Walmart Q3 Earnings Preview: Can Ad Revenue Maintain Strong Growth?

Insights – Will Walmart’s Q3 ad revenue continue its strong growth? Can Sam’s Club membership numbers hit new highs?

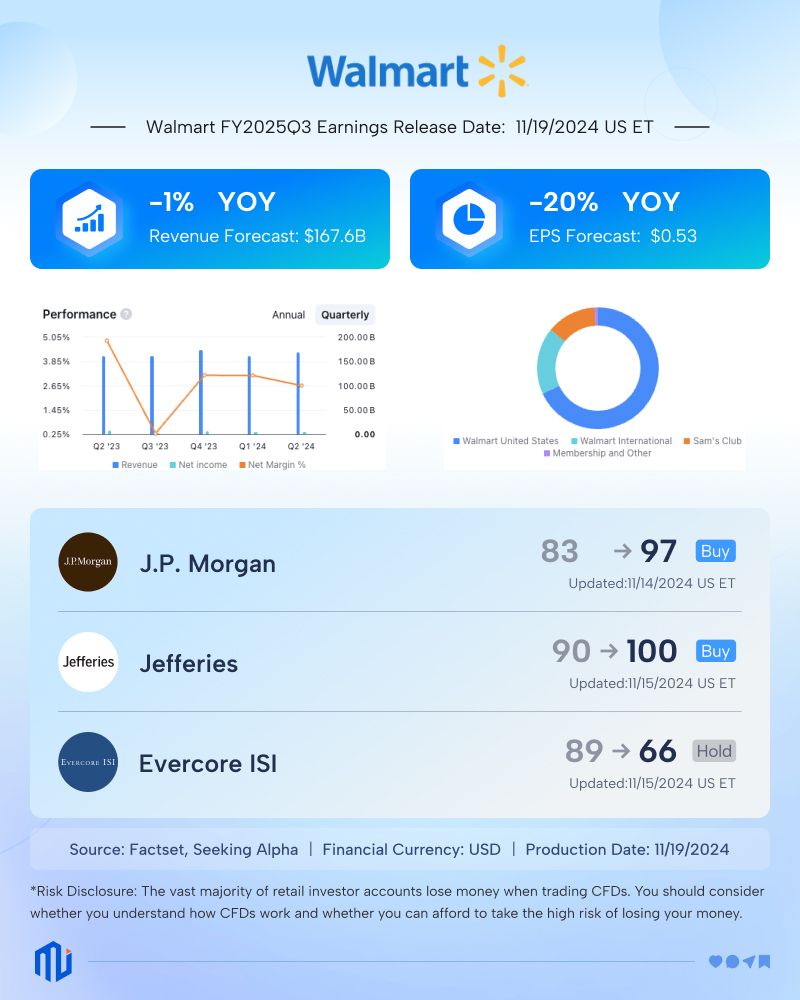

On Tuesday, November 19, before the U.S. market opens, Walmart (WMT.US) is set to release its FY2025 Q3 results (Q3 CY2024).

Analysts forecast Walmart’s Q3 net income to be $4.24 billion, significantly higher than the same period last year. Q3 revenue projected at $167.73 billion, up 4% from $160.8 billion in the same period last year.

In the previous quarter, Walmart’s revenue grew 4.8% year-over-year to $169.34 billion, surpassing the expected $168.46 billion. Adjusted operating income rose 7.2% to $790 million, with adjusted earnings per share (EPS) of $0.67, up 9.8% year-over-year, exceeding the forecast of $0.65.

Key Drivers: China Market, Sam’s Club, and Ad Revenue Growth

This quarter, Walmart’s sales growth in China will be a key focus. In Q2, Walmart China’s net sales reached $4.6 billion, up 17.7% year-over-year, with comparable sales growing 13.8% and e-commerce net sales up 23%. However, growth has slowed compared to a year ago.

Additionally, ad revenue and Sam’s Club performance are also under investor scrutiny. Bank of America has noted that ad revenue is a crucial part of Walmart’s business, with its high profit margins helping to boost overall company profits.

Last quarter, Walmart’s ad revenue grew 26%, driven by a 30% increase in Walmart Connect. In the U.S., ad sales from third-party sellers grew nearly 50%. Meanwhile, U.S. Sam’s Club sales rose 5.2%, and global membership for Sam’s Club hit new highs.

Jefferies Raises Price Target to $100

Analysts remain bullish on Walmart’s stock, with most giving a "Buy" rating. JPMorgan recently raised Walmart’s price target from $83 to $97, maintaining its "Buy" rating. Additionally, Jefferies increased its price target from $90 to $100.

However, some analysts have lowered their targets. Evercore ISI reduced its price target from $83 to $66, though it maintained an "Outperform" rating. Some analysts are waiting for Walmart’s latest earnings report to adjust their price targets accordingly.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.