as 1 minute, 5 minutes or 15 minutes...

BTC chart time frame

Based on your market overview, you can choose to buy/sell orders with the volume that meets your needs. Furthermore, Mitrade provides users with a leverage ratio of up to 10x to increase their positions.

You can make buy/sell orders with this trading pair. This trading pair will display the number of orders created.

Bitcoin orders

Instead of buying and holding for a long time (HODL), you can close orders to take profit/stop loss. You can make an unlimited number of such orders.

In case you want the order to be executed automatically, you can set the take profit/stop loss point for each order as shown in the image above. When the price reaches those points, the order will be automatically executed without your intervention.

P/s: Due to the large volume of orders that need to be executed, the use of computer programs (bot trade) can save costs and time. This guarantees speed when it comes to entering and exiting positions and reduces the risk of trading based on emotions and biases.

3. What are scalping trading strategies?

Based on the characteristics of Scalping trading, there are 3 main strategies that are frequently used by traders. Specifically as follows:

High volume trading: Because they focus on small price changes for each asset, traders often buy in large quantities to increase profits. A trader can open a position for thousands of shares and wait for a small price change to occur. This change can be just a few cents. With this strategy, the asset needs to have enough liquidity, the volatility level must not be too large and sudden so that all positions can be opened/closed effectively.

Breakout trading: Traders will look for reasonable entry points, usually the starting point of a trend where they believe the price will go up/down. Then they will open positions and wait for an exit signal from the market.

Trading the spread: is a strategy where traders aim to profit by simultaneously buying and selling an asset.

Marking making: With this strategy, Traders want to take advantage of the bid/ask spread by placing a bid and ask price for an asset at the same time .

4. What are the advantages and disadvantages of scalping?

Similar to other strategies of trading, scalping also has some limitations.

Advantages

Lower risk: Because of the short holding time and acceptance of a narrow price range, traders can control the risk effectively compared to other strategies.

Higher potential profit: Although opening/closing orders is only based on narrow price changes, making many different orders and using leverage can give traders higher potential profit because it does not depend on large price changes in the market.

Many trading opportunities: Opening multiple orders allows you to follow and make the most of opportunities in the market.

No need for in-depth knowledge: With scalping, you don’t even need to have knowledge about the asset. This is primarily due to the brief duration of the orders and their total reliance on technical analysis settings.

Disadvantages

Time-consuming: Creating numerous orders simultaneously is a task that not all traders can handle. In addition to time, it requires a high level of concentration and patience from the trader to repeat the same things over and over again.

High spreads: Scalping entails making a large number of trades.. This means that eventually, the sum of those trades can cause the spread to increase to a really large amount of money.

Liquidation risk: You can use leverage to increase the profits on your scalping orders. However, that also means you will get higher liquidation risks.

5. What is risk management in scalping?

There is no fixed formula for risk management in scalping. Every individual possesses a unique level of risk tolerance However, to minimize losses when using this scalping trading strategy, consider the following general principles:

First, absolutely adhere to the strategy: If you have accepted to use the scalping trading strategy, adhere to it absolutely. For example, if you decide to spend money to buy 0.01 lot of BTC and use 10x leverage, apply this formula synchronously to the following orders.

Second, you should set take-profit and stop-loss marks: This ensures that you can proactively control your own profits and losses. This prevents you from being too FOMO and skipping the take profit stage.

Third, use technical indicators: Traders can use technical indicators such as MACD, RSI, SMA, etc. to predict the next price movement, thereby helping to limit losses in trading.

6. Conclusion

Scalping trading can bring traders large profits based on hundreds or thousands of small trades. Short market exposure time and small movements are the main components that make this strategy popular among many types of traders.

Therefore, traders can use scalping as a main strategy or as an add-on to other types of trading, depending on their investment preferences. Regardless of the choice, traders must maintain a strict exit strategy.

7. FAQ

#What technical indicators should be used for scalping trading?

Some popular technical indicators for scalping trading are MACD, RSI, SMA, MA or Parabolic SAR…

#Is scalping trading legal?

Both retail and institutional investors use scaling as a legal trading strategy. The act of buying and selling large transactions with small price fluctuations is completely legal according to financial regulations. However, it always has certain risks and investors need to learn about it carefully before starting.

#Should you only use a scalping trading strategy?

This depends on each person's risk appetite. You can use many different trading strategies. However, at one time you should only follow one strategy.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.