ASML: The Cyclical Titan at the Heart of AI’s Next Chapter

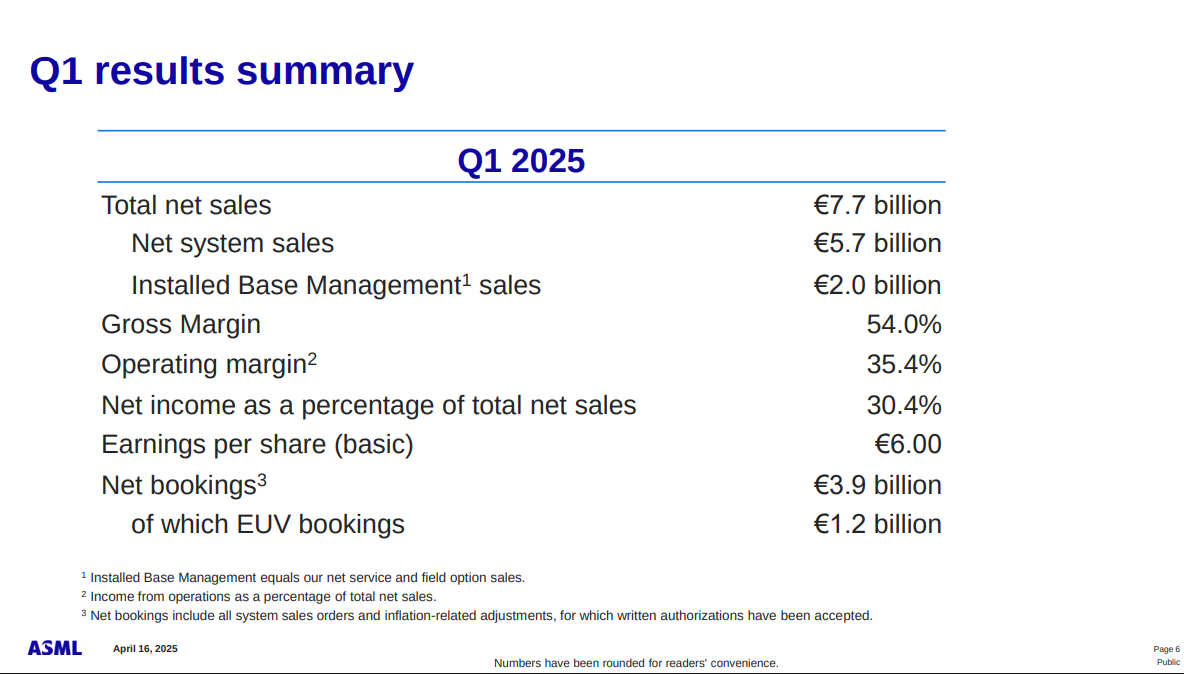

- ASML's Q1 2025 revenue fell 16.4% QoQ to €7.74B, but gross margin expanded to 54% on richer EUV mix.

- Installed base services contributed €2B+, over 25% of revenue, with resilient cash flows despite a 38.7% QoQ shipment decline.

- Net income reached €2.36B (30.4% margin); CapEx stayed high at €415M, and €2.6B was returned via buybacks.

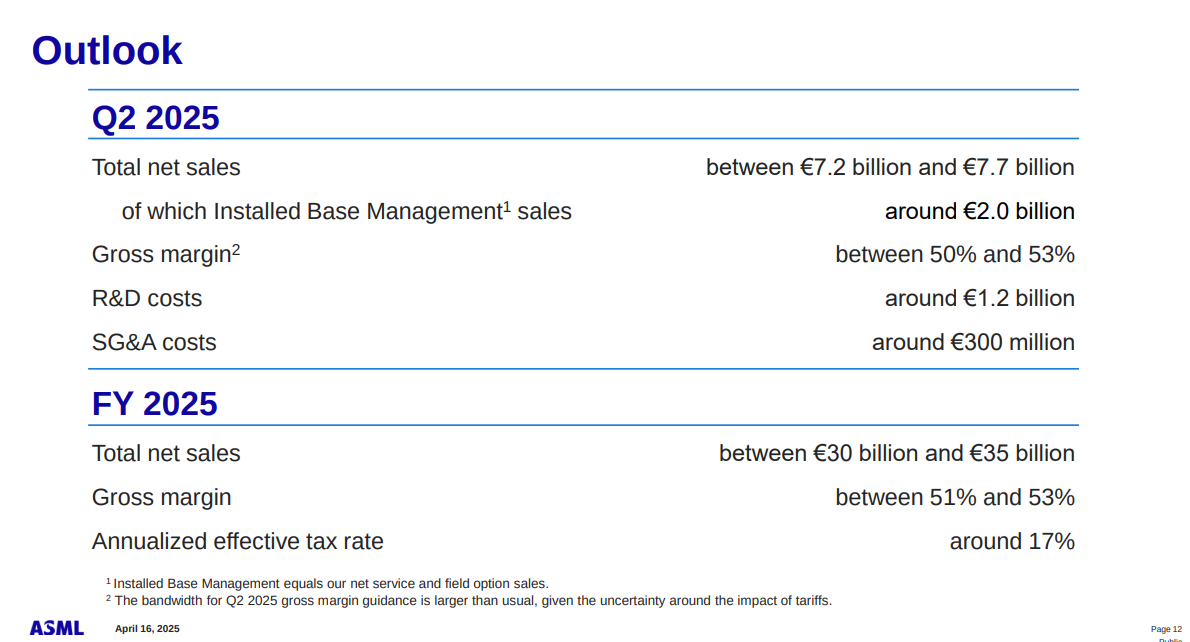

- Shares trade at 24.8x forward earnings, with management guiding €30–35B FY25 revenue and long-term upside from High-NA ramp.

TradingKey - Amidst the choppy macroeconomic environment and increasing geopolitical tension, ASML's (ASML) Q1 2025 results highlight its seemingly paradoxical position as both a cyclical capital equipment provider to the semiconductor industry and an essential facilitator of secular AI expansion. Although shipments of new lithography systems declined by 38.7% from quarter to quarter and net bookings dropped to €3.94 billion, which brought about a 7% share price decline, the organization reiterated its FY2025 revenue range of €30–35 billion. This suggests that investors are moving through short-cycle order uncertainty while factoring in long-cycle upside. The contradiction between deteriorating short-cycle indicators and the confidence of managers in long-cycle structural expansion is at the heart of ASML's investment enigma.

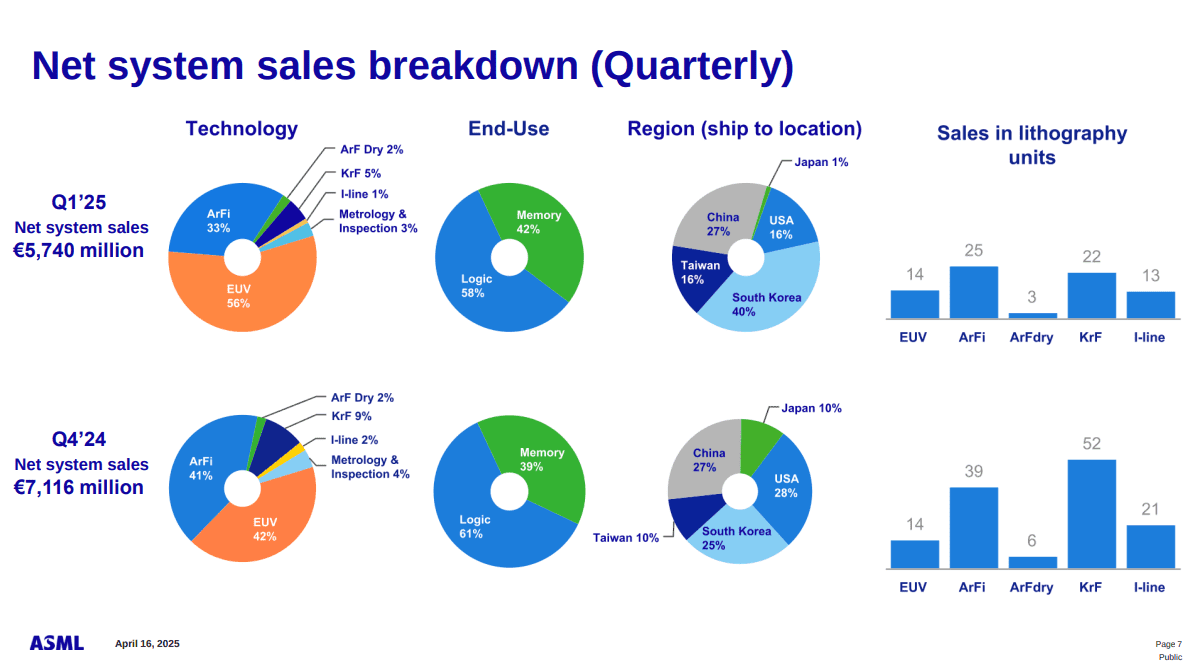

This tension is most clearly represented in ASML's changing end-market mix. The progress toward EUV (Extreme Ultraviolet) and High-NA systems is driven not only by technology leadership but also by increasing exposure to high-end nodes powering workloads in applications based on artificial intelligence. Even with cyclical weakness in bookings, Q1's 54% gross margin, which exceeded guidance, was underpinned by richer EUV mix and the shipment of the fifth High-NA system. Such landmarks indicate monetization is decoupling from unit volumes, foreshadowing margin growth as the High-NA cycle matures. But risks are prevalent: U.S.-China trade relations, tariffs, and price power among trailing-edge customers jeopardize volume recovery as much as ASP (average selling price) protectability.

ASML thereby sits in an unusual position: both a bellwether to cyclical semiconductor investment trends and a strategic keystone in the international arms race for AI. This dual role demands more thoughtfully considered valuation considerations, marrying traditional metrics to strategic position, optionality, and geopolitical risk premia. The sections that follow analyze ASML's moat, cadence, competition, and valuation asymmetry, placing investors in position to evaluate whether recent weakness is a transitory detour or an early entrance to the subsequent leg of AI-driven capex growth.

Source: Q1 Deck

Strategic Engine Behind the Boom in AI Infrastructure

ASML's business is built upon a razor-blade dynamic: The initial sale of sophisticated lithography machines, especially EUV machines, and then subsequent profitability from an expanding installed base through service and upgrade revenues. The EUV machines help chipmakers such as TSMC, Intel, and Samsung add more transistors to every wafer, a necessary ability in the age of generative AI and high-performance computing. High-NA EUV machines are at the forefront of this ability, capable of feature size reductions to 8nm and smaller, one requirement to facilitate trillion-parameter AI models in efficient silicon.

In Q1 2025, 77 lithography systems were shipped by ASML, wherein installed base revenue (upgrades and services) provided an added €2 billion, more than 25% of total revenues. Notably, gross margin increased to 54%, from 51.7% in Q4, as there is a more lucrative product mix and milestone-related incentives with High-NA delivery. The results confirm a pivot to quality over quantity: fewer volumes, but at greater ASPs and margin. Service revenues have remained incredibly resilient despite the reported unit shipment contraction, supporting cash flow stability and confirming the company's razor-blade business model.

The flywheel in place is technological lock-in. ASML is the only supplier of EUV systems in the world, essentially a monopoly supplier of mission-critical infrastructure. This imparts pricing power and long-duration visibility, especially with customers competing to book capacity for AI workloads. The fifth High-NA shipment in Q1, with three customers already signed, validates early traction. Not only are these systems growing ASML's TAM (total addressable market), but also increasing its moat through greater switching costs and increasing complexity of integration.

In addition, ASML's service backlog as well as long lead times produce operational leverage. Management's narrative of "growth years" in 2025 and 2026 is based on embedded demand in customer roadmaps. Although quarterly bookings are unstable, conversion to revenue is less affected by macro environment relative to peers. Such insulation supports that ASML's valuation will need to capture more than quarterly orders, it will need to build in a premium for platform longevity and systemic applicability.

Source: Q1 Deck

Competitive Position in a Fragmented, Geo-politically Charged

ASML's EUV lithography supremacy continues to hold unrivalled sway, but its larger competitive landscape is now defined by geopolitical tension, customer capex limitations, and competing segments in trailing-edge lithography. There are core competitors such as Canon and Nikon, especially in DUV (deep ultraviolet) platforms, but not even they have replicated ASML's R&D path or commercial momentum in EUV. What sets ASML apart is product sophistication, yes, but also how deeply embedded it is in the value chains of fabless chip designers, foundries, as well as IDM giants.

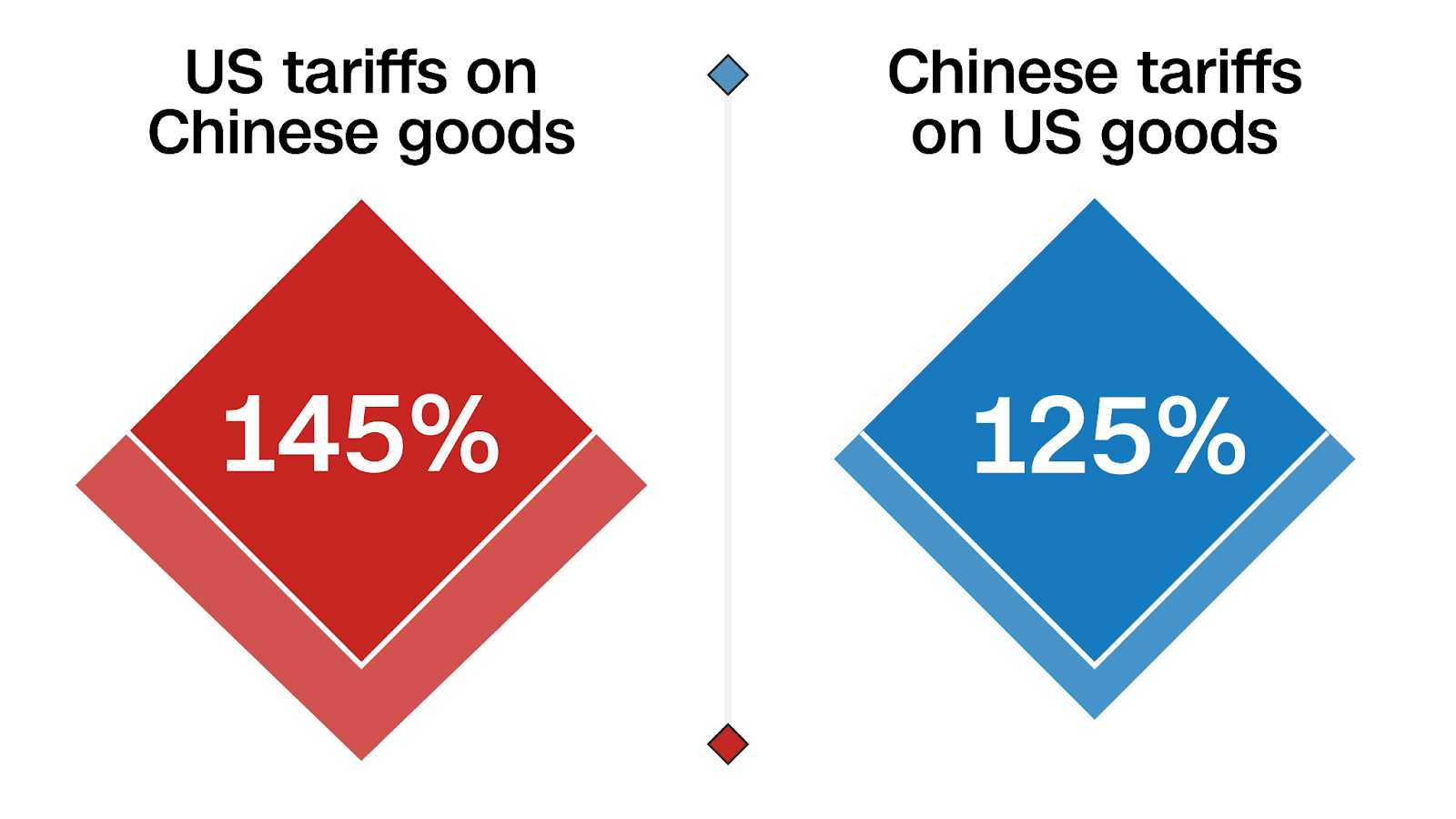

Tariffs now stand as a wild card, potentially jeopardizing ASML's relatively seamless globalization strategy. The company identified four zones where tariffs might have an impact: direct shipments to America, tariffs on components and tools, input material, and retaliatory tariffs in America-bound exports. CFO Roger Dassen indicated these might redefine the cost base and margin structure of the company. In addition, stricter export controls to China, a market that accounted for historically 20–30% of bookings, might limit upside and distort competitive balance, preferring local options or driving customers to legacy nodes.

However, in higher-end nodes, ASML's advantage is currently unbreachable. Even Intel and TSMC, spending billions in-house on R&D, are still beholden to ASML's road map. This makes ASML something of a gatekeeper in the arms race for AI. It's an essential node in the world's silicon supply chain, upstream from Nvidia, AMD, and Apple, all of which depend upon state-of-the-art lithography to make their latest chips.

In the age of AI, competition is not merely about tools but about ecosystems. The strength of ASML comes from co-development partnerships with important customers. By working closely together in photomask design, overlay accuracy, and defect control, ASML burrows deeper in customer processes, raising switching costs. Those integrations, albeit immeasurable, are a soft moat that complements intellectual property holdings as well as hardware supremacy.

Financial Deep Dive: Strength under the Surface

ASML's Q1 2025 revenue accounts are an eye-opener of operational strength hiding behind cyclical pressures. Revenue fell by 16.4% QoQ to €7.74 billion, after normalizing from record system manufacturing in Q4. Gross profit fell by only 12.7%, however, due to a 300bps gross margin expansion. Net income amounted to €2.36 billion, which is an impressive 30.4% net margin, above last quarter's 29.1% as well as 23.1% YoY. This is evidence of healthy operating leverage despite system shipments falling.

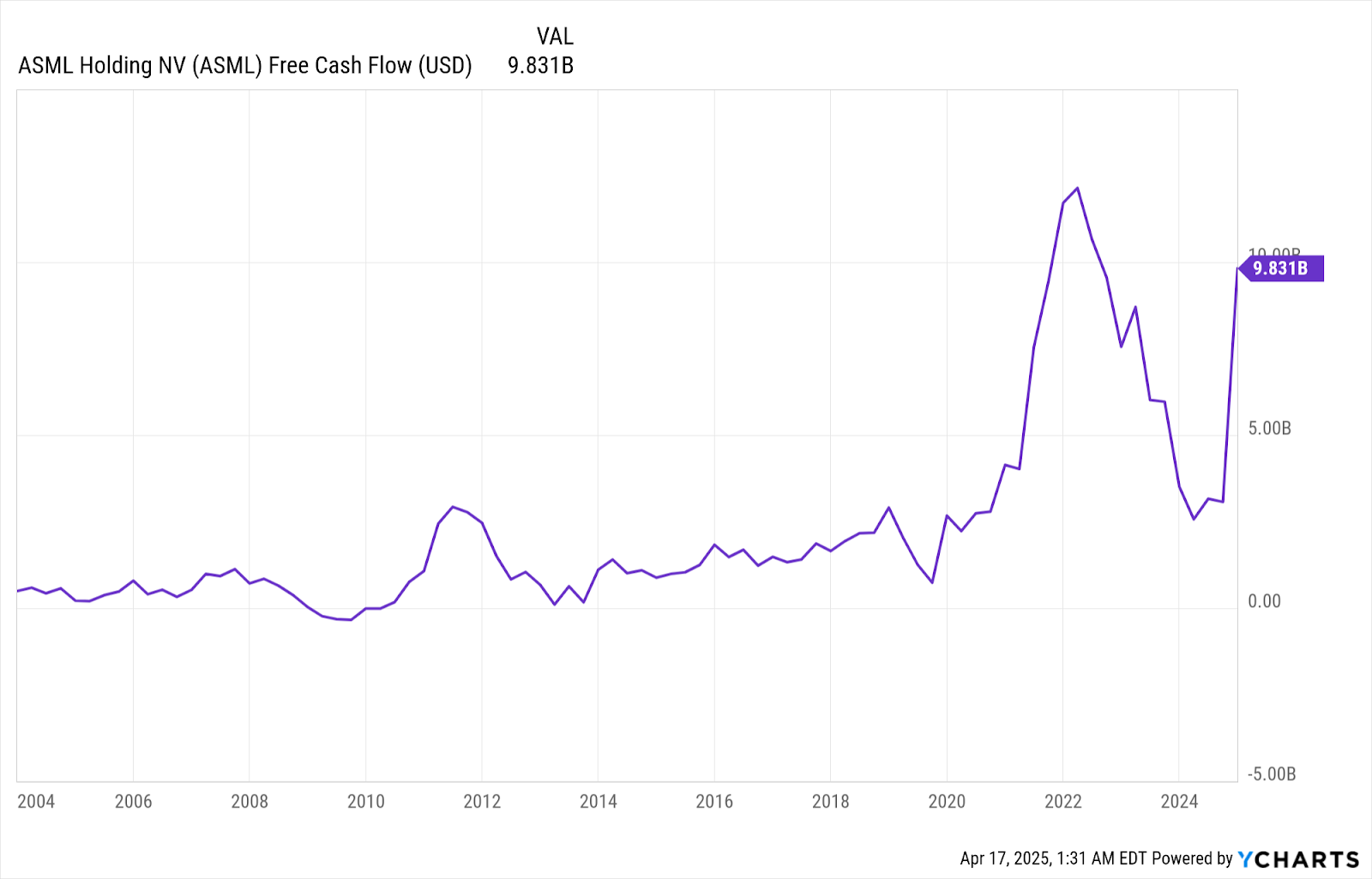

Cashflow dynamics add more detail. Operating cash flow was negative (-€58 million), as an outlay of €2.8 billion from working capital, particularly inventory accumulation and receivables, prevailed. Yet this seems intentional: inventory levels increased mildly to €11 billion (+1.2%) in anticipation of second-half deliveries. CapEx remained high at €415 million, as investment in High-NA production capacity and process control continues. Meanwhile, ASML bought back €2.6 billion in shares, which is an indication of confidence in long-run value.

IBM's installed base business maintained stabilizing revenues at Q1's €2 billion, higher even than all used and new system sales combined. With more than 1,400 installed systems, whether in body shops in Asia or installed by OEMs in high-end equipment in North America, IBM generates recurring, high-margin cash flows which mitigate cyclicality. R&D spending increased to €1.16 billion, a 12.5% YoY rise, which underlines the company's investment in next-gen EUV and metrology products.

From a balance sheet point of view, ASML is still conservatively geared. Net cash declined to €9.1 billion from €12.7 billion as a consequence of buybacks, but the equity ratio is higher at 38.5%, with leverage still being insignificant. Notably, ASML continues to estimate FY25 revenues of €30–35 billion, we infer a H2 ramp, and gross margins of 51–53%. This would see full-year net income at c. €10 billion, based on maintaining expense rates.

Source: Q1 Deck

Valuation: A Premium to Be Justified

Its valuation today captures both its monopoly position as well as market skepticism. The shares are priced at 24.8x non-GAAP forward earnings, which is 30% higher relative to sector peers but 37.7% lower relative to ASML's 5-year average. On an EV/Sales metric, shares are at 7x forward sales, again, higher relative to peers at 2.4x but 36% lower relative to its own historical mean of 10.7x.

This divergence is indicative of the market's perception of ASML as being structurally essential but cyclically weak. The deceleration in net bookings (-44.5% QoQ) with management's conservative Q2 guidance (sales range of €7.2–€7.7 billion) added uncertainty to short-run momentum. The long-run DCF thesis is intact, though: based on €33 billion FY25 revenue, 53% gross margin, and normalized FCF margin of 25%, ASML would be able to produce €8.25 billion in free cash flow. Using a 25x FCF multiple delivers a base case valuation in the ballpark of €206 billion (~€515/share), just ahead of where we are today.

Still, optionality is undervalued. If High-NA systems ramp more quickly or TSMC's and Samsung's node transitions are accelerated by AI demand, then by 2026 revenue might print more than €35 billion. In a bull case, where ASML makes revenue of €40 billion by 2027 at a net margin of 30%, implied FCF would be more than €10 billion, warranting a present-day €250–275/share fair value. Alternatively, an extended tariff regime or China decoupling might suppress volumes, bringing ASML back to a sub-€25 billion revenue trajectory and compressing valuation to ~€350/share.

The asymmetric pay-off of the stock thus rests then on EUV adoption durability, tariffs management, and capex pull-through by AI. Those expecting a second-half rebound or an acceleration in 2026 are paying a moderate premium, but risk-reward tilts in their favor if guidance is conservative.

Source: Ycharts (FCF TTM)

Risks: Tariff Uncertainty, Cyclical Drag, and ASP Sensitivity

In conjunction with its strategic value, ASML is still exposed to various material risks. Tariff exposure, in particular from recent U.S. and Chinese actions, brings operational uncertainty. CFO Dassen's four-pronged breakdown of tariff risks shows the range of possible cost pressures, from import taxes imposed upon materials to retaliatory measures being taken upon shipments.

Cyclicality is also an issue. The sharp contraction in new system shipments (–38.7% QoQ) and used system shipments (–69.2% QoQ) is indicative of macro pull-backs in semiconductor capex, particularly from memory customers. ASPs will also be under pressure if there is a shift in demand to mid-node systems or if export controls keep major Chinese buyers out of advanced EUV systems.

Then, too, there is execution risk in High-NA ramp. While shipments are starting early, any delayed customer adoption or product integration can impact margin mix and extend payback periods for continuing R&D investment.

Source: CNN

Conclusion: Strategic Moat, Cyclical Noise

ASML's Q1 2025 results are indicative of a business trapped in tactical headwinds but strategic inevitability. Softness in shipments and bookings in the near term masks expanding margin dynamics, healthy installed base monetization, and profound entrenchment in chipmaking roadmaps fueled by AI. Valuation is patience-worthy, with tariff risk to be watched, but ASML's role in underpinning chipmaking globally makes it one of the few non-substitutable participants in tech infrastructure.