Nasdaq 100 Rebalancing: Apple and Nvidia Poised for Gains with Increased Weight?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Insights – Following the Nasdaq 100 rebalancing, Apple and Nvidia are expected to attract additional fund inflows.

On December 23, the Nasdaq 100 Index underwent a rebalancing adjustment.

The weightings of Tesla, Meta, and Broadcom in the index were reduced, while Apple, Nvidia, Microsoft, Amazon, and Alphabet saw their weightings increase.

Key changes include:

Tesla (TSLA): Reduced from 4.9% to 3.9%

Broadcom (AVGO): Reduced from 6.3% to 4.4%

Meta (META): Reduced from 4.9% to 3.3%

Apple (AAPL): Increased from 9.2% to 9.8%

Nvidia (NVDA): Increased from 7.9% to 8.4%

Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOG):Increases of less than 0.5%

The weightings of Nasdaq 100 components are typically determined by market capitalization. However, when the combined weighting of constituents exceeding 4.5% surpasses or equals 48%, the index triggers a rebalancing.

This rebalancing was driven by Broadcom’s significant stock price surge, which pushed its weighting above the 4.5% threshold. Year-to-date, Broadcom has risen 116%, Meta is up 74%, and Tesla has gained 73%.

Since most ETFs track the Nasdaq 100 Index, Apple, Nvidia, Microsoft, Amazon, and Alphabet are likely to attract increased fund inflows, while Tesla, Meta, and Broadcom could face outflows.

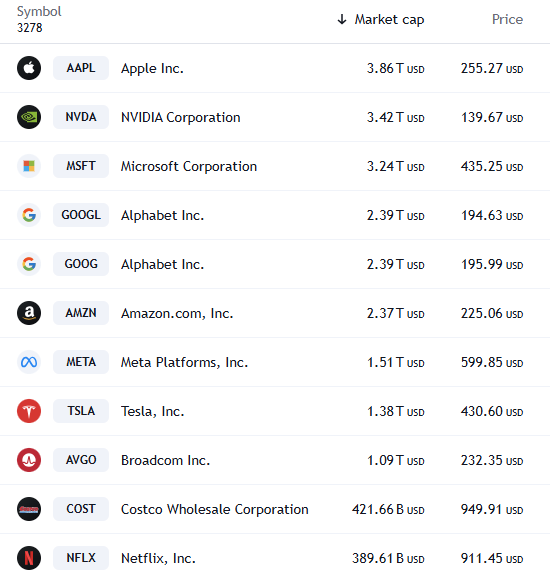

As of Dec 23, the top 10 stocks by market capitalization in the Nasdaq 100 Index are: Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, Tesla, Broadcom, Costco, and Netflix.

Source: TradingView; Top 10 Stocks by Market Cap in the Nasdaq 100 Index

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.