U.S. Big Banks Earnings Q1 2025: Profits Amidst Worries, A Tale of Trump's Mixed Influence?

Against the backdrop of President Donald Trump’s "deregulation" agenda, Wall Street’s major banks have yet to stage a significant rally in early 2025. However, buoyed by high interest rates and policy uncertainty under the Trump administration, which has fuelled increased stock trading activity, the Q1 earnings reports from the six largest U.S. banks exceeded expectations. Still, caution about the outlook remains.

As usual, several large U.S. banks were among the first to release their quarterly results, officially launching the Q1 2025 earnings season.

Prior to the announcement, JPMorgan Chase issued a warning that market volatility was weighing on investment banking, loan demand remained sluggish, and it had revised down its revenue growth forecast for the sector in 2025. UBS analysts also tempered investor expectations, suggesting that while results may reflect recent strength, the focus should be on future performance amid ongoing macroeconomic uncertainty.

Nevertheless, many analysts remained optimistic about the equity trading performance of large banks. Evercore ISI analysts remarked that while Q1 might not bring major surprises, strong trading activity represented the best chance for outperformance.

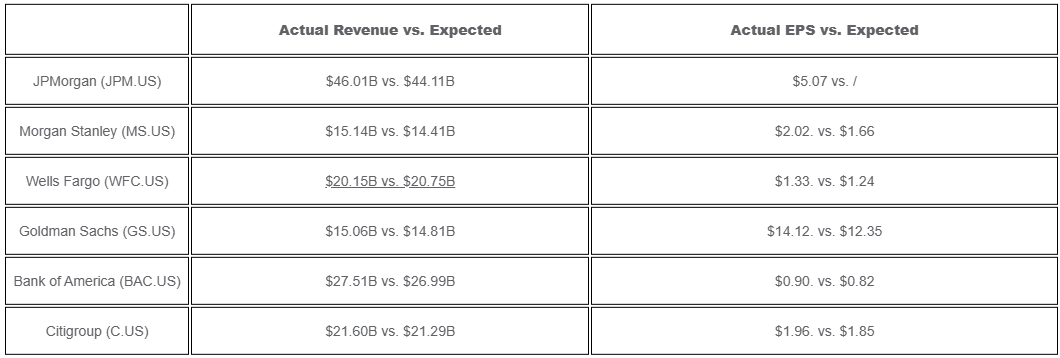

The results from the six largest U.S. banks ultimately reflected this view. Driven by solid net interest income and surging equity trading revenues, JPMorgan Chase, Morgan Stanley, Goldman Sachs, Bank of America, and Citigroup all reported revenue and profits above LSEG’s consensus estimates. Wells Fargo was the only exception, with its revenue slightly below expectations.

Source: CNBC, LSEG, TradingKey

The businesses underpinning these banks' better-than-expected Q1 results are closely linked to Trump's policy agenda. Despite strong earnings reports, executives from these companies cautioned that the surrounding Trump policies continue to pose risks to future business performance.

Highlight 1: Trump Uncertainty Boosts Equity Trading to Record Highs

JPMorgan Chase, the largest U.S. bank, reported a 21% year-over-year increase in trading revenue for Q1, with equity trading surging 48% to a record high of $3.8 billion. Goldman Sachs and Morgan Stanley also delivered record results in equity trading, posting gains of 27% and 4.1%, respectively. Meanwhile, Citigroup and Bank of America reported increases of 23% and 17% in their equity trading divisions.

In total, the six largest U.S. banks recorded a 33% year-over-year increase in equity trading revenue for Q1, reaching $16.3 billion, exceeding levels seen during the peaks of both the 2020 pandemic and the 2008 global financial crisis.

Goldman Sachs attributed the strong performance in March to investors hedging against uncertainties stemming from various trade policies, which kept client activity elevated.

Analysts noted that as long as this volatility persists—and there is no reason to believe it will stop soon—equity trading desks are likely to remain highly active.

Highlight 2: Net Interest Income Growth Amid High Rates; Consumers Remain Resilient for Now

Although the Fed has entered a rate-cutting cycle—having lowered rates three times since September 2024—the risk of inflation rebounding due to President Trump's tariff policies is making further cuts more difficult. The benchmark interest rate remains relatively high.

With policy rates still elevated, the costs of borrowing have proven more resilient than a decline in deposit rates, which tend to fall more quickly. This dynamic has benefited traditional U.S. banks focused on lending. Bank of America's net interest income (NII) rose 3% to 14.4 billion, while JPMorgan’s NII increased to 23.4 billion.

Before the announcement of Trump's tariff measures, Bank of America projected that its NII growth would reach 6%-7% in 2025, setting new records.

Despite growing concerns over a potential economic slowdown, consumer activity in Q1 appeared relatively strong. Bank of America reported a 4% year-over-year increase in credit and debit card spending, indicating consumers remain resilient, continuing to spend while maintaining healthy credit profiles.

However, recent robust retail sales and consumer confidence data may present a misleadingly optimistic picture. Analysts caution that the uptick in spending could reflect consumers "front-running" the tariffs by making preemptive purchases. In reality, underlying financial conditions and sentiment may already be weakening.

Future Outlook: Uncertainty Reigns

While Q1 results were solid, senior executives at Wall Street firms are increasingly concerned about future growth—particularly in investment banking.

Goldman Sachs noted that the current volatile environment has contributed to weaker-than-expected investment banking activity so far this year. The bank reported that its clients, including corporate CEOs and institutional investors, remain cautious due to both near-term and long-term uncertainties, limiting their ability to make critical strategic decisions.

Wells Fargo’s CEO also warned that U.S. trade policy poses significant risks, with volatility and uncertainty likely to persist. The bank has prepared for a potential slowdown in the economic environment in 2025.

JPMorgan Chase echoed similar concerns, stating that the economy is experiencing considerable turbulence. While tax reforms and deregulation could have positive effects, risks such as tariffs, trade wars, persistent inflation, high fiscal deficits, elevated asset prices, and ongoing market volatility may weigh heavily on future growth.

Trump’s "Deregulation Era": Policies Unfulfilled, Bank Stock Rally Delayed

Markets initially expected U.S. banks to be major beneficiaries of Donald Trump’s second term, given his historical preference for relaxed financial regulations.

So far, however, Trump’s policy focus has leaned heavily toward tariffs, with no significant deregulatory measures introduced. In fact, in mid-March, Trump nominated Federal Reserve Governor Michelle Bowman to serve as the Fed’s Vice Chair for Supervision.

Bowman’s regulatory stance aligns with the Trump administration’s deregulatory approach. She has voiced opposition to proposals such as higher capital requirements under Basel III. Goldman Sachs CEO David Solomon remarked that the entire banking industry would welcome Bowman’s appointment.

In Q1, the Financial Select Sector SPDR Fund (XLF) rose 3.44%, outperforming the S&P 500’s 4.59% decline. However, it lagged behind the Energy Select Sector SPDR Fund (XLE), which gained 9.95% and the Health Care Select Sector SPDR Fund (XLV).

The Q1 stock price changes for JPMorgan Chase, Morgan Stanley, Goldman Sachs, Bank of America, Citigroup, and Wells Fargo in Q1 were 2.86%, -6.58%, -4.12%, -4.45%, 1.55%, and 2.71%, respectively.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.