AI, also known as artificial intelligence, has been gradually changing the world since its inception in the 1950s. It has had a significant impact on various industries, including healthcare, manufacturing, education, and financial investment.

AI stocks refer to stocks issued by companies associated with AI technology. Therefore, is artificial intelligence a powerful and enduring investment trend for the future? Which AI stocks are worth paying attention to? And which companies in the U.S. or other stock markets are most closely aligned with AI technology? Let's explore these questions today.

1. What is AI stock and the current situation

AI stocks refers to stocks of companies that are directly involved in the development, implementation, or utilization of artificial intelligence (AI) technology. These companies typically focus on AI research, software development, data analysis, machine learning, robotics, or other related fields.

The current situation of AI stocks varies depending on the specific companies and market conditions. Generally, AI stocks have gained significant attention and popularity in recent years due to the growing importance and potential of AI technology in various industries. Many investors see AI as a promising sector with long-term growth potential.

▶ ChatGPT Ignites a Frenzy in AI Stocks

In late 2022, ChatGPT, an artificial intelligence conversational chatbot, emerged and attracted over a hundred million users within two months of its launch. With its ability to handle most knowledge-based tasks, it has disrupted people's previous perceptions, leading global capital to once again focus on the AI field.

According to PitchBook data, investments in AI startups specializing in generating human-like text, images, and computer code have increased by 65% this year. Tech giants have also increased their investments in AI, with some applications already making significant progress. For example, Google has introduced the AI chatbot "Bard," while Microsoft is combining its office software with GPT to launch Microsoft 365 Copilot.

As a result, tech giants have performed exceptionally well this year, with Microsoft's stock price rising over 35% since the beginning of the year, and Google's stock price increasing by over 50%. NVIDIA, benefiting greatly from the AI frenzy, has surged by over 230%.

The latest financial report shows that NVIDIA's revenue for Q2 2023 (ending in July) doubled to $13.5 billion compared to the same period last year. Data center revenue, including AI chips, reached a record $10.32 billion, more than doubling in just one quarter. The performance guidance for Q3 is even more impressive, with NVIDIA expecting a 170% year-on-year revenue growth to $16 billion, marking two consecutive quarters of doubling revenue and surpassing analyst expectations by 28%.

NVIDIA's performance is a testament to the vast potential of AI. Goldman Sachs believes that as AI continues to boost company profitability, the stock prices of AI stocks will experience further increases.

▶ AI Industry Chain

With AI being so popular, how can we invest in it? Well, to invest in AI, we first need to understand the industries related to AI.

Broadly speaking, AI can be classified into three layers: the foundational layer, the technology layer, and the application layer.

Foundational Layer: Data acquisition and analysis, cloud computing, big data, 5G communication, chips, neuromorphic chips, etc.

Technology Layer: Computer vision, natural language processing, human-computer interaction, foundational open-source frameworks, technology platforms, machine learning algorithms, neuromorphic algorithms, etc.

Application Layer: Security, transportation, healthcare, manufacturing, finance, education, home automation, visual products, robotics, etc.

As for the AI industry chain, it can be divided into upstream, midstream, and downstream. Here's a summary:

AI Supply Chain | Components | Representative Companies |

Upstream | CPUs, GPUs, chips, etc. | NVIDIA, AMD, TSMC, etc. |

Midstream | Server contract manufacturers, branded manufacturers | Quanta, Dell, Ingram Micro, etc. |

Downstream | Software services, AI companies | Microsoft, Google, OpenAI, etc. |

[Source: Compiled by Mitrade]

If you're interested in the representative companies mentioned in the AI supply chain table, such as Microsoft and Google, you can obtain real-time information and price analysis of relevant stocks through the Mitrade online trading platform. This will help you better understand market trends and stay updated with firsthand market information.

2. The leading AI Stocks in the US Stock Market

AI stocks are widely distributed in the US stock market, covering upstream, midstream, and downstream sectors. Since early 2023, the Philadelphia Semiconductor Index (SOX), which is related to the AI industry, has risen by over 60.01%, outperforming the general market. With the boost from the AI boom, US tech stocks have also performed well, with the NASDAQ 100 Index rising by 36.90% this year, far exceeding the S&P 500 25.91%.

2023 Performance of US AI Tech Stocks

[Image Source: TradingView-updated 5/2024]

Currently, the surge in US bond yields has put some pressure on the valuation of AI stocks. However, as the Federal Reserve nears the end of its interest rate hikes, valuation pressure is expected to ease, and the stock prices of US AI stocks are expected to rise again. Below, we have selected the following AI stocks in the US:

2.1 NVIDIA (NASDAQ:NVDA)

NVIDIA, also known as "NVIDIA," is a professional semiconductor company. In 2016, it launched AI-focused products and experienced rapid growth in a short period of time. Its core graphics processing unit (GPU), which was originally used for display card calculations, can now support various fields such as autonomous driving, game visual simulation experiences, and AI computing.

Recently, NVIDIA has released the Nvidia H100 NVL for the high computing power requirements of ChatGPT and introduced AI supercomputing cloud services. With the increasing demand for computing power in the future, NVIDIA clearly has a bright outlook.

Real-time quote chart for NVIDIA ▼ Mitrade

2.1 Microsoft (NASDAQ:MSFT)

Microsoft, a software giant, invested $1 billion in OpenAI in 2019, making Microsoft the exclusive cloud service provider for OpenAI. In January 2023, Microsoft announced another investment of $10 billion and would acquire 49% of the company's shares.

Having taken the lead, Microsoft launched the new search engine NewBing based on ChatGPT in February 2023, with daily active users exceeding 100 million.

Real-time quote chart for Microsoft ▼ Mitrade

2.3 Alphabet (NASDAQ:GOOG)

Alphabet Inc, also known as Google, is one of the leading stocks in artificial intelligence (AI) and machine learning. The company heavily relies on AI and machine learning, and its original search engine technology, PageRank, is based on advanced models and algorithms.

Google has always been at the forefront of AI research and has developed its own AI chips, including Google Tensor. In 2023, Google launched the chatbot Bard. In the future, Google will further increase its investment in AI to consolidate its leading position.

Real-time quote chart for Google ▼ Mitrade

2.4 Advanced Micro Devices (NASDAQ:AMD)

Like NVIDIA, Advanced Micro Devices (AMD) is one of the leading manufacturers of graphics processing chips (GPUs) and has also benefited from AI development. According to Bloomberg, the ChatGPT frenzy has driven up AMD's orders, and its future revenue is expected to further increase.

Real-time quote chart for Advanced Micro Devices ▼ Mitrade

2.5 C3.ai (NYSE: AI)

C3.ai is an enterprise AI software provider that has already released over 40 enterprise AI software applications and has collaborations with the three major cloud services: Google, Amazon, and Microsoft. Although it has not yet achieved profitability, its CEO, Thomas M. Siebel, stated that C3.ai is expected to achieve positive cash flow and non-GAAP profit in 2024.

2.6 Amazon.com, Inc. (NASDAQ:AMZN)

Amazon (AMZN) is a standout investment opportunity in the AI sector for 2024. Its significant strides in AI and cloud services, coupled with consistent financial growth, make it a promising prospect. As Amazon continues to penetrate new markets, it remains a potential powerhouse for AI-related investments.

Real-time quote chart for Amazon.com, Inc. ▼ Mitrade

2.7 ServiceNow, Inc. (NYSE: NOW)

ServiceNow, Inc. (NOW) has made significant investments in AI, including the expansion of its generative AI (GenAI) capabilities. ServiceNow has also formed a strategic alliance with Microsoft, integrating their AI capabilities to enhance enterprise productivity.

Furthermore, ServiceNow has committed $1 billion to its venture firm, ServiceNow Ventures, to invest in AI and automation companies targeting enterprise use cases. These strategic investments in AI have positioned ServiceNow as a key player in the AI sector, making its stock a potential investment for those interested in the AI industry.

Real-time quote chart for ServiceNow, Inc. ▼ Mitrade

2.8 Meta Platforms (NASDAQ:META)

Meta Platforms, Inc. (META), formerly known as Facebook, is a significant player in the AI sector in 2024. The company has made substantial investments in AI, including the development of the Llama family of large language models (LLMs), a conversational assistant called Meta AI, and AI-powered smart glasses.

"AI will be our biggest investment area in 2024," said Mark Zuckerberg, Meta's CEO. The company's AI investments have driven a 24% year-over-year increase in Meta’s ad business in Q4 for a total of $38.7 billion.

Real-time quote chart for Meta Platforms ▼ Mitrade

2.9 Adobe (NASDAQ:ADBE)

Despite a slower-than-expected incorporation of generative AI into its revenue stream, Adobe forecasts a revenue of approximately $21.4 billion for the fiscal year ending December 2024.

Adobe's dedication to innovation, especially in the field of generative AI, is apparent in its advancements, although the noticeable aspect is the limited speed at which these technologies are generating revenue.

Real-time quote chart for Adobe ▼ Mitrade

2.10 IBM (NYSE: IBM)

With a stock price of $169.901 (05/09/2024) , IBM has strategic focus on these areas has led to a robust free cash flow generation. IBM’s commitment to dividends and its strong financial performance make it a compelling investment.

Real-time quote chart for IBM ▼ Mitrade

Furthermore, IBM’s acquisition of HashiCorp, Inc. has strengthened its position in the AI landscape. With these strategic investments, IBM presents a promising investment opportunity in the tech industry.

Stock Name | Stock Code | Marketcap (T$) | Listing Date | Dividend Yield | 1-Year Return |

NVIDIA | NVDA | 2.26 | 1999 | 0.03% | 129.06% |

Microsoft | MSFT | 3.05 | 1986 | 0.82% | 39.2% |

Alphabet | GOOG | 2.11 | 2014 | / | 52.4% |

Advanced Micro Devices | AMD | 0.248 | 1972 | / | 73.0% |

C3.ai | AI | 0.003 | 2020 | / | 183.9% |

Amazon.com, Inc. | AMZN | 1.96 | 1997 | / | 78.23% |

ServiceNow, Inc. | NOW | 0.147 | 2003 | / | 64.91% |

Meta Platforms (Facebook) | META | 1.2 | 2012 | 0.43% | 104.18% |

Adobe | ADBE | 0.218 | 1982 | / | 42.51% |

IBM | IBM | 0.156 | 1962 | 3.97% | 39.38% |

[Source: Google Finance, as of 2024, compiled by Mitrade]

3. Is it worth investing in AI stocks in 2024?

In the short term, there is still hype surrounding the AI concept. With the continuous iteration of ChatGPT functionality and the emergence of numerous innovative applications, people's enthusiasm for AI will continue to be maintained.

In 2023, the global artificial intelligence (AI) market was estimated at a substantial USD 515.31 billion, with expectations set for a robust expansion in the near future. The market is anticipated to grow to USD 621.19 billion by 2024, fueled by the widespread adoption of AI technologies, strategic partnerships, and a surge in demand for personalized services.

Looking further ahead, the market is projected to reach an astounding USD 2,740.46 billion by 2032, growing at a compound annual growth rate (CAGR) of 20.4% from 2024 to 2032. AI's influence is evident in its rapid user growth, exemplified by ChatGPT, which amassed over a million users shortly after its release in November 2022.

Overall, the AI sector holds tremendous potential for development and is on track for extraordinary growth that promises to transform various facets of our daily lives, including business and healthcare.

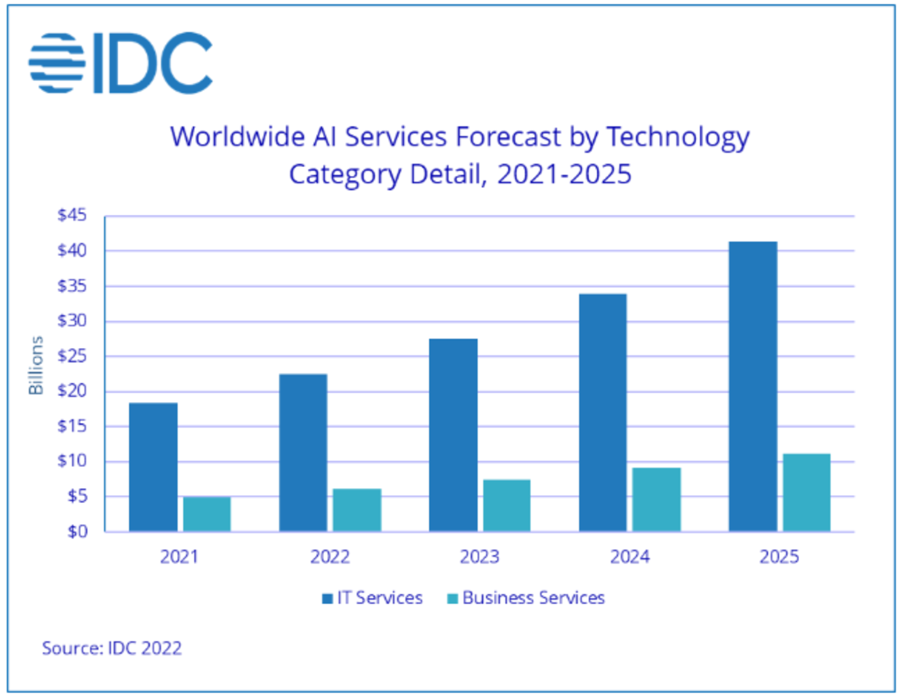

According to IDC data, AI services are experiencing rapid growth.

[Image source: IDC, Rapid growth of AI services]

[Image source: IDC, Rapid growth of AI services]

With the combination of thematic speculation and industry fundamentals, we are optimistic about the upward trend of AI stocks in 2024. However, it is important to note that some stocks may have a risk of correction due to overvaluation, so we must be mindful of the timing of purchases.

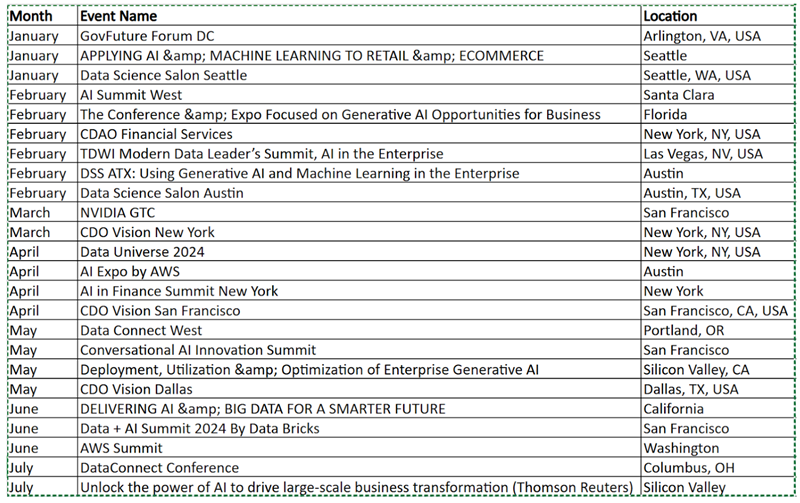

Below are 24 significant AI events in 2024 in the United States summarized by AIM Research. Through these events, we can glimpse the development trends and risks of AI and better assess the AI opportunities for relevant technology companies.

AIM Research summary of 24 significant AI events in 2024:

4. Different ways to invest in AI stocks

When it comes to investing in AI stocks, besides directly buying individual stocks, we can also invest through stock funds and ETFs. The relevant methods are summarized as follows:

Investment Products | Stock | Equity Fund | ETF |

Management Style | Active (I choose stocks) | Active (fund manager stock picking) | Passive (tracking index) |

Risk | concentrated | dispersion | dispersion |

Transaction Cost | Low | middle | Low |

Management Fee | none | middle | Low |

Main Trading Platform | Brokerage firm | Fund platform | Brokerage firm |

Advantage | Convenient to buy and sell | Select different stock portfolios to balance risks and returns | low transaction costs |

Shortcoming | A single stock has high risk | Transaction costs are higher | Easy to get discounts and premiums |

Ai Related Products | TSMC (2330.TW), NVDA (NVDA.US), etc. | First Gold Global AI Robotics and Automation Industry Fund | Taishin Global AI ETF (00851), Yuanta Global AI ETF (00762) |

In addition to these options, we can also trade AI stocks using Contracts for Difference (CFDs). Trading stocks with CFDs allows you to trade with only 5%-10% of the stock's face value, significantly increasing the utilization of funds.

0 commission, low spreads

0 commission, low spreads Diverse risk management tools

Diverse risk management tools Flexible leverages and instant analysis

Flexible leverages and instant analysis Practice with $50,000 risk-free virtual money

Practice with $50,000 risk-free virtual money

Furthermore, you can practice simulated trading exercises using the intuitive trading interface to better familiarize yourself with risk management tools such as stop loss and trailing stop.

5. Advantages of investing in AI stocks

Broad Coverage and Tremendous Market Potential: AI stocks revolve around the AI technology and have formed a unique industry chain from development to application. Although AI is still in its early stages, its predictable significant impact on productivity in the future signifies that AI has become a symbol of the fourth industrial revolution. With the recognition of AI by society and governments, along with the combined effect of encouraging policies and the rapid development of the AI industry itself, AI stocks have promising prospects.

High-quality Companies with Lucrative Investment Returns: AI belongs to the realm of cutting-edge scientific technology, and companies involved in the AI-related industry possess advanced technical support, a significant market share, and strong financial foundations. They are leaders in their respective industries and maintain the agility to adapt to market changes, making outstanding contributions to various aspects of AI development. These companies have reliable and high-quality growth prospects, bringing more investment returns to investors.

Wide Attention and General Bullish Outlook for the Future: With the mutual promotion and development of policies, academia, funding, and hardware and software, AI technology will give rise to higher-quality AI applications in various fields.

Furthermore, the compatibility with 5G will address the data issues that AI technology depends on from the source. The more convenient and flexible Internet of Things will completely change everyone's way of life. Not only investors, but everyone is looking forward to the arrival of the AI era.

6. Risks of investing in AI stocks

AI Technological Advancements May Not Meet Expectations: Although AI stocks are currently experiencing robust development and attracting investor participation, it is important to recognize that AI technology is still in its early stages. While utilizing the benefits of AI technology, one cannot completely avoid its potential drawbacks, such as the possibility of errors even in intelligent AI systems.

In some cases, a minor error can lead to immeasurable losses, ultimately affecting the actual price trend of related AI stocks, which may deviate from expectations. For example, when Google (GOOG.US) introduced the chatbot Bard, a wrong answer caused the stock price to drop over 7% on the same day, resulting in a market capitalization loss of billions of dollars.

Overvaluation of Some AI Stocks: Starting from the end of 2022, AI stocks have been on the rise, with some stocks even doubling in value. Some of this increase may be due to speculative trading by certain investors. Good stocks also need to have a good price, and some AI stocks may be overvalued (e.g., C3.ai), posing a significant risk of a potential correction after purchasing.

Potential Tightening of Future Regulations: Due to concerns about privacy breaches, Italy has banned the use of ChatGPT, and European countries such as Germany, France, and the United States are considering stricter regulations on AI chatbots. If regulations tighten in the future, it could have an impact on AI stocks.

7. Things to consider before investing in AI stocks

Percentage of Business Related to the Concept: Pay attention to the percentage of the company's business that is related to AI. Some companies may be classified as AI stocks, but only a small portion of their business is actually related to AI. When selecting investment opportunities, carefully examine the company's actual involvement and future prospects in the AI field.

Benefits to Upstream and Downstream Industries: Even within the same AI stocks, there may be variations in their position in the industry chain and their relationships with other companies. It is important to select stocks that are in advantageous positions within the entire AI industry chain and can benefit from the development of upstream and downstream industries.

Company's Fundamentals: Understand the company's financial condition, revenue growth, market competitiveness, and other fundamental factors. These factors are crucial in assessing the company's future profitability and long-term growth prospects.

8. What to do when AI stocks incur losses

Identify the reasons for the losses: Analyze the reasons behind the stock losses, whether it is due to a market downturn or issues specific to the company itself. If it is a market adjustment or temporary correction, and the company's fundamentals remain strong, the losses may be short-term and not a cause for excessive concern.

Assess the company's fundamentals: Conduct in-depth research on the company's fundamentals, including íts financial condition, business development, product competitiveness, etc. If there are significant problems with the company's fundamentals, such as sustained losses or management changes, it may be necessary to reevaluate investment decisions.

Risk management and adjustments: Based on personal investment strategies and risk tolerance, consider reducing holdings, setting stop-loss points, or adjusting the investment portfolio to mitigate risks.

9. Conclusion

In summary, there are risks involved in investing in any stocks, including AI stocks. Before investing, it is important to understand the company's level of involvement in the concept, the benefits to upstream and downstream industries, and the company's fundamentals.

During the investment process, closely monitor market and company dynamics, and engage in risk management and adjustments based on individual circumstances.

Should I invest in AI stocks in 2024?

What are the challenges of investing in AI stocks?

What is the future of AI in the stock market?

Are there any AI ETFs (Exchange-Traded Funds) to consider?

Before making any trading decisions, it is important to equip yourself with sufficient fundamental knowledge, have a comprehensive understanding of market trends, be aware of risks and hidden costs, carefully consider investment targets, level of experience, risk appetite, and seek professional advice if necessary.

Furthermore, the content of this article is solely the author's personal opinion and does not necessarily constitute investment advice. The content of this article is for reference purposes only, and readers should not use this article as a basis for any investment decisions.

Investors should not rely on this information as a substitute for independent judgment or make decisions solely based on this information. It does not constitute any trading activity and does not guarantee any profits in trading.

If you have any inquiries regarding the data, information, or content related to Mitrade in this article, please contact us via email: insights@mitrade.com. The Mitrade team will carefully review the content to continue improving the quality of the article.