After a two-session surge driven by the emergence of the chipmaker's artificial intelligence (AI) business in the fiscal fourth-quarter earnings report it delivered on Thursday, Broadcom (NASDAQ: AVGO) was pulling back Tuesday morning alongside the broader semiconductor sector.

While there wasn't any company-specific news about Broadcom, its sell-off was indicative of a larger trend. As of 11:59 a.m. ET, the stock was down 4.4%.

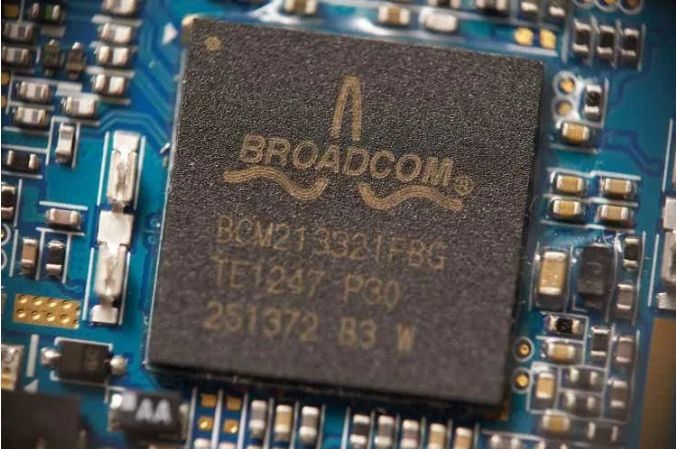

Image source: Getty Images.

Did Broadcom's rally go too far?

Investors seem to be debating the fair value of this stock after its post-earnings jump last week. Broadcom's results were mostly in line with analysts' consensus estimates, as was its guidance, but investors were particularly impressed with its AI-related growth. The company said its AI revenue jumped 220% in fiscal 2024 (which ended Nov. 3), and management predicted that AI revenue would grow by 65% in fiscal 2025's first quarter. It based that growth forecast on the high demand for its Jericho 3 Ethernet switches, which are designed for AI networks.

Despite investors' enthusiasm for Broadcom's AI business, a broader sense of skepticism seemed to pervade the market Tuesday. Its chip stock peers Nvidia, Arm, and Marvell were all down as well.

There wasn't a clear trigger for the sell-off, but investors seem to be worrying again that demand for AI products may not be as strong as current stock prices imply. Nvidia stock is now down four straight sessions in a row amid signs that growth in AI spending is likely to slow next year.

What it means for Broadcom

High expectations are now baked into Broadcom's stock price. It trades at a price-to-earnings ratio of nearly 50 based on adjusted earnings, and its growth rate will moderate as it laps its acquisition of VMware, which closed in November 2023.

Still, with AI-related tailwinds building for Broadcom, the stock looks fairly valued. It should be a winner over the long term.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.