SoundHound AI (NASDAQ: SOUN) and Twilio (NYSE: TWLO) have enjoyed contrasting fortunes on the stock market in 2024, and that's not surprising considering the financial performance of both companies, which can be attributed to the state of the end markets that they are serving.

While SoundHound AI stock has delivered impressive gains of 120% so far this year, despite bouts of significant volatility, Twilio is down 11%. Known for providing voice artificial intelligence (AI) solutions to customers in multiple industries, SoundHound stock popped significantly earlier this year after it emerged that Nvidia has a small investment in it.

Twilio, on the other hand, has struggled to gain traction because of its slow growth. However, it is increasingly focused on providing more AI solutions to customers in the cloud-communications space and recently made a move thanks to which it is set to become a competitor of SoundHound AI.

So, if you have to choose from one of these two AI stocks for your portfolio, which one should you be buying right now? Let's find out.

The case for SoundHound AI

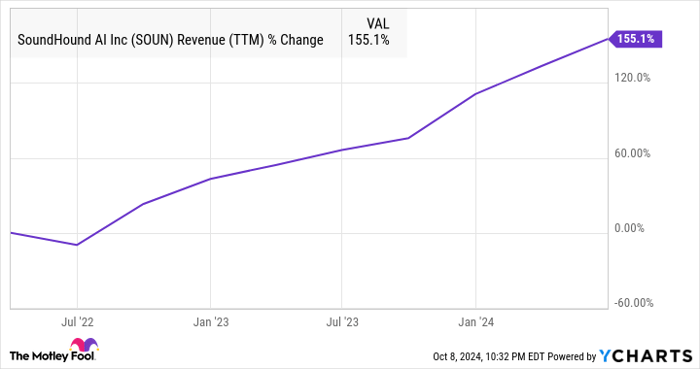

SoundHound AI is a voice AI solutions specialist, and the good part is that the company's offerings have been gaining traction among customers. This is evident from the terrific growth that SoundHound has been delivering.

SOUN Revenue (TTM) data by YCharts.

The company's revenue in the second quarter of 2024 was up an impressive 54% from the same period last year to $13.5 million. Of course, SoundHound is a very small company right now, but its guidance for the full year and for 2025 tells us that it is pulling the right strings to make the most of a huge end-market opportunity.

SoundHound is forecasting at least $80 million in revenue this year, which would be a huge improvement over its 2023 revenue of $46 million. Even better, SoundHound believes that it could cross $150 million in revenue in 2025, indicating that its revenue growth is set to accelerate next year. One reason why that would happen is because of SoundHound's recent acquisition of Amelia, an enterprise AI software provider which the former believes will help it improve its standing in the customer-service market.

SoundHound has paid $80 million for Amelia and expects the latter to contribute $45 million in annual recurring AI software revenue apart from other revenue streams such as agent fees and professional services. SoundHound is building a solid base of customers that includes Stellantis, electric vehicle (EV) companies, and quick-service restaurants, and the acquisition of Amelia should allow it to further expand its reach in a market that it believes is worth $140 billion.

Also, with a cumulative subscriptions and bookings backlog of $723 million (which nearly doubled on a year-over-year basis in the previous quarter), SoundHound AI's potential-revenue pipeline seems strong enough to help it sustain its impressive growth beyond next year. All this indicates that SoundHound could continue to remain a top AI stock in the long run.

The case for Twilio

Twilio operates in the communications platform-as-a-service (CPaaS) market, giving customers cloud-based platforms through which they can use its application-programming interfaces (APIs) to get in touch with their customers through various channels such as voice, video, text, email, and others. In simpler words, Twilio's APIs allow its customers to move from physical contact centers to cloud-based contact centers.

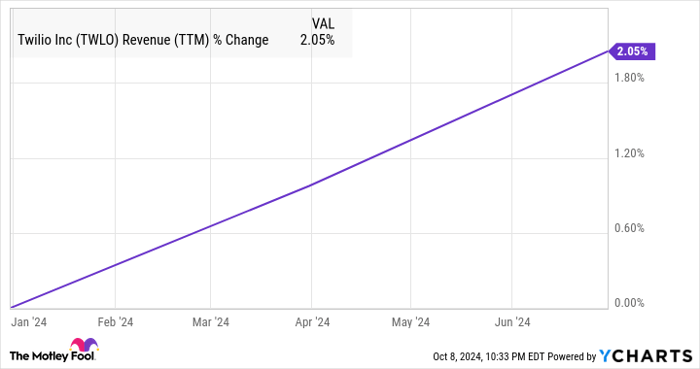

It is worth noting that the company was enjoying tremendous growth a few years ago thanks to the rapid transition from physical to cloud-contact centers. In 2019, the company's top-line growth stood at 74%, followed by 55% in 2025. The next two years were also good, with revenue growing 61% in 2021 and 34% in 2022, though it is worth noting that it acquired a total of eight companies between 2018 and 2021.

However, as the chart below shows, Twilio's growth hasn't been solid enough.

TWLO Revenue (TTM) data by YCharts.

The company is now looking to integrate AI solutions into its offerings so that it can make a bigger dent in the customer-service space. It has launched Customer AI, a technology that uses real-time data coupled with AI to help businesses improve their engagement with customers to create better experiences and stronger relationships so that they can generate more returns. And now, Twilio has announced that it will be integrating OpenAI's Realtime API into its platform as well to help customers build conversational AI assistants.

With an existing base of 316,000 active-customer accounts, Twilio is sitting on a solid cross-selling opportunity that it could capitalize on by launching AI-focused products. The good part is that Twilio is witnessing an improvement in demand for its AI offerings, as management pointed out on its August earnings-conference call:

In the quarter, we started to see success with our newer higher-margin software products. These are products that leverage AI such as Verify and Voice Intelligence, as well as platform innovations that natively embed AI and machine learning, such as traffic optimization engine and engagement suite to drive greater deliverability and better customer engagement.

Twilio adds that its AI products are "rapidly gaining adoption and can become meaningful growth drivers over time." The company's top line is projected to jump by 5% in 2024 to $4.37 billion followed by a 7% increase in 2025, and there is a possibility that it could enjoy a stronger growth trajectory in the long run as its AI-centric efforts start bearing fruit.

The verdict

It is evident that SoundHound AI is currently growing at a tremendously faster pace than Twilio, while the latter is trying to revive its growth with the help of AI. SoundHound's advantage is that it is a smaller company operating in a huge market, which is why it is growing at a stunning pace. However, buying SoundHound AI means that investors will have to pay a rich price-to-sales ratio of 23.

Twilio is significantly cheaper as it is trading at less than 3 times sales, but its anemic growth explains why it trades at such a multiple. So, choosing one of these two AI stocks boils down to an investor's appetite for risk. Conservative investors would be tempted to buy Twilio considering that it is cheap and could witness an improvement in its growth thanks to AI.

However, those with a higher-risk appetite could consider buying SoundHound as it seems well positioned to sustain its terrific growth in the future with the help of AI.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 7, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Twilio. The Motley Fool recommends Stellantis. The Motley Fool has a disclosure policy.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.