What Is Portfolio Diversification? How to Create a Diversified Portfolio

In the world of investing, putting all your eggs in one basket can be a risky strategy. Portfolio diversification is a fundamental concept that can help you manage risk and enhance the potential for long-term returns. But what exactly does it mean to diversify your portfolio, and how to create a diversified portfolio?

This article will break down the basics of portfolio diversification, explore its benefits, and provide practical steps to help you build a well-balanced and diversified investment portfolio that aligns with your financial goals.

1. What is portfolio diversification? Why is it important?

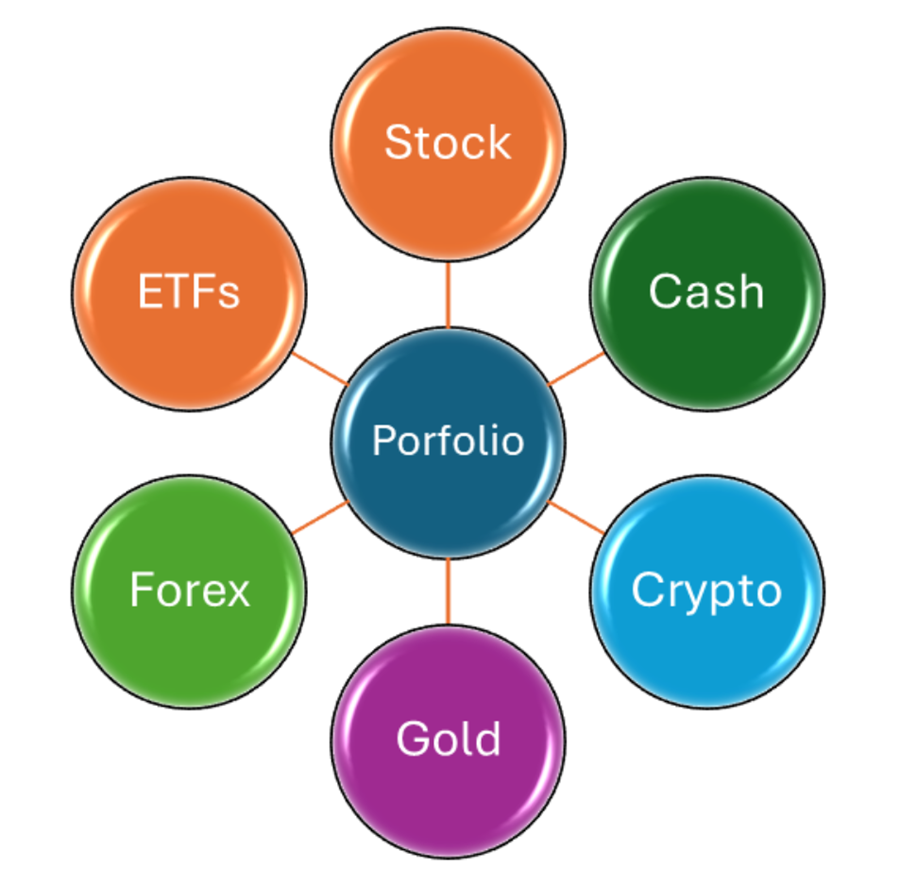

Portfolio diversification is an investment strategy that involves spreading your investments across a variety of asset classes, industries, or geographic regions to reduce the overall risk of your portfolio. Instead of concentrating all your money in a single type of asset or sector, diversification means investing in a mix of assets that are likely to perform differently under the same market conditions. For example, a diversified portfolio might include stocks, cryptocurrencies, forex, and commodities, as well as investments in both domestic and international markets.

Portfolio diversification is crucial for several reasons, primarily related to risk management, return optimization, and psychological comfort. Here’s why it matters:

Risk reduction: Each investment carries unique risks (e.g., market risk, industry-specific risk). Diversification helps reduce exposure to these risks by not being overly dependent on any single investment.

Enhanced returns: Different assets perform well under different economic conditions. By diversifying, an investor can capture gains from various sources, potentially leading to better overall returns. Additionally, a well-diversified portfolio can offer a better balance between risk and return, achieving higher returns for a given level of risk.

Protection against market uncertainty or volatility: By spreading investments across different assets (e.g., stocks, cryptocurrencies, forex, commodities), the risk of a significant loss due to poor performance of a single investment is reduced. Moreover, different sectors and asset classes react differently to economic changes. Diversification allows a portfolio to be more resilient across different phases of economic cycles.

Reduces Anxiety: A diversified portfolio can ease the anxiety of market fluctuations. Even if one part of the portfolio underperforms, the overall impact is cushioned, offering peace of mind.

Maximizing opportunities through diversification means investing globally to benefit from various economies and across markets or sectors to reduce exposure to any single market or industry's risks. This approach spreads risk and enhances potential growth.

Portfolio diversification is a fundamental strategy in investing that helps manage risk, stabilize returns, and provide psychological benefits by reducing the likelihood of large losses and offering exposure to various growth opportunities.

2. Principles of portfolio diversification

Effective portfolio diversification is crucial for managing investment risk and achieving long-term financial goals. By understanding and applying the core principles of diversification, investors can create a balanced portfolio that minimizes exposure to any single investment or market segment.

Here’s a look at the key principles that guide successful diversification strategies and help build a robust investment portfolio:

Asset allocation: Distribute capital across different asset classes, such as forex, stocks, commodities, and savings. Each asset class has unique risk and return characteristics, and their performance often varies under different market conditions. For example, an investor has $100,000. Instead of putting all of it into tech stocks, they allocate $50,000 to a diversified stock portfolio, $30,000 to real estate investment trusts (REITs), and $20,000 to government bonds. This mix reduces the impact if the stock market underperforms, as bonds and real estate may perform differently in economic downturns.

Sector diversification: Invest in various industries or sectors (e.g., technology, healthcare, finance) to avoid overexposure to any single industry’s fluctuations.

Geographic diversification: Include investments from different geographic regions (domestic and international) to reduce the impact of regional economic downturns or political instability.

Investment types: Diversify within asset classes by including various types of investments, such as growth stocks, value stocks, and income-generating bonds, to balance risk and return.

Time horizon: Consider different time horizons and invest in assets that align with your short-term, medium-term, and long-term financial goals.

Risk tolerance: Tailor diversification strategies to your risk tolerance level, ensuring that the mix of assets aligns with your comfort level regarding market volatility and potential losses.

Regular rebalancing: Periodically review and adjust your portfolio to maintain your desired level of diversification, as market movements can cause shifts in asset allocation over time.

Correlation: Select assets that have low or negative correlations with each other. This means that when one asset class performs poorly, others may perform better, reducing overall portfolio risk. For example, An investor holds 30 different tech stocks. While this seems diversified, the companies all operate in the same sector and could be equally affected by industry-specific risks like changes in tech regulations. In this case, the portfolio is not truly diversified because it’s overly concentrated in one sector.

By applying these principles, you build a well-structured portfolio that can withstand market fluctuations, akin to a diversified team, a strategically crafted investment strategy, or a finely calibrated financial model.

3. How to create a diversified portfolio

Creating a diversified portfolio is essential for managing investment risk and achieving steady growth. By strategically spreading your investments across various asset classes, sectors, and geographies, you can protect your portfolio from significant losses and enhance your potential returns. Here’s a step-by-step guide to building a well-diversified investment portfolio tailored to your financial goals and risk tolerance.

#Step 01. Assess your capital, financial goals, and risk tolerance

Assess your available capital and investment amounts: Calculate how much money you have available to invest. This includes savings that you can afford to invest without affecting your daily expenses or emergency funds. If you have a small amount of capital, some investment options may be more accessible than others.

Define Objectives: Set clear objectives by defining short-term, medium-term, or long-term financial goals to determine the appropriate time horizon and types of investment assets.

Evaluate Risk Tolerance: Assess your risk tolerance by determining if you prefer higher returns with more volatility, balanced growth with moderate fluctuations, or stability with minimal risk and lower returns.

#Step 2. Determine asset allocation

Spreading your investments across various asset classes, such as stocks, commonities, savings, or forex. This reduces the impact of poor performance in any one category.

Note: Depending on the type of investment, the criteria may vary. For example, if a trader uses CFD trading, they can start with low capital while employing high leverage, but this will result in higher risk.

#Step 3. Diversify within asset classes

Further diversify within each asset class by allocating investments across various sectors, industries, and geographic regions. For instance, when investing in stocks, include a mix of large-cap, mid-cap, and small-cap companies from different industries (technology, healthcare, finance, etc.)and countries (the US, Australia, Hongkong, etc.).

#Step 4. Regularly rebalance your portfolio

Review Performance: Assess your investments' performance regularly (weekly, monthly or quarterly depending on your investment time horizon) to ensure they align with your goals. If certain assets have significantly increased or decreased in value, adjust your allocations accordingly. For instance, if stocks have performed exceptionally well, consider selling some stocks and purchasing more bonds to maintain your desired asset allocation.

Rebalance: To maintain your target allocation, sell assets that have exceeded their intended proportion and buy those that are underrepresented. For example, if your target allocation is 60% stocks and 40% bonds, and stocks have grown to 70%, you should sell some stocks and invest in bonds to return to the 60/40 ratio.

#Step 5. Stay informed and adjust as needed

Monitor market trends: Keep abreast of economic news, including indicators, interest rates, and market developments to stay informed. Track the performance of different assets and sectors regularly. For example, if a new technology trend emerges, you might want to adjust your stock holdings to capitalize on growth opportunities in that sector.

Adapt strategy: Modify your portfolio in response to significant life changes such as a new job, or retirement. Additionally, adjust your strategy based on evolving market conditions and economic forecasts. For instance, as you approach retirement, consider reallocating more of your assets into safer investments like bonds and cash to reduce risk.

#Step 6. Seek professional advice

Work with a financial advisor to receive personalized advice that aligns your portfolio with your specific needs, goals, and risk tolerance. By leveraging their expert insights and strategies, you can better tailor your investments to your financial situation.

By following these detailed steps, you can create a diversified portfolio that balances risk and reward, helping you achieve your financial goals with confidence.

4. Limitations of portfolio diversification

While portfolio diversification is a powerful strategy for managing risk and achieving balanced returns, it does come with its own set of limitations.

Understanding these limitations is crucial for optimizing your investment strategy and ensuring that diversification aligns with your financial goals. Here’s a look at some key constraints to be aware of when diversifying your portfolio.

Incomplete risk elimination: While diversification can reduce unsystematic risk, it cannot eliminate systematic risk—such as market-wide downturns that affect all investments.

Diminishing returns: Over-diversification may lead to diminished returns, as the potential gains from high-performing investments can be diluted by underperforming ones.

Complexity in management: Managing a highly diversified portfolio can become complex and time-consuming, requiring constant monitoring and rebalancing.

Higher costs: Diversification through mutual funds or ETFs can incur higher fees, including management fees, trading commissions, and other expenses.

Potential for overlap: Investments in multiple funds or vehicles may lead to unintended overlap in holdings, reducing the effectiveness of diversification.

Limited upside in bull markets: In strong bull markets, a highly diversified portfolio might not capture the full upside potential of leading asset classes or sectors.

Market correlation risks: During periods of economic crisis or extreme market events, even diversified assets may become highly correlated, reducing the benefits of diversification.

Misalignment with goals: A diversified portfolio might not always align with specific investment goals or timelines, potentially affecting performance relative to those objectives.

Recognizing these limitations can help investors make more informed decisions and balance the benefits of diversification with the realities of its constraints.

5. Summary

In conclusion, portfolio diversification is an essential strategy for mitigating risk and enhancing potential returns by allocating investments across a variety of asset classes, sectors, and geographic regions.

A well-diversified portfolio can help cushion against market volatility, ensuring that poor performance in one area is offset by gains in another. This approach not only provides a more stable investment experience but also aligns with your financial goals and risk tolerance. By thoughtfully diversifying your portfolio, you position yourself for more consistent long-term growth and greater financial security.

6. FAQs

#How often should I rebalance my portfolio?

Regularly review your portfolio, typically every six to twelve months, to ensure it aligns with your desired asset allocation. Rebalance if your investments have shifted significantly from your target allocation due to market movements.

#Can diversification completely eliminate risk?

No, diversification cannot eliminate all risk, particularly systematic risk (market-wide risk). It reduces unsystematic risk (specific to individual investments), but overall market declines or economic downturns can still affect a diversified portfolio.

#How do I know if my portfolio is properly diversified?

Assess whether your investments are spread across different asset classes, sectors, and regions. Evaluate if your portfolio aligns with your risk tolerance and investment goals. Financial advisors or portfolio analysis tools can help evaluate diversification and suggest adjustments.

#How does international diversification benefit my portfolio?

Investing in international markets can reduce your reliance on domestic economic conditions and expose you to growth opportunities in other regions. It helps spread risk across different economies and currencies.

#What are some common mistakes in portfolio diversification?

Common mistakes include excessive concentration in one asset class or sector, failing to rebalance regularly, investing in too many similar funds, and not considering global diversification. Regularly reviewing and adjusting your portfolio can help avoid these pitfalls.

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.