NVIDIA’s Upcoming Earnings: What Should Investors Focus On?

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Insights – Wall Street remains optimistic that NVIDIA’s Blackwell chips will continue to drive its performance upward, with many analysts raising their price targets.

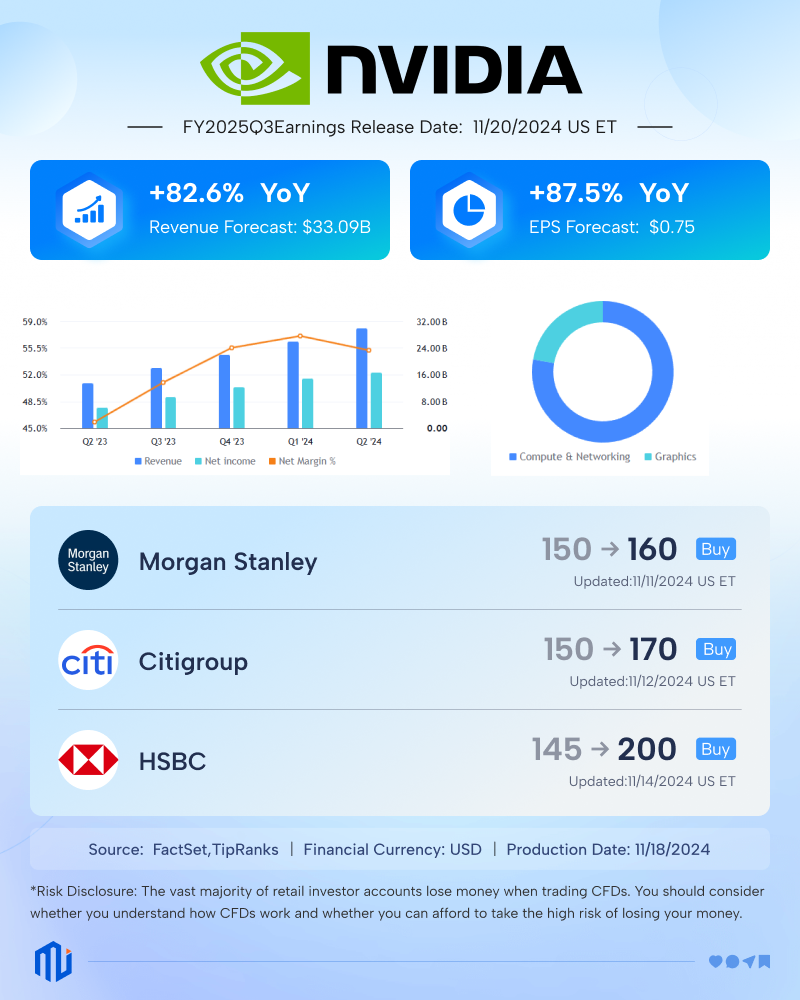

On November 20, AI chip giant NVIDIA (NVDA) will release its earnings results for the FY2025 Q3. According to FactSet, NVIDIA's quarterly revenue is expected to reach $33.09 billion, up 82.6% year-over-year, and EPS of $0.75, an 87.5% increase year-over-year.

NVIDIA’s stock has surged nearly 200% year-to-date, with its market cap surpassing $3.6 trillion, positioning it as the largest company globally.

Source: TradingView; NVIDIA (NVDA) 2024 YTD Performance

Key Focus: Blackwell Chips and Forward Guidance

NVIDIA’s Hopper and Blackwell GPU architectures are expected to boost AI and data center revenue. While Hopper demand remains strong, Blackwell’s transition to mass production in late 2024 or early 2025 could drive significant revenue.

Source: FinChat

Although NVIDIA beat revenue and earnings expectations last quarter, its stock fell 6% due to weaker-than-expected guidance and delays in Blackwell chip deliveries. This quarter, investors should closely watch Blackwell's Q4 rollout and the 2025 sales outlook.

Reports indicated that overheating issues with NVIDIA’s Blackwell GPUs in data centers required rack redesigns, leading to customer delays. Supply chain challenges and SMCI's financial uncertainty have also heightened investor concerns.

Melius Research, a well-known investment firm, suggests that investors should continue holding NVIDIA, as the next-generation Blackwell GPU could represent a watershed moment, akin to Apple’s "iPhone moment."

Wall Street Raises Price Targets

Ahead of the earnings report, Wall Street analysts have been raising their price targets for NVIDIA. Morgan Stanley raised its target from $150 to $160, while Citigroup increased its target from $150 to $170. Oppenheimer boosted its target from $150 to $175. Most Wall Street analysts believe that the Blackwell cycle will continue to drive NVIDIA’s performance higher.

However, the latest 13F filings show that some institutional investors have already reduced their positions in NVIDIA. Hillhouse Capital exited its position in NVIDIA during Q3, while Bridgewater Associates reduced its holdings by 27%. This suggests lingering market concerns about NVIDIA’s stock outlook.

How Will NVIDIA’s Stock Perform?

According to TipRanks, NVIDIA’s stock has moved ±9% following its earnings reports over the past eight quarters, with a 62.5% probability of rising post-earnings.

Vanda Research analysts note that if NVIDIA’s earnings significantly exceed market expectations, investor enthusiasm for the stock will likely increase. However, if the results just meet expectations, investors may respond by selling.

Source: TipRanks; NVIDIA Stock Performance Post-Earnings

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.