Thanksgiving Week Stock Performance Shines, Particularly in Election Years: BofA

- Bitcoin Poised For ‘Boring’ 2025 Close – Here’s When BTC’s Real Test Will Come

- TradingKey 2025 Markets Recap & Outlook | Global Central Banks 2025 Recap and 2026 Outlook: Navigating Post-Easing Recovery and Diverging Paths

- Gold Price Hits New High: Has Bitcoin Fully Declined?

- Gold jumps above $4,440 as geopolitical flare, Fed cut bets mount

- Breaking: Gold rises to record high above $4,500 on safe-haven flows

- US Q3 GDP Released, Will US Stocks See a "Santa Claus Rally"?【The week ahead】

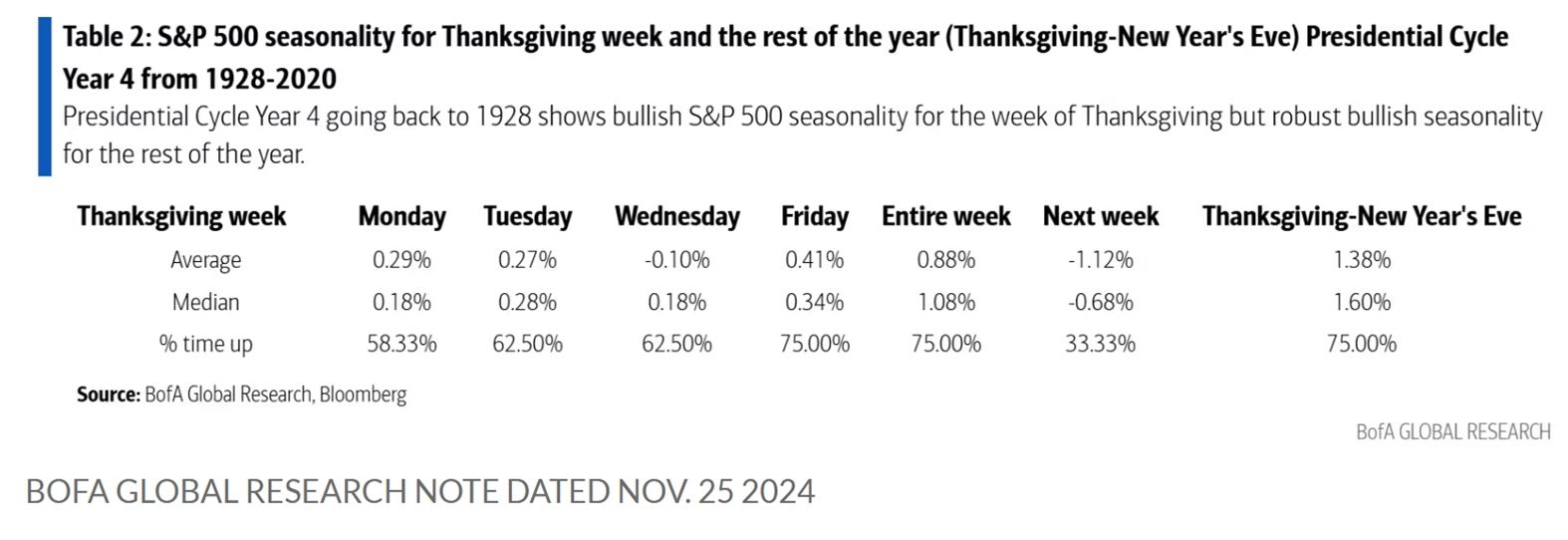

Insights - Bank of America strategist Stephen Suttmeier noted in a Monday report that Thanksgiving week has historically been strong for stock market. While the S&P 500 (SPX) often dips the following week.

Since 1928, the S&P 500 has risen during Thanksgiving week 60% of the time, with an average return of 0.28% and a median return of 0.46%. In presidential election years, the chances of gains rise to 75%, with an average return of 0.88% and a median return of 1.08%.

The report also pointed out that while the S&P 500 tends to show "some post-Thanksgiving digestion" with lower returns, strong positive returns from Thanksgiving to New Year's Eve in presidential election years suggest that investors should consider buying during the post-Thanksgiving dip in anticipation of a year-end rally.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.