How To Buy Nvidia Stocks (NASDAQ: NVDA)? Are Nvidia Stocks Worth Investing In During 2024?

Nvidia - A company specialized in GPU (graphics processing unit) devices, has been attracting the attention of Wall Street investors recently. The halo effect of artificial intelligence (AI) along with its activities in the cryptocurrency mining sector have significantly contributed to Nvidia's success, driving the NVDA stock price to an all-time high.

If Nvidia can maintain its current growth pace, it is expected to become the 6th company to reach a market capitalization of $1 trillion. So, what has helped this company accelerate in such a competitive market? How has Nvidia's stock price performed in recent years? Let's explore this in more detail in the following article.

1. Overview of Nvidia and the AI Industry

According to updated information from Wikipedia, Nvidia Corporation, or Nvidia, is a multinational American technology company founded on April 5, 1993 by Jensen Huang in Delaware and headquartered in Santa Clara, California.

This is a software company specializing in the design of graphics processing units (GPUs) used for cloud computing, supercomputing, mobile computing, tablets, or entertainment and navigation systems. In addition, Nvidia has also expanded into areas such as data science, high-performance computing, and the automotive industry.

However, the focus and the source of Nvidia's success lies in the GPU segment. Therefore, in the scope of this article, we will delve deeper into this aspect.

To help you better understand the scale of Nvidia, let's take a look at some key financial figures. The data is taken from tradingview as of 2024.

Nvidia's revenue in 2023 was approximately $26.97 billion; total assets were around $41.18 billion with a global workforce of approximately 26,196 employees.

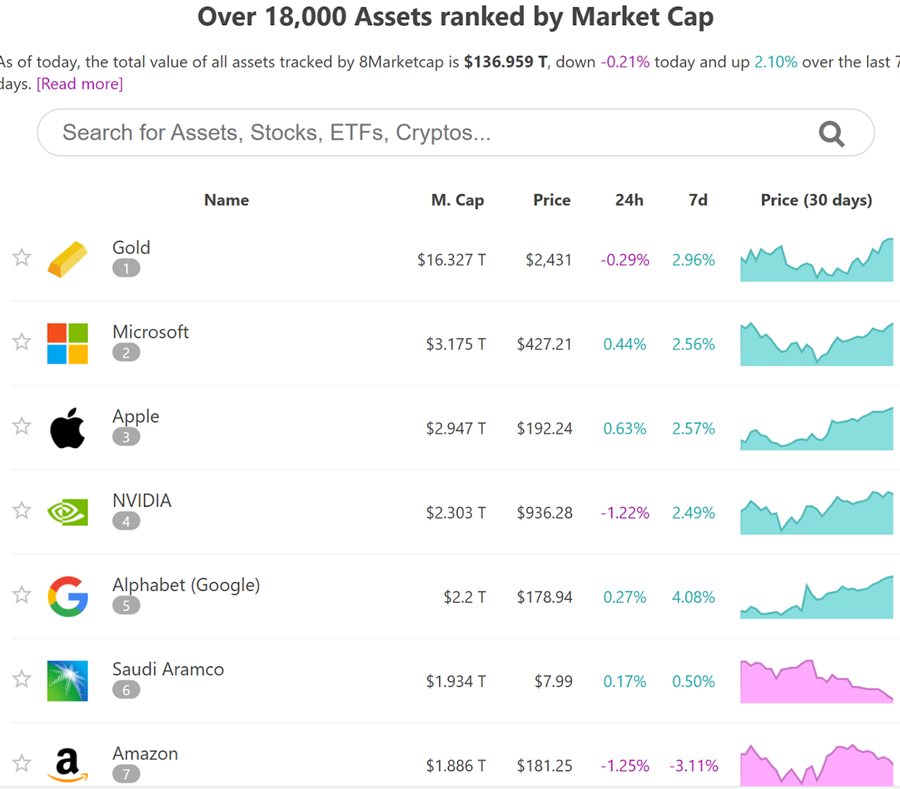

With a market capitalization close to $2,35 trillion (as of 21/5/2024), Nvidia is currently ranked at the 4th after Microsoft and Apple and before Google (according to 8marketcap).

Nvidia's market capitalization. Source: 8marketcap

Nvidia's earnings report estimates revenue of $24,59 billion in the first quarter-2024. The company also reported revenue of $22,10 billion in Q4/2023, $1,7 billion higher than expected and up 8,37% from the previous quarter.

Register and trade stock CFDs with 0 commission and low spreads! Trade Demo with 50,000USD RISK-FREE virtual money!

According to Reuters, the company's stock (NASDAQ: NVDA) has risen more than 202% in 1 year. This has made it the 4th most valuable company in the United States according to the 8marketcap ranking.

While Nvidia initially started as a company specializing in GPUs for video games, when people realized that GPUs could be used in the field of AI, it became a catalyst accelerating Nvidia's development. Tech giants like Amazon, Google, Meta, and Microsoft began purchasing Nvidia chips to process their data.

Even Elon Musk's electric vehicle company, Tesla, revealed in 2021 that it was using Nvidia's supercomputer chips to power the autonomous capabilities of its vehicles.

Furthermore, the emergence of chatbots like ChatGPT and Google Bard has recently ignited a surge in generative AI. At this point, GPUs play a crucial role in AI by helping to accelerate the training of models and allowing them to learn from larger datasets.

Nvidia itself is also actively engaged in R&D to release new GPU models that are said to run at double the speed of the previous generation. This is why people have high expectations for a bright future for Nvidia in the coming years.

2. Are Nvidia stocks worth investing in?

Nvidia has a technological advantage and a solid market position in the graphics card field, and its strong R&D investment and patent protection provide it with strong support. Financial data clearly shows that Nvidia's profitability is far superior to competitors like AMD and Intel, and its market share is also in a leading position. For the technology industry, the impact of financial market risks is quite large. Currently, the Federal Reserve's (Fed) rate hike cycle is nearing an end, and market concerns about corporate funding have also eased somewhat.

Based on the collected information, there are a few perspectives to consider regarding investing in NVIDIA stock in 2024:

The growth outlook for the artificial intelligence (AI) industry is very positive. The AI market is forecasted to grow rapidly in the coming decade, from $100 billion to nearly $20 trillion. NVIDIA is playing a major role in developing AI technology, such as providing the A100 chip for training ChatGPT models.

NVIDIA is not only focused on the traditional PC gaming market, but has also expanded into applications like mobile computing, AI-based audio and video processing. This helps diversify the company's revenue streams.

The strong growth of the cryptocurrency market using proof-of-work (PoW) technology could also drive demand for NVIDIA's GPUs, although the future of this segment remains uncertain.

In summary, with the positive outlook for the AI industry and new applications, NVIDIA stock could be a consideration for investors in 2024. However, as with any investment, properly assessing risk and determining one's own risk tolerance is very important before making a decision.

3. How much is NVIDIA stock (NASDAQ: NVDA)?

The NVDA stock of Nvidia is listed on the Nasdaq stock exchange in the US. With such impressive performance, it's no surprise that Nvidia has made it into the Nasdaq 100, S&P 100, and S&P 500 indices. At the time of writing this, the NVDA stock is trading at $936,07, recording a 1,24% decrease in the last 24 hours.

NVDA stock price. Source: Tradingview

Based on the chart, we can see that:

The Nvidia stock has reached its all-time high since its listing. Compared to the price of $0.82 in January 1999, the current NVDA price has increased by more than 214109%.

The NVDA stock has formed a double-top pattern, with the most recent peak recorded on November 19, 2021, at $329.81. It's important to note that this was a period of overall financial market exuberance, when the price of the cryptocurrency Bitcoin (BTC) also reached an all-time high.

However, the NVDA stock has also experienced a significant decline in value, reaching only $112.27 in October 2022.

The underperformance of the NVDA stock in 2022 was a reflection of the broader macroeconomic challenges during that period. Nvidia's Q4 revenue declined 21% due to a downturn in the gaming segment. The cyclical nature of demand combined with high inflation rates eroded the purchasing power of gamers.

Interestingly, this period also coincided with the dark times for many large cryptocurrency companies, such as the collapse of Terra and the disappearance of the FTX empire, which impacted numerous related entities and even led to the legal troubles of Sam Bankman-Fried.

Fortunately, thanks to Nvidia's strong financial position, the temporary recession did not have a significant impact on the company's performance. The company still maintains a dominant 78% market share in discrete GPUs and retains its leadership position through technological innovation. Based on this, Nvidia's stock could continue to be an attractive option for investors.

4. NVIDIA stock forecast 2024/2025

For the short-term forecast, according to experts from stockscan, With an average analyst price objective of $1100.83, NVIDIA Corp (NVDA) stock price is expected to rise 16.87% from $941.96 in 30 days. Analyst price targets range from $1021.63 to $1180.03.

They suggest NVDA is a Strong Buy with 18 technical analysis indicators signaling 11 Buy, 2 Sell, and 4 Neutral signals. Trading bullish markets is easier, thus it may be a good time to buy NVDA.

Relative Strength Index: NVDA is neither overbought nor oversold with an RSI(14) of 58.21. It indicates short-term neutrality.

The STOCH number of 80.10 shows that NVDA is oversold. NVDA pricing is at or near its greatest level over a lookback period.

The STOCHRSI rating of 63.19 shows that NVDA is neither overbought nor oversold. It suggests a balanced market without strong buying or selling.

ADX (Average Directional Index): At 14.28, the ADX predicts price movement but lacks confidence.

NVDA is still overbought, but not excessively so, with a CCI(14) of 85.09.

…In 2025, NVIDIA Corp Stock (NVDA) is anticipated to average $3,887.16, with a top of $5,231.05 and a low of $2,543.27. This is a 312.67% increase from $941.96.

NVIDIA Corp Stock (NVDA) Price Forecast for 2025 (Source: stockscan.io)

Meanwhile, according to priceforecast.com, the starting price of Nvidia was $495.22 in 2024. As of this now, Nvidia stock is trading for $947.80, a 91% rise in price since the start of the year. By the end of 2024, Nvidia is expected to cost $1,425; this is a +188% annual change.

The increase of +50% from now till year's end. The midpoint of 2024 is when we anticipate seeing $994. The price of Nvidia is expected to increase to $1,853 in the first half of 2025 and then add $139 in the second half to complete the year at $1,992, a +110% increase over the present price.

5. How to buy NVIDIA Stocks? How to Efficiently Invest in NVIDIA Stocks?

Investors have shown great interest in NVIDIA, a leading company in the field of AI and graphics processors. There are three common investment methods to consider when investing in NVIDIA stocks: directly buying stocks, through exchange-traded funds (ETFs), and through contracts for difference (CFDs). Each method has its own unique advantages and risks:

Investment method | Investment Advantages | investment risk |

Directly purchase NVDA stocks | To purchase NVDA stocks, you need to open an account through a brokerage firm for trading; you can participate in the company's growth opportunities, and if the company distributes dividends, investors can also receive them; | Requires relatively high starting capital and is fully exposed to fluctuations in the company’s stock price |

ETFs | May include NVDA and other technology stocks, reducing the risk of relying on a single stock | Because multiple companies are involved, the impact of an outperformance of a single company such as NVDA on the overall portfolio may be diluted |

CFDs trading | There is no need to actually own the stock, and leverage can be used to amplify the investment effect; short selling is allowed when the stock price falls to profit from the market decline. | High leverage means an increased potential risk of loss |

When comparing these three investment methods, directly buying stocks is suitable for those who want to hold long-term and directly benefit from the company's growth. ETFs are suitable for those seeking diversification and wanting to reduce the impact of single stock volatility. CFDs cater to advanced investors seeking high flexibility and short-term trading opportunities.

If you are interested in NVIDIA stocks and want to try CFD trading, you can invest through some CFD online trading platforms, which offer a demo account for a trading experience to familiarize yourself with the trading platform and actual operations.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Trade Demo with $50,000 risk-free virtual money

Trade Demo with $50,000 risk-free virtual money

6. The risks when investing in Nvidia stocks

Here is an overview of the objective and subjective risks associated with Nvidia stock:

Objective risks:

The macroeconomic outlook is quite bleak. Due to the current global inflation, there has been a noticeable decrease in consumer spending, resulting in a significant decline in Nvidia's revenue. If inflation and economic recession worsen, it will pose significant challenges for Nvidia to counter the prevailing market conditions.

Decrease in user demand: The majority of Nvidia's revenue is generated through the sale of graphics cards designed for gaming purposes. Nevertheless, it appears that this market is filled to capacity. While Nvidia is making efforts to venture into the field of AI, it's important to note that the transition to generating significant revenue from this sector will not occur immediately.

Intense competition: Nvidia faces strong competition from other brands in this field. Rival companies like Intel, AMD, and Apple are steadily strengthening their presence, which is impacting Nvidia's market share and stock prices.

Subjective risks:

Nvidia has consistently maintained a low dividend rate since the end of 2018, in contrast to its competitors like Intel and Broadcom who have higher dividend rates.

Nvidia's P/E ratio stands out among other technology companies like Apple and Intel, which has raised concerns about the valuation of its stock.

7. Conclusion

Artificial intelligence (AI) is currently a hot topic in the investment world, and many NVIDIA concept stocks have achieved good results in 2023 and 2024 on the back of this trend. However, it is worth noting that the gains of many concept stocks have already been very substantial, and whether their actual performance can support the high stock prices remains to be closely observed.

However, from a long-term investment perspective, the transformation brought by artificial intelligence is just beginning, and the supply of NVIDIA's GPU products still cannot fully meet market demand. AI models like Sora, which convert text to video, will further drive market demand for related products. Therefore, in the long run, the NVIDIA stocks have a solid basis for actual performance growth. Investors should continue to pay attention to the development of this industry to benefit from it, but also exercise caution and diversification to manage the risks.

What Is the Long-Term Outlook for NVIDIA?

What factors should I consider before investing in Nvidia stocks?

Does Nvidia pay dividends?

How do global economic factors impact Nvidia stocks?

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.